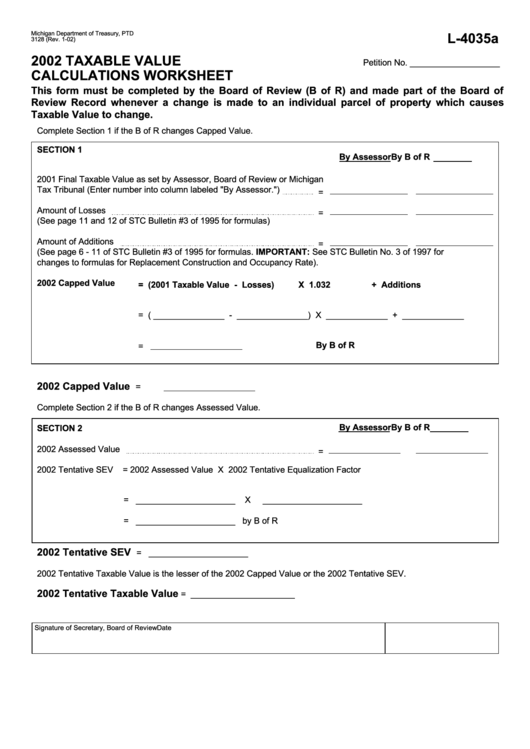

Form L-4035a - Taxable Value Calculations Worksheet

ADVERTISEMENT

Michigan Department of Treasury, PTD

L-4035a

3128 (Rev. 1-02)

2002 TAXABLE VALUE

Petition No. ___________________

CALCULATIONS WORKSHEET

This form must be completed by the Board of Review (B of R) and made part of the Board of

Review Record whenever a change is made to an individual parcel of property which causes

Taxable Value to change.

Complete Section 1 if the B of R changes Capped Value.

SECTION 1

By Assessor

By B of R

2001 Final Taxable Value as set by Assessor, Board of Review or Michigan

Tax Tribunal (Enter number into column labeled "By Assessor.")

=

Amount of Losses

=

(See page 11 and 12 of STC Bulletin #3 of 1995 for formulas)

Amount of Additions

=

(See page 6 - 11 of STC Bulletin #3 of 1995 for formulas. IMPORTANT: See STC Bulletin No. 3 of 1997 for

changes to formulas for Replacement Construction and Occupancy Rate).

2002 Capped Value

= (2001 Taxable Value - Losses)

X 1.032

+ Additions

= ( _______________ - _______________) X _____________ + _____________

By B of R

=

2002 Capped Value

=

Complete Section 2 if the B of R changes Assessed Value.

By Assessor

By B of R

SECTION 2

2002 Assessed Value

=

2002 Tentative SEV

= 2002 Assessed Value X 2002 Tentative Equalization Factor

= _____________________

X

_____________________

= _____________________ by B of R

2002 Tentative SEV

= _____________________

2002 Tentative Taxable Value is the lesser of the 2002 Capped Value or the 2002 Tentative SEV.

2002 Tentative Taxable Value

= ______________________

Signature of Secretary, Board of Review

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1