Form Ta-41 Instructions - Transient Accommodations - Time Share Occupancy Tax Return

ADVERTISEMENT

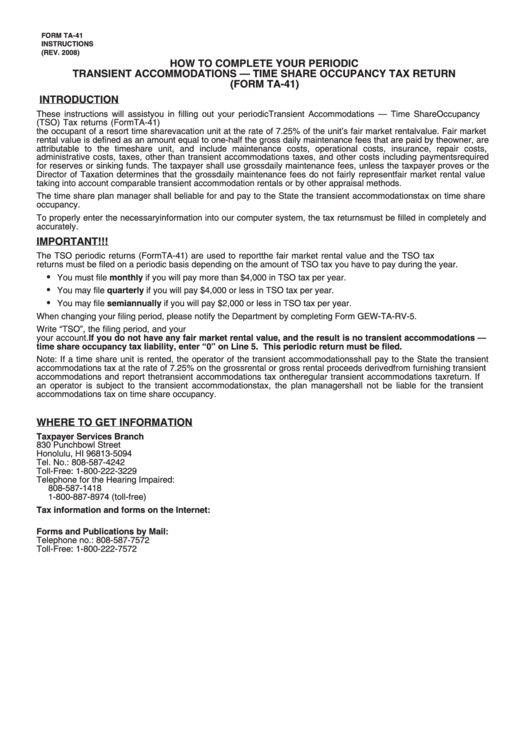

FORM TA-41

INSTRUCTIONS

(REV. 2008)

HOW TO COMPLETE YOUR PERIODIC

TRANSIENT ACCOMMODATIONS — TIME SHARE OCCUPANCY TAX RETURN

(FORM TA-41)

INTRODUCTION

These instructions will assist you in filling out your periodic Transient Accommodations — Time Share Occupancy

(TSO) Tax returns (Form TA-41) correctly. The transient accommodations tax on time share occupancy is levied on

the occupant of a resort time share vacation unit at the rate of 7.25% of the unit’s fair market rental value. Fair market

rental value is defined as an amount equal to one-half the gross daily maintenance fees that are paid by the owner, are

attributable to the time share unit, and include maintenance costs, operational costs, insurance, repair costs,

administrative costs, taxes, other than transient accommodations taxes, and other costs including payments required

for reserves or sinking funds. The taxpayer shall use gross daily maintenance fees, unless the taxpayer proves or the

Director of Taxation determines that the gross daily maintenance fees do not fairly represent fair market rental value

taking into account comparable transient accommodation rentals or by other appraisal methods.

The time share plan manager shall be liable for and pay to the State the transient accommodations tax on time share

occupancy.

To properly enter the necessary information into our computer system, the tax returns must be filled in completely and

accurately.

IMPORTANT!!!

The TSO periodic returns (Form TA-41) are used to report the fair market rental value and the TSO tax due. These

returns must be filed on a periodic basis depending on the amount of TSO tax you have to pay during the year.

•

You must file monthly if you will pay more than $4,000 in TSO tax per year.

•

You may file quarterly if you will pay $4,000 or less in TSO tax per year.

•

You may file semiannually if you will pay $2,000 or less in TSO tax per year.

When changing your filing period, please notify the Department by completing Form GEW-TA-RV-5.

Write “TSO”, the filing period, and your T.S.O. registration number on your check so that it may be properly credited to

your account. If you do not have any fair market rental value, and the result is no transient accommodations —

time share occupancy tax liability, enter “0” on Line 5. This periodic return must be filed.

Note: If a time share unit is rented, the operator of the transient accommodations shall pay to the State the transient

accommodations tax at the rate of 7.25% on the gross rental or gross rental proceeds derived from furnishing transient

accommodations and report the transient accommodations tax on the regular transient accommodations tax return. If

an operator is subject to the transient accommodations tax, the plan manager shall not be liable for the transient

accommodations tax on time share occupancy.

WHERE TO GET INFORMATION

Taxpayer Services Branch

830 Punchbowl Street

Honolulu, HI 96813-5094

Tel. No.: 808-587-4242

Toll-Free: 1-800-222-3229

Telephone for the Hearing Impaired:

808-587-1418

1-800-887-8974 (toll-free)

Tax information and forms on the Internet:

Forms and Publications by Mail:

Telephone no.: 808-587-7572

Toll-Free: 1-800-222-7572

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4