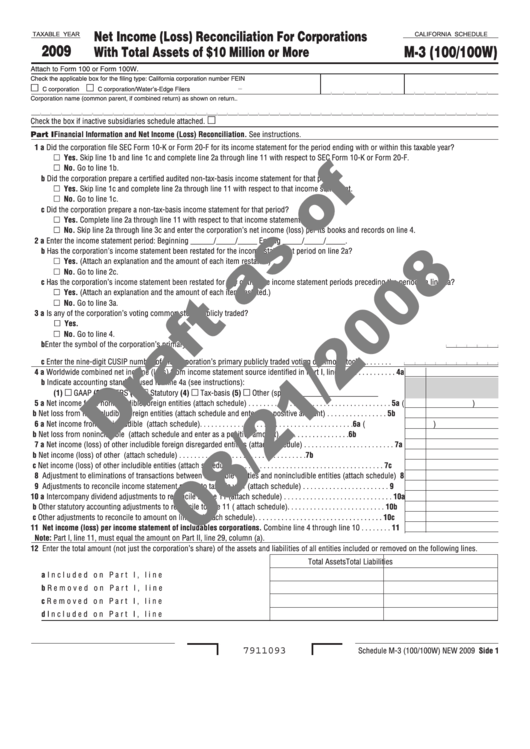

California Schedule M-3 (100/100w) - Net Income (Loss) Reconciliation For Corporations With Total Assets Of 10 Million Or More - 2009

ADVERTISEMENT

Net Income (Loss) Reconciliation For Corporations

TAXABLE YEAR

CALIFORNIA SCHEDULE

2009

M-3 (100/100W)

With Total Assets of $10 Million or More

Attach to Form 100 or Form 100W.

Check the applicable box for the filing type:

California corporation number FEIN

-

m

m

C corporation

C corporation/Water’s-Edge Filers

Corporation name (common parent, if combined return) as shown on return..

Check the box if inactive subsidiaries schedule attached.

Part I Financial Information and Net Income (Loss) Reconciliation. See instructions.

a

Did the corporation file SEC Form 10-K or Form 20-F for its income statement for the period ending with or within this taxable year?

m Yes. Skip line 1b and line 1c and complete line 2a through line 11 with respect to SEC Form 10-K or Form 20-F.

m No. Go to line 1b.

b

Did the corporation prepare a certified audited non-tax-basis income statement for that period?

m Yes. Skip line 1c and complete line 2a through line 11 with respect to that income statement.

m No. Go to line 1c.

c

Did the corporation prepare a non-tax-basis income statement for that period?

m Yes. Complete line 2a through line 11 with respect to that income statement.

m No. Skip line 2a through line 3c and enter the corporation’s net income (loss) per its books and records on line 4.

2 a

Enter the income statement period: Beginning ______/_____/_____ Ending _____/_____/_____.

b

Has the corporation’s income statement been restated for the income statement period on line 2a?

m Yes. (Attach an explanation and the amount of each item restated.)

m No. Go to line 2c.

c

Has the corporation’s income statement been restated for any of the five income statement periods preceding the period on line 2a?

m Yes. (Attach an explanation and the amount of each item restated.)

m No. Go to line 3a.

3 a

Is any of the corporation’s voting common stock publicly traded?

m Yes.

m No. Go to line 4.

b

Enter the symbol of the corporation’s primary U.S. publicly traded voting common stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Enter the nine-digit CUSIP number of the corporation’s primary publicly traded voting common stock. . . . . . . . .

4 a

Worldwide combined net income (loss) from income statement source identified in Part I, line 1 . . . . . . . . . . . . . .

4a

b

Indicate accounting standard used for line 4a (see instructions):

m

m

m

m

m

()

GAAP (2)

IFRS (3)

Statutory (4)

Tax-basis (5)

Other (specify) ____________________

5 a

Net income from nonincludible foreign entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5a

(

)

b

Net loss from nonincludible foreign entities (attach schedule and enter as a positive amount) . . . . . . . . . . . . . . . .

5b

6 a

Net income from nonincludible U.S. entities (attach schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

(

)

b

Net loss from nonincludible U.S. entities (attach schedule and enter as a positive amount). . . . . . . . . . . . . . . . . . .

6b

7 a

Net income (loss) of other includible foreign disregarded entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . .

7a

b

Net income (loss) of other U.S. disregarded entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

c

Net income (loss) of other includible entities (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7c

8

Adjustment to eliminations of transactions between includible entities and nonincludible entities (attach schedule)

8

9

Adjustments to reconcile income statement period to taxable year (attach schedule) . . . . . . . . . . . . . . . . . . . . . . .

9

0 a

Intercompany dividend adjustments to reconcile to line 11 (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0a

b

Other statutory accounting adjustments to reconcile to line 11 ( attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . .

0b

c

Other adjustments to reconcile to amount on line 11 (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0c

Net income (loss) per income statement of includables corporations. Combine line 4 through line 10 . . . . . . . .

Note: Part I, line 11, must equal the amount on Part II, line 29, column (a).

2

Enter the total amount (not just the corporation’s share) of the assets and liabilities of all entities included or removed on the following lines.

Total Assets

Total Liabilities

a

Included on Part I, line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

Removed on Part I, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Removed on Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

Included on Part I, line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7911093

Schedule M-3 (100/100W) NEW 2009 Side

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3