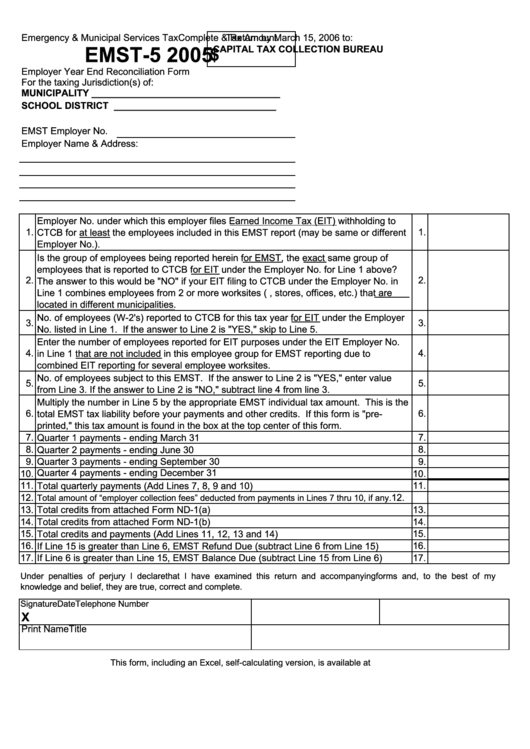

Form Emst-5 - Employer Year End Reconciliation Form - 2005

ADVERTISEMENT

Emergency & Municipal Services Tax

Tax Amount

Complete & Return by March 15, 2006 to:

2005

EMST-5

CAPITAL TAX COLLECTION BUREAU

$

Employer Year End Reconciliation Form

For the taxing Jurisdiction(s) of:

MUNICIPALITY ____________________________________

SCHOOL DISTRICT _______________________________

EMST Employer No.

Employer Name & Address:

Employer No. under which this employer files Earned Income Tax (EIT) withholding to

1.

1.

CTCB for at least the employees included in this EMST report (may be same or different

Employer No.).

Is the group of employees being reported herein for EMST, the exact same group of

employees that is reported to CTCB for EIT under the Employer No. for Line 1 above?

2.

2.

The answer to this would be "NO" if your EIT filing to CTCB under the Employer No. in

Line 1 combines employees from 2 or more worksites (e.g., stores, offices, etc.) that are

located in different municipalities.

No. of employees (W-2's) reported to CTCB for this tax year for EIT under the Employer

3.

3.

No. listed in Line 1. If the answer to Line 2 is "YES," skip to Line 5.

Enter the number of employees reported for EIT purposes under the EIT Employer No.

4.

4.

in Line 1 that are not included in this employee group for EMST reporting due to

combined EIT reporting for several employee worksites.

No. of employees subject to this EMST. If the answer to Line 2 is "YES," enter value

5.

5.

from Line 3. If the answer to Line 2 is "NO," subtract line 4 from line 3.

Multiply the number in Line 5 by the appropriate EMST individual tax amount. This is the

6.

6.

total EMST tax liability before your payments and other credits. If this form is "pre-

printed," this tax amount is found in the box at the top center of this form.

7.

Quarter 1 payments - ending March 31

7.

8.

Quarter 2 payments - ending June 30

8.

9.

Quarter 3 payments - ending September 30

9.

Quarter 4 payments - ending December 31

10.

10.

11.

Total quarterly payments (Add Lines 7, 8, 9 and 10)

11.

12.

12.

Total amount of “employer collection fees” deducted from payments in Lines 7 thru 10, if any.

13.

Total credits from attached Form ND-1(a)

13.

14.

Total credits from attached Form ND-1(b)

14.

15.

Total credits and payments (Add Lines 11, 12, 13 and 14)

15.

16.

If Line 15 is greater than Line 6, EMST Refund Due (subtract Line 6 from Line 15)

16.

17.

If Line 6 is greater than Line 15, EMST Balance Due (subtract Line 15 from Line 6)

17.

Under penalties of perjury I declare that I have examined this return and accompanying forms and, to the best of my

knowledge and belief, they are true, correct and complete.

Signature

Date

Telephone Number

X

Print Name

Title

This form, including an Excel, self-calculating version, is available at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3