Form Ri-2848 - Power Of Attorney

ADVERTISEMENT

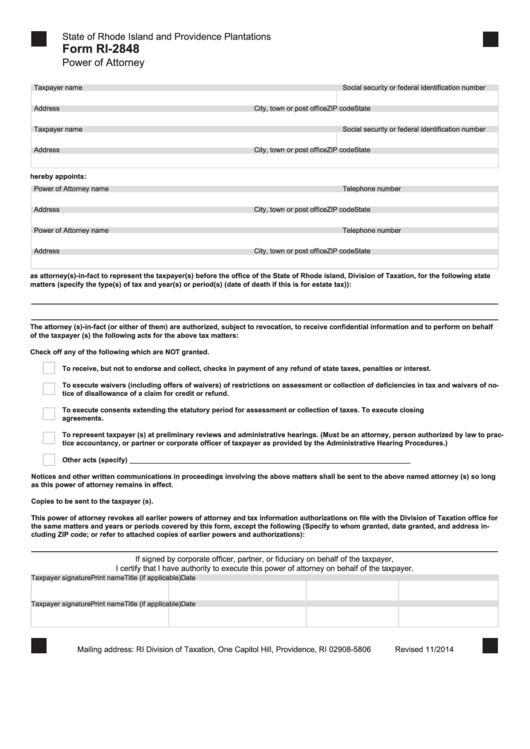

State of Rhode Island and Providence Plantations

Form RI-2848

Power of Attorney

Taxpayer name

Social security or federal identification number

Address

City, town or post office

State

ZIP code

Taxpayer name

Social security or federal identification number

Address

City, town or post office

State

ZIP code

hereby appoints:

Power of Attorney name

Telephone number

Address

City, town or post office

State

ZIP code

Power of Attorney name

Telephone number

Address

City, town or post office

State

ZIP code

as attorney(s)-in-fact to represent the taxpayer(s) before the office of the State of Rhode island, Division of Taxation, for the following state

matters (specify the type(s) of tax and year(s) or period(s) (date of death if this is for estate tax)):

The attorney (s)-in-fact (or either of them) are authorized, subject to revocation, to receive confidential information and to perform on behalf

of the taxpayer (s) the following acts for the above tax matters:

Check off any of the following which are NOT granted.

To receive, but not to endorse and collect, checks in payment of any refund of state taxes, penalties or interest.

To execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of no-

tice of disallowance of a claim for credit or refund.

To execute consents extending the statutory period for assessment or collection of taxes. To execute closing

agreements.

To represent taxpayer (s) at preliminary reviews and administrative hearings. (Must be an attorney, person authorized by law to prac-

tice accountancy, or partner or corporate officer of taxpayer as provided by the Administrative Hearing Procedures.)

Other acts (specify) ______________________________________________________________________

Notices and other written communications in proceedings involving the above matters shall be sent to the above named attorney (s) so long

as this power of attorney remains in effect.

Copies to be sent to the taxpayer (s).

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the Division of Taxation office for

the same matters and years or periods covered by this form, except the following (Specify to whom granted, date granted, and address in-

cluding ZIP code; or refer to attached copies of earlier powers and authorizations):

If signed by corporate officer, partner, or fiduciary on behalf of the taxpayer,

I certify that I have authority to execute this power of attorney on behalf of the taxpayer.

Taxpayer signature

Print name

Title (if applicable)

Date

Taxpayer signature

Print name

Title (if applicable)

Date

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

Revised 11/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2