Seed Capital Investment Tax Credit Worksheet For Tax Year 2009

ADVERTISEMENT

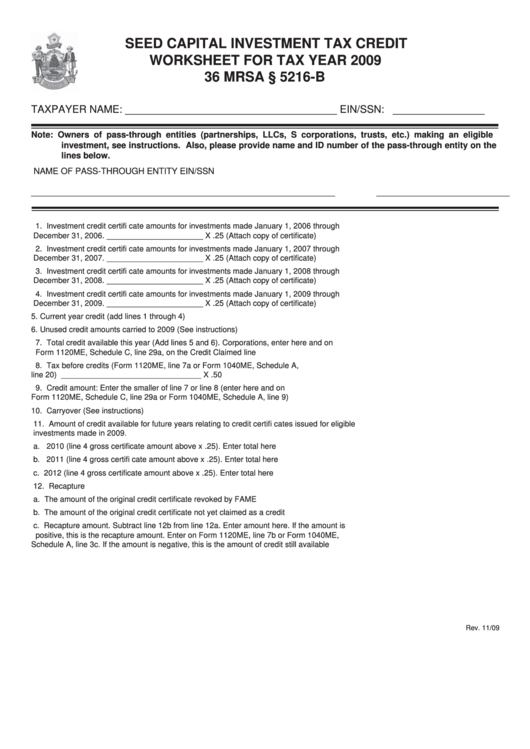

SEED CAPITAL INVESTMENT TAX CREDIT

WORKSHEET FOR TAX YEAR 2009

36 MRSA § 5216-B

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the pass-through entity on the

lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1. Investment credit certifi cate amounts for investments made January 1, 2006 through

December 31, 2006. ______________________ X .25 (Attach copy of certifi cate) ..............................1. _____________________

2. Investment credit certifi cate amounts for investments made January 1, 2007 through

December 31, 2007. ______________________ X .25 (Attach copy of certifi cate) ..............................2. _____________________

3. Investment credit certifi cate amounts for investments made January 1, 2008 through

December 31, 2008. ______________________ X .25 (Attach copy of certifi cate) ..............................3. _____________________

4. Investment credit certifi cate amounts for investments made January 1, 2009 through

December 31, 2009. ______________________ X .25 (Attach copy of certifi cate) ..............................4. _____________________

5. Current year credit (add lines 1 through 4) .............................................................................................5. _____________________

6. Unused credit amounts carried to 2009 (See instructions) .....................................................................6. _____________________

7. Total credit available this year (Add lines 5 and 6). Corporations, enter here and on

Form 1120ME, Schedule C, line 29a, on the Credit Claimed line ..........................................................7. _____________________

8. Tax before credits (Form 1120ME, line 7a or Form 1040ME, Schedule A,

line 20) ________________________________ X .50 .........................................................................8. _____________________

9. Credit amount: Enter the smaller of line 7 or line 8 (enter here and on

Form 1120ME, Schedule C, line 29a or Form 1040ME, Schedule A, line 9) ..........................................9. _____________________

10. Carryover (See instructions) .................................................................................................................10. _____________________

11. Amount of credit available for future years relating to credit certifi cates issued for eligible

investments made in 2009.

a. 2010 (line 4 gross certifi cate amount above x .25). Enter total here ...........................................11a. _____________________

b. 2011 (line 4 gross certifi cate amount above x .25). Enter total here .............................................11b. _____________________

c. 2012 (line 4 gross certifi cate amount above x .25). Enter total here ............................................ 11c. _____________________

12. Recapture

a. The amount of the original credit certifi cate revoked by FAME .....................................................12a. _____________________

b. The amount of the original credit certifi cate not yet claimed as a credit .......................................12b. _____________________

c. Recapture amount. Subtract line 12b from line 12a. Enter amount here. If the amount is

positive, this is the recapture amount. Enter on Form 1120ME, line 7b or Form 1040ME,

Schedule A, line 3c. If the amount is negative, this is the amount of credit still available .............12c. _____________________

Rev. 11/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1