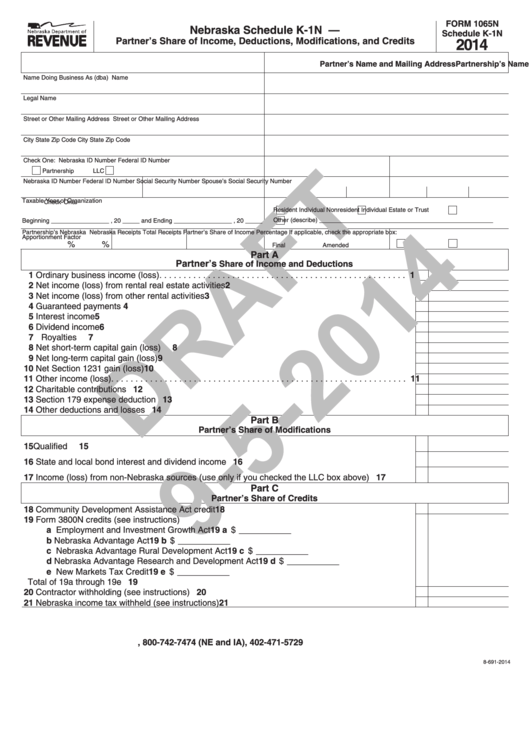

Form 1065n Schedule K-1n Draft - Nebraska Schedule K-1n Partner'S Share Of Income, Deductions, Modifications, And Credits - 2014

ADVERTISEMENT

FORM 1065N

Nebraska Schedule K-1N —

Schedule K-1N

Partner’s Share of Income, Deductions, Modifications, and Credits

2014

Partnership’s Name and Mailing Address

Partner’s Name and Mailing Address

Name Doing Business As (dba)

Name

Legal Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Check One:

Nebraska ID Number

Federal ID Number

Partnership

LLC

Nebraska ID Number

Federal ID Number

Social Security Number

Spouse’s Social Security Number

Taxable Year of Organization

Check One:

Resident Individual

Nonresident Individual

Estate or Trust

Other (describe) ___________________________________________________

Beginning _________________ , 20 _____ and Ending _________________ , 20 _____

Partnership’s Nebraska

Nebraska Receipts

Total Receipts

Partner’s Share of Income Percentage

If applicable, check the appropriate box:

Apportionment Factor

%

%

Final

Amended

Part A

Partner’s

Share of Income and Deductions

1 Ordinary business income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Net income (loss) from rental real estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Net income (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Guaranteed payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Net short-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Net long-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Net Section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Other income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Section 179 expense deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Other deductions and losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Part B

Partner’s Share of Modifications

15 Qualified U.S. government interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 State and local bond interest and dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Income (loss) from non-Nebraska sources (use only if you checked the LLC box above) . . . . . . . 17

Part C

Partner’s Share of Credits

18 Community Development Assistance Act credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Form 3800N credits (see instructions)

a Employment and Investment Growth Act . . . . . . . . . . . . . . . . . . . . . . . . . 19 a $ ___________

b Nebraska Advantage Act . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 b $ ___________

c Nebraska Advantage Rural Development Act . . . . . . . . . . . . . . . . . . . . . 19 c $ ___________

d Nebraska Advantage Research and Development Act . . . . . . . . . . . . . . 19 d $ ___________

e New Markets Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 e $ ___________

Total of 19a through 19e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Contractor withholding (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Nebraska income tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-691-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1