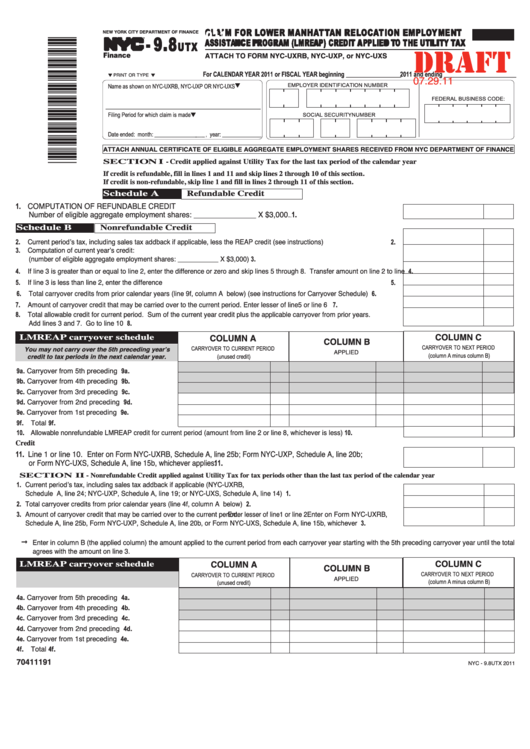

Form Nyc-9.8utx Draft - Claim For Lower Manhattan Relocation Employment Assistance Program (Lmreap) Credit Applied To The Utility Tax - 2011

ADVERTISEMENT

DR FT

- - 9 9 . . 8 8

C C L L A A I I M M F F O O R R L L O O W W E E R R M M A A N N H H A A T T T T A A N N R R E E L L O O C C A A T T I I O O N N E E M M P P L L O O Y Y M M E E N N T T

2011

NEW YORK CITY DEPARTMENT OF FINANCE

A A S S S S I I S S T T A A N N C C E E P P R R O O G G R R A A M M ( ( L L M M R R E E A A P P ) ) C C R R E E D D I I T T A A P P P P L L I I E E D D T T O O T T H H E E U U T T I I L L I I T T Y Y T T A A X X

U U T T X X

TM

ATTACH TO FORM NYC-UXRB, NYC-UXP, or NYC-UXS

Finance

07.29.11

For CALENDAR YEAR 2011 or FISCAL YEAR beginning ________________ 2011 and ending _____________________

M PRINT OR TYPE M

Name as shown on NYC-UXRB, NYC-UXP OR NYC-UXS M

EMPLOYER IDENTIFICATION NUMBER

FEDERAL BUSINESS CODE:

Filing Period for which claim is made M

SOCIAL SECURITY NUMBER

Date ended: month: ___________________ , year: ______________

ATTACH ANNUAL CERTIFICATE OF ELIGIBLE AGGREGATE EMPLOYMENT SHARES RECEIVED FROM NYC DEPARTMENT OF FINANCE

SECTION I - Credit applied against Utility Tax for the last tax period of the calendar year

If credit is refundable, fill in lines 1 and 11 and skip lines 2 through 10 of this section.

If credit is non-refundable, skip line 1 and fill in lines 2 through 11 of this section.

Schedule A

Refundable Credit

1. COMPUTATION OF REFUNDABLE CREDIT

Number of eligible aggregate employment shares: _______________ X $3,000.

.............................................................

1.

Schedule B

Nonrefundable Credit

Current periodʼs tax, including sales tax addback if applicable, less the REAP credit (see instructions) .......................................2.

2.

Computation of current yearʼs credit:

3.

(number of eligible aggregate employment shares: ___________ X $3,000) ............................................................................ 3.

If line 3 is greater than or equal to line 2, enter the difference or zero and skip lines 5 through 8. Transfer amount on line 2 to line 10...... 4.

4.

If line 3 is less than line 2, enter the difference ..................................................................................................................................5.

5.

Total carryover credits from prior calendar years (line 9f, column A below) (see instructions for Carryover Schedule) ............ 6.

6.

Amount of carryover credit that may be carried over to the current period. Enter lesser of line 5 or line 6 ............................... 7.

7.

Total allowable credit for current period. Sum of the current year credit plus the applicable carryover from prior years.

8.

Add lines 3 and 7. Go to line 10 ................................................................................................................................................ 8.

COLUMN C

LMREAP carryover schedule

COLUMN A

COLUMN B

You may not carry over the 5th preceding yearʼs

CARRYOVER TO NEXT PERIOD

CARRYOVER TO CURRENT PERIOD

APPLIED

credit to tax periods in the next calendar year.

(column A minus column B)

(unused credit)

9a. Carryover from 5th preceding year ................ 9a.

9b. Carryover from 4th preceding year................ 9b.

9c. Carryover from 3rd preceding year................ 9c.

9d. Carryover from 2nd preceding year............... 9d.

9e. Carryover from 1st preceding year ................ 9e.

9f. Total ............................................................. 9f.

10. Allowable nonrefundable LMREAP credit for current period (amount from line 2 or line 8, whichever is less) ........................ 10.

Credit

11. Line 1 or line 10. Enter on Form NYC-UXRB, Schedule A, line 25b; Form NYC-UXP, Schedule A, line 20b;

or Form NYC-UXS, Schedule A, line 15b, whichever applies.

...........................................................................................................

11.

SECTION II - Nonrefundable Credit applied against Utility Tax for tax periods other than the last tax period of the calendar year

1. Current periodʼs tax, including sales tax addback if applicable (NYC-UXRB,

Schedule A, line 24; NYC-UXP, Schedule A, line 19; or NYC-UXS, Schedule A, line 14) ........................................................... 1.

2. Total carryover credits from prior calendar years (line 4f, column A below) ................................................................................. 2.

3. Amount of carryover credit that may be carried over to the current period. Enter lesser of line 1 or line 2. Enter on Form NYC-UXRB,

Schedule A, line 25b, Form NYC-UXP, Schedule A, line 20b, or Form NYC-UXS, Schedule A, line 15b, whichever applies ....... 3.

Enter in column B (the applied column) the amount applied to the current period from each carryover year starting with the 5th preceding carryover year until the total

agrees with the amount on line 3.

COLUMN C

COLUMN A

LMREAP carryover schedule

COLUMN B

CARRYOVER TO NEXT PERIOD

CARRYOVER TO CURRENT PERIOD

APPLIED

(column A minus column B)

(unused credit)

4a. Carryover from 5th preceding year ................ 4a.

4b. Carryover from 4th preceding year................ 4b.

4c. Carryover from 3rd preceding year................ 4c.

4d. Carryover from 2nd preceding year............... 4d.

4e. Carryover from 1st preceding year ................ 4e.

4f. Total ............................................................. 4f.

70411191

NYC - 9.8UTX 2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2