Form Ftb 9106 - Household Income Schedule

ADVERTISEMENT

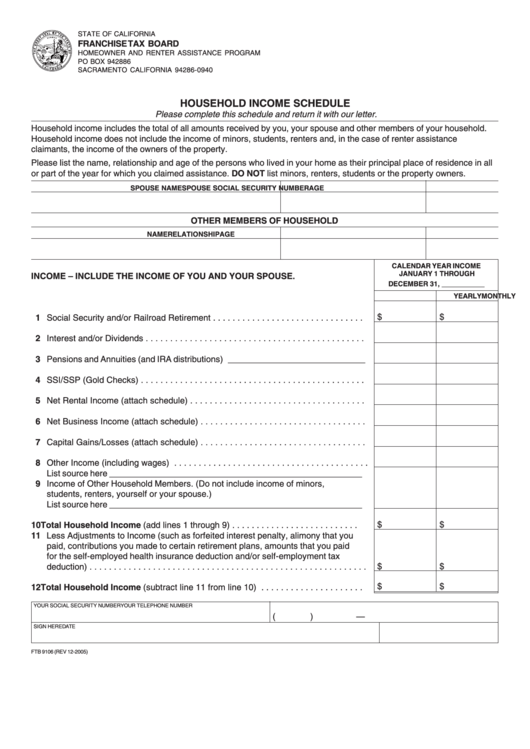

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

HOMEOWNER AND RENTER ASSISTANCE PROGRAM

PO BOX 942886

SACRAMENTO CALIFORNIA 94286-0940

HOUSEHOLD INCOME SCHEDULE

Please complete this schedule and return it with our letter.

Household income includes the total of all amounts received by you, your spouse and other members of your household.

Household income does not include the income of minors, students, renters and, in the case of renter assistance

claimants, the income of the owners of the property.

Please list the name, relationship and age of the persons who lived in your home as their principal place of residence in all

or part of the year for which you claimed assistance. DO NOT list minors, renters, students or the property owners.

SPOUSE NAME

SPOUSE SOCIAL SECURITY NUMBER

AGE

OTHER MEMBERS OF HOUSEHOLD

NAME

RELATIONSHIP

AGE

CALENDAR YEAR INCOME

JANUARY 1 THROUGH

INCOME – INCLUDE THE INCOME OF YOU AND YOUR SPOUSE.

DECEMBER 31, ___________

MONTHLY

YEARLY

$

$

1 Social Security and/or Railroad Retirement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Interest and/or Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Pensions and Annuities (and IRA distributions) _____________________________

4 SSI/SSP (Gold Checks) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Net Rental Income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Net Business Income (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Capital Gains/Losses (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Other Income (including wages) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

List source here _____________________________________________________

9 Income of Other Household Members. (Do not include income of minors,

students, renters, yourself or your spouse.)

List source here _____________________________________________________

$

$

10 Total Household Income (add lines 1 through 9) . . . . . . . . . . . . . . . . . . . . . . . . . .

11 Less Adjustments to Income (such as forfeited interest penalty, alimony that you

paid, contributions you made to certain retirement plans, amounts that you paid

for the self-employed health insurance deduction and/or self-employment tax

$

$

deduction) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

12 Total Household Income (subtract line 11 from line 10) . . . . . . . . . . . . . . . . . . . . .

YOUR SOCIAL SECURITY NUMBER

YOUR TELEPHONE NUMBER

(

)

—

SIGN HERE

DATE

FTB 9106 (REV 12-2005)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1