Form 1746 - Missouri Sales Or Use Tax Exemption Application With Instrucftions - 2012

ADVERTISEMENT

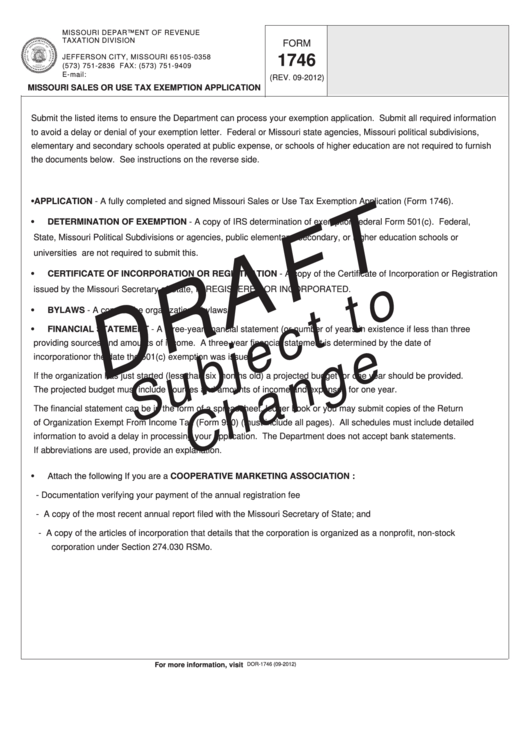

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

FORM

P.O. BOX 358

1746

JEFFERSON CITY, MISSOURI 65105-0358

(573) 751-2836 FAX: (573) 751-9409

E-mail: salestaxexemptions@dor.mo.gov

(REV. 09-2012)

MISSOURI SALES OR USE TAX EXEMPTION APPLICATION

Submit the listed items to ensure the Department can process your exemption application. Submit all required information

to avoid a delay or denial of your exemption letter. Federal or Missouri state agencies, Missouri political subdivisions,

elementary and secondary schools operated at public expense, or schools of higher education are not required to furnish

the documents below. See instructions on the reverse side.

•

APPLICATION - A fully completed and signed Missouri Sales or Use Tax Exemption Application (Form 1746).

•

DETERMINATION OF EXEMPTION - A copy of IRS determination of exemption federal Form 501(c). Federal,

State, Missouri Political Subdivisions or agencies, public elementary, secondary, or higher education schools or

universities are not required to submit this.

•

CERTIFICATE OF INCORPORATION OR REGISTRATION - A copy of the Certificate of Incorporation or Registration

issued by the Missouri Secretary of State, IF REGISTERED OR INCORPORATED.

•

BYLAWS - A copy of the organization’s bylaws.

•

FINANCIAL STATEMENT - A three-year financial statement (or number of years in existence if less than three

providing sources and amounts of income. A three-year financial statement is determined by the date of

incorporationor the date the 501(c) exemption was issued.

If the organization has just started (less than six months old) a projected budget for one year should be provided.

The projected budget must include sources and amounts of income and expenses for one year.

The financial statement can be in the form of a spreadsheet, ledger book or you may submit copies of the Return

of Organization Exempt From Income Tax (Form 990) (must include all pages). All schedules must include detailed

information to avoid a delay in processing your application. The Department does not accept bank statements.

If abbreviations are used, provide an explanation.

•

Attach the following If you are a COOPERATIVE MARKETING ASSOCIATION :

-

Documentation verifying your payment of the annual registration fee

-

A copy of the most recent annual report filed with the Missouri Secretary of State; and

-

A copy of the articles of incorporation that details that the corporation is organized as a nonprofit, non-stock

corporation under Section 274.030 RSMo.

For more information, visit

DOR-1746 (09-2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4