Form Dd-1 - District Sales Tax Return

ADVERTISEMENT

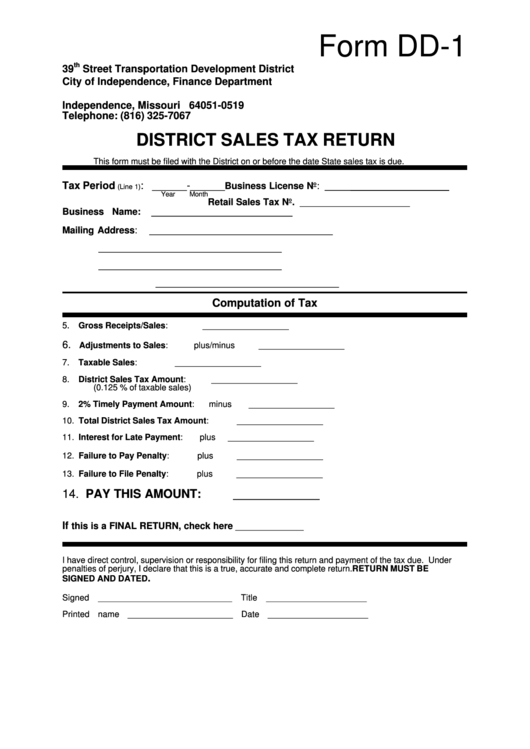

Form DD-1

th

39

Street Transportation Development District

City of Independence, Finance Department

P.O. Box 1019

Independence, Missouri 64051-0519

Telephone: (816) 325-7067

DISTRICT SALES TAX RETURN

This form must be filed with the District on or before the date State sales tax is due.

Tax Period

: ______-______

Business License No: ___________________

(Line 1)

Year

Month

Retail Sales Tax No. _____________________

Business Name:

___________________________

Mailing Address:

___________________________________

___________________________________

___________________________________

___________________________________

Computation of Tax

5.

Gross Receipts/Sales:

__________________

6.

Adjustments to Sales:

plus/minus

__________________

7.

Taxable Sales:

__________________

8.

District Sales Tax Amount:

__________________

(0.125 % of taxable sales)

9.

2% Timely Payment Amount:

minus __________________

10. Total District Sales Tax Amount:

__________________

11. Interest for Late Payment:

plus

__________________

12. Failure to Pay Penalty:

plus

__________________

13. Failure to File Penalty:

plus

__________________

14. PAY THIS AMOUNT:

_______________

If

this is a FINAL RETURN, check here _____________

I have direct control, supervision or responsibility for filing this return and payment of the tax due. Under

penalties of perjury, I declare that this is a true, accurate and complete return. RETURN MUST BE

.

SIGNED AND DATED

Signed ____________________________

Title _____________________

Printed name ______________________

Date _____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2