Form Ls-1 - Local Services Tax Quarterly - 2011

ADVERTISEMENT

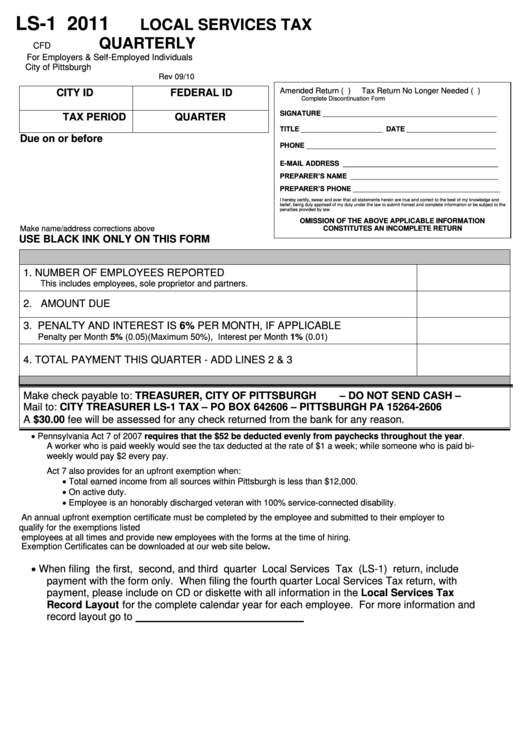

LS-1 2011

LOCAL SERVICES TAX

QUARTERLY

CFD

For Employers & Self-Employed Individuals

City of Pittsburgh

Rev 09/10

Amended Return ( )

Tax Return No Longer Needed ( )

CITY ID

FEDERAL ID

Complete Discontinuation Form

SIGNATURE _____________________________________________

TAX PERIOD

QUARTER

TITLE _____________________ DATE _______________________

Due on or before

PHONE _________________________________________________

E-MAIL ADDRESS ________________________________________

PREPARER’S NAME ______________________________________

PREPARER’S PHONE ______________________________________

I hereby certify, swear and aver that all statements herein are true and correct to the best of my knowledge and

belief, being duly apprised of my duty under the law to submit honest and complete information or be subject to the

penalties provided by law.

OMISSION OF THE ABOVE APPLICABLE INFORMATION

Make name/address corrections above

CONSTITUTES AN INCOMPLETE RETURN

USE BLACK INK ONLY ON THIS FORM

1. NUMBER OF EMPLOYEES REPORTED

This includes employees, sole proprietor and partners.

2. AMOUNT DUE

3. PENALTY AND INTEREST IS 6% PER MONTH, IF APPLICABLE

Penalty per Month 5% (0.05) (Maximum 50%), Interest per Month 1% (0.01)

4. TOTAL PAYMENT THIS QUARTER - ADD LINES 2 & 3

– DO NOT SEND CASH –

Make check payable to: TREASURER, CITY OF PITTSBURGH

Mail to: CITY TREASURER LS-1 TAX – PO BOX 642606 – PITTSBURGH PA 15264-2606

A $30.00 fee will be assessed for any check returned from the bank for any reason.

Pennsylvania Act 7 of 2007 requires that the $52 be deducted evenly from paychecks throughout the year.

A worker who is paid weekly would see the tax deducted at the rate of $1 a week; while someone who is paid bi-

weekly would pay $2 every pay.

Act 7 also provides for an upfront exemption when:

Total earned income from all sources within Pittsburgh is less than $12,000.

On active duty.

Employee is an honorably discharged veteran with 100% service-connected disability.

An annual upfront exemption certificate must be completed by the employee and submitted to their employer to

qualify for the exemptions listed above. Employers must make upfront exemption forms readily available to

employees at all times and provide new employees with the forms at the time of hiring.

Exemption Certificates can be downloaded at our web site below.

When filing the first, second, and third quarter Local Services Tax (LS-1) return, include

payment with the form only. When filing the fourth quarter Local Services Tax return, with

payment, please include on CD or diskette with all information in the Local Services Tax

Record Layout for the complete calendar year for each employee. For more information and

record layout go to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1