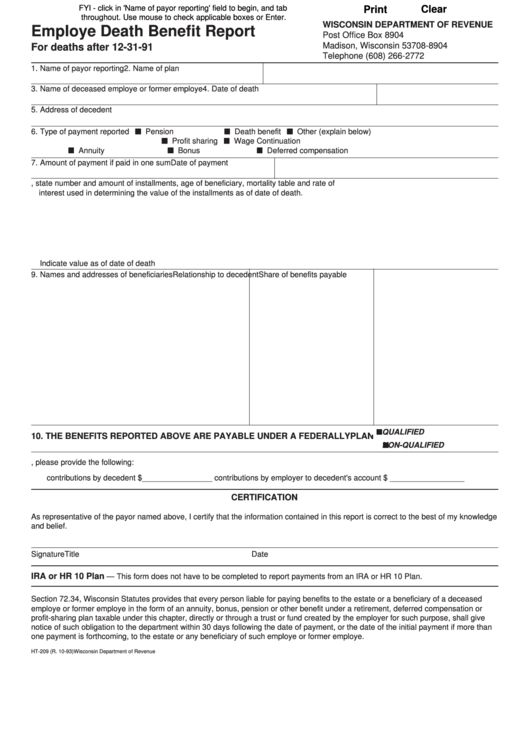

FYI - click in 'Name of payor reporting' field to begin, and tab

Clear

Print

throughout. Use mouse to check applicable boxes or Enter.

WISCONSIN DEPARTMENT OF REVENUE

Employe Death Benefit Report

Post Office Box 8904

Madison, Wisconsin 53708-8904

For deaths after 12-31-91

Telephone (608) 266-2772

1. Name of payor reporting

2. Name of plan

3. Name of deceased employe or former employe

4. Date of death

5. Address of decedent

6. Type of payment reported

Pension

Death benefit

Other (explain below)

Profit sharing

Wage Continuation

Annuity

Bonus

Deferred compensation

7. Amount of payment if paid in one sum

Date of payment

8. If payment will be made by installments, state number and amount of installments, age of beneficiary, mortality table and rate of

interest used in determining the value of the installments as of date of death.

Indicate value as of date of death

9. Names and addresses of beneficiaries

Relationship to decedent

Share of benefits payable

QUALIFIED

10. THE BENEFITS REPORTED ABOVE ARE PAYABLE UNDER A FEDERALLY

PLAN

NON-QUALIFIED

11. If the decedent contributed to the plan or toward the benefits reported on this form, please provide the following:

contributions by decedent $ ________________ contributions by employer to decedent's account $ _________________

CERTIFICATION

As representative of the payor named above, I certify that the information contained in this report is correct to the best of my knowledge

and belief.

Signature

Title

Date

IRA or HR 10 Plan

— This form does not have to be completed to report payments from an IRA or HR 10 Plan.

Section 72.34, Wisconsin Statutes provides that every person liable for paying benefits to the estate or a beneficiary of a deceased

employe or former employe in the form of an annuity, bonus, pension or other benefit under a retirement, deferred compensation or

profit-sharing plan taxable under this chapter, directly or through a trust or fund created by the employer for such purpose, shall give

notice of such obligation to the department within 30 days following the date of payment, or the date of the initial payment if more than

one payment is forthcoming, to the estate or any beneficiary of such employe or former employe.

HT-209 (R. 10-93)

Wisconsin Department of Revenue

1

1