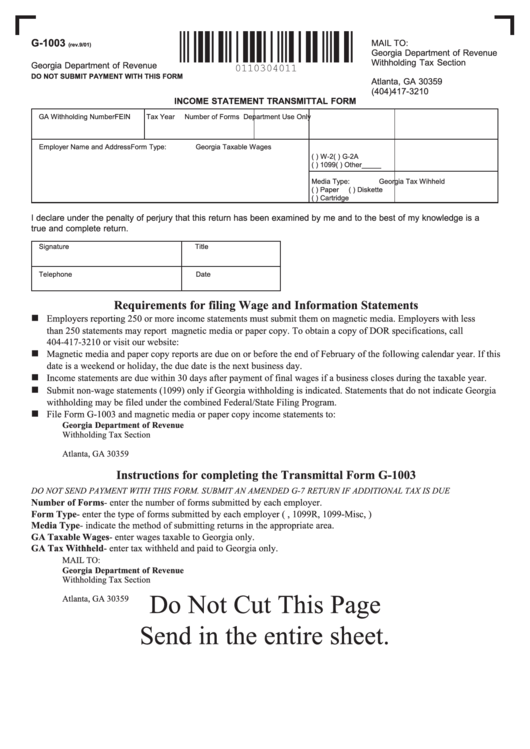

G-1003

MAIL TO:

(rev.9/01)

Georgia Department of Revenue

Withholding Tax Section

Georgia Department of Revenue

P.O. Box 98077

DO NOT SUBMIT PAYMENT WITH THIS FORM

Atlanta, GA 30359

(404)417-3210

INCOME STATEMENT TRANSMITTAL FORM

GA Withholding Number

FEIN

Tax Year

Number of Forms

Department Use Only

Employer Name and Address

Form Type:

Georgia Taxable Wages

( ) W-2

( ) G-2A

( ) 1099 ( ) Other_____

Media Type:

Georgia Tax Wihheld

( ) Paper

( ) Diskette

( ) Cartridge

I declare under the penalty of perjury that this return has been examined by me and to the best of my knowledge is a

true and complete return.

Signature

Title

Telephone

Date

Requirements for filing Wage and Information Statements

n

Employers reporting 250 or more income statements must submit them on magnetic media. Employers with less

than 250 statements may report magnetic media or paper copy. To obtain a copy of DOR specifications, call

404-417-3210 or visit our website:

n

Magnetic media and paper copy reports are due on or before the end of February of the following calendar year. If this

date is a weekend or holiday, the due date is the next business day.

n

Income statements are due within 30 days after payment of final wages if a business closes during the taxable year.

n

Submit non-wage statements (1099) only if Georgia withholding is indicated. Statements that do not indicate Georgia

withholding may be filed under the combined Federal/State Filing Program.

n

File Form G-1003 and magnetic media or paper copy income statements to:

Georgia Department of Revenue

Withholding Tax Section

P.O. Box 98077

Atlanta, GA 30359

Instructions for completing the Transmittal Form G-1003

DO NOT SEND PAYMENT WITH THIS FORM. SUBMIT AN AMENDED G-7 RETURN IF ADDITIONAL TAX IS DUE

Number of Forms- enter the number of forms submitted by each employer.

Form Type- enter the type of forms submitted by each employer (i.e. W-2, 1099R, 1099-Misc,....)

Media Type- indicate the method of submitting returns in the appropriate area.

GA Taxable Wages- enter wages taxable to Georgia only.

GA Tax Withheld- enter tax withheld and paid to Georgia only.

MAIL TO:

Georgia Department of Revenue

Withholding Tax Section

P.O. Box 98077

Do Not Cut This Page

Atlanta, GA 30359

Send in the entire sheet.

1

1