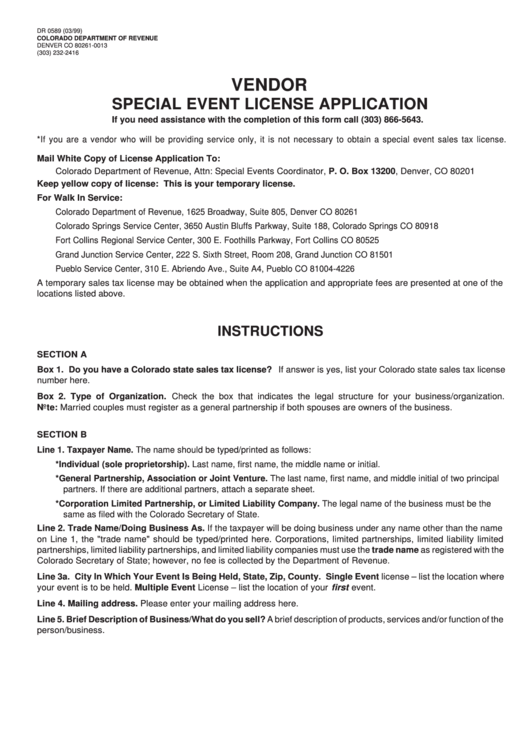

Form Dr 0589 - Vendor Special Event License Application With Instructions

ADVERTISEMENT

DR 0589 (03/99)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0013

(303) 232-2416

VENDOR

SPECIAL EVENT LICENSE APPLICATION

If you need assistance with the completion of this form call (303) 866-5643.

*If you are a vendor who will be providing service only, it is not necessary to obtain a special event sales tax license.

Mail White Copy of License Application To:

Colorado Department of Revenue, Attn: Special Events Coordinator, P. O. Box 13200, Denver, CO 80201

Keep yellow copy of license: This is your temporary license.

For Walk In Service:

Colorado Department of Revenue, 1625 Broadway, Suite 805, Denver CO 80261

Colorado Springs Service Center, 3650 Austin Bluffs Parkway, Suite 188, Colorado Springs CO 80918

Fort Collins Regional Service Center, 300 E. Foothills Parkway, Fort Collins CO 80525

Grand Junction Service Center, 222 S. Sixth Street, Room 208, Grand Junction CO 81501

Pueblo Service Center, 310 E. Abriendo Ave., Suite A4, Pueblo CO 81004-4226

A temporary sales tax license may be obtained when the application and appropriate fees are presented at one of the

locations listed above.

INSTRUCTIONS

SECTION A

Box 1. Do you have a Colorado state sales tax license? If answer is yes, list your Colorado state sales tax license

number here.

Box 2. Type of Organization. Check the box that indicates the legal structure for your business/organization.

Note: Married couples must register as a general partnership if both spouses are owners of the business.

SECTION B

Line 1. Taxpayer Name. The name should be typed/printed as follows:

* Individual (sole proprietorship). Last name, first name, the middle name or initial.

* General Partnership, Association or Joint Venture. The last name, first name, and middle initial of two principal

partners. If there are additional partners, attach a separate sheet.

* Corporation Limited Partnership, or Limited Liability Company. The legal name of the business must be the

same as filed with the Colorado Secretary of State.

Line 2. Trade Name/Doing Business As. If the taxpayer will be doing business under any name other than the name

on Line 1, the "trade name" should be typed/printed here. Corporations, limited partnerships, limited liability limited

partnerships, limited liability partnerships, and limited liability companies must use the trade name as registered with the

Colorado Secretary of State; however, no fee is collected by the Department of Revenue.

Line 3a. City In Which Your Event Is Being Held, State, Zip, County. Single Event license – list the location where

your event is to be held. Multiple Event License – list the location of your first event.

Line 4. Mailing address. Please enter your mailing address here.

Line 5. Brief Description of Business/What do you sell? A brief description of products, services and/or function of the

person/business.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5