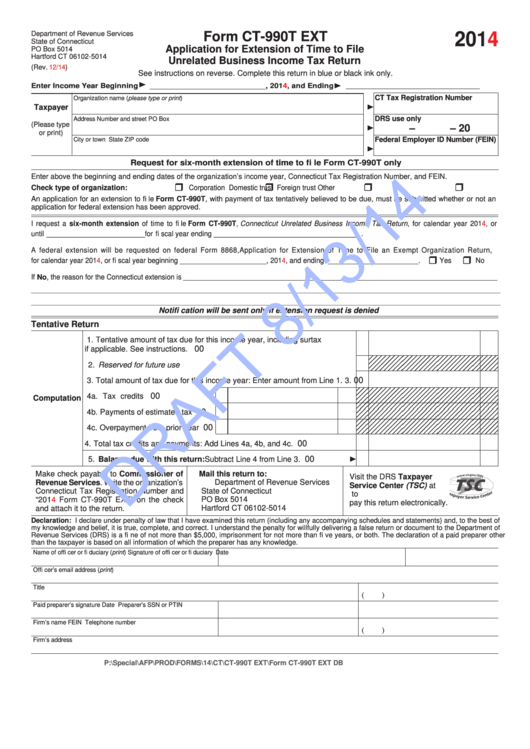

Form Ct-990t Ext - Application For Extension Of Time To File Unrelated Business Income Tax Return - 2014

ADVERTISEMENT

Department of Revenue Services

Form CT-990T EXT

2014

State of Connecticut

Application for Extension of Time to File

PO Box 5014

Hartford CT 06102-5014

Unrelated Business Income Tax Return

(Rev.

12/14

)

See instructions on reverse. Complete this return in blue or black ink only.

____________________________

Enter Income Year Beginning

___________________________ , 2014, and Ending

CT Tax Registration Number

Organization name (please type or print)

Taxpayer

DRS use only

Address

Number and street

PO Box

(Please type

–

– 20

or print)

Federal Employer ID Number (FEIN)

City or town

State

ZIP code

Request for six-month extension of time to fi le Form CT-990T only

Enter above the beginning and ending dates of the organization’s income year, Connecticut Tax Registration Number, and FEIN.

Check type of organization:

Corporation

Domestic trust

Foreign trust

Other

An application for an extension to fi le Form CT-990T, with payment of tax tentatively believed to be due, must be submitted whether or not an

application for federal extension has been approved.

I request a six-month extension of time to fi le Form CT-990T, Connecticut Unrelated Business Income Tax Return, for calendar year 2014, or

until _________________________ for fi scal year ending _____________________________________ .

A federal extension will be requested on federal Form 8868, Application for Extension of Time to File an Exempt Organization Return,

for calendar year 2014, or fi scal year beginning ______________________, 2014, and ending _______________________ .

Yes

No

If No, the reason for the Connecticut extension is

_________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________

Notifi cation will be sent only if extension request is denied

Tentative Return

1. Tentative amount of tax due for this income year, including surtax

00

if applicable. See instructions. ................................................................

1.

2. Reserved for future use ...........................................................................

2.

00

3. Total amount of tax due for this income year: Enter amount from Line 1.

3.

00

4a. Tax credits ................................... 4a

Computation

00

4b. Payments of estimated tax .......... 4b

00

4c. Overpayment from prior year ...... 4c

00

4. Total tax credits and payments: Add Lines 4a, 4b, and 4c. .....................

4.

00

5. Balance due with this return: Subtract Line 4 from Line 3. ..................

5.

Make check payable to Commissioner of

Mail this return to:

Visit the DRS Taxpayer

Department of Revenue Services

Revenue Services. Write the organization’s

Service Center (TSC) at

Connecticut Tax Registration Number and

State of Connecticut

to

“2014

Form CT-990T EXT” on the check

PO Box 5014

pay this return electronically.

Hartford CT 06102-5014

and attach it to the return.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of

Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other

than the taxpayer is based on all information of which the preparer has any knowledge.

Name of offi cer or fi duciary (print)

Signature of offi cer or fi duciary

Date

Offi cer’s email address (print)

Title

Telephone number

(

)

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

Firm’s name

FEIN

Telephone number

(

)

Firm’s address

P:\Special\AFP\PROD\FORMS\14\CT\CT-990T EXT\Form CT-990T EXT DB 20140423.indd 20140423

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2