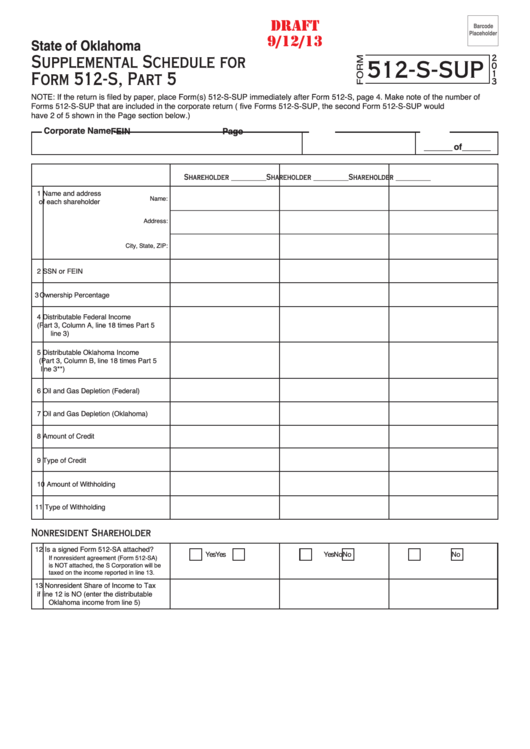

Form 512-S-Sup Draft - Supplemental Schedule For Form 512-Ti

ADVERTISEMENT

Draft

Barcode

Placeholder

9/12/13

State of Oklahoma

Supplemental Schedule for

2

512-S-SUP

0

Form 512-S, Part 5

1

3

NOTE: If the return is filed by paper, place Form(s) 512-S-SUP immediately after Form 512-S, page 4. Make note of the number of

Forms 512-S-SUP that are included in the corporate return (e.g. If there are five Forms 512-S-SUP, the second Form 512-S-SUP would

have 2 of 5 shown in the Page section below.)

Corporate Name

FEIN

Page

______ of ______

Shareholder __________

Shareholder __________

Shareholder __________

1

Name and address

Name:

of each shareholder

Address:

City, State, ZIP:

2

SSN or FEIN

3

Ownership Percentage

4

Distributable Federal Income

(Part 3, Column A, line 18 times Part 5

line 3)

5

Distributable Oklahoma Income

(Part 3, Column B, line 18 times Part 5

line 3**)

6

Oil and Gas Depletion (Federal)

7

Oil and Gas Depletion (Oklahoma)

8

Amount of Credit

9

Type of Credit

10 Amount of Withholding

11

Type of Withholding

Nonresident Shareholder

12

Is a signed Form 512-SA attached?

Yes

No

Yes

No

Yes

No

If nonresident agreement (Form 512-SA)

is NOT attached, the S Corporation will be

taxed on the income reported in line 13.

13

Nonresident Share of Income to Tax

if line 12 is NO (enter the distributable

Oklahoma income from line 5)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1