Form 531- Final Earned Income Tax Return - West Shore Tax Bureau

ADVERTISEMENT

TAX RETURN.qxd

1/12/06

1:59 PM

Page 1

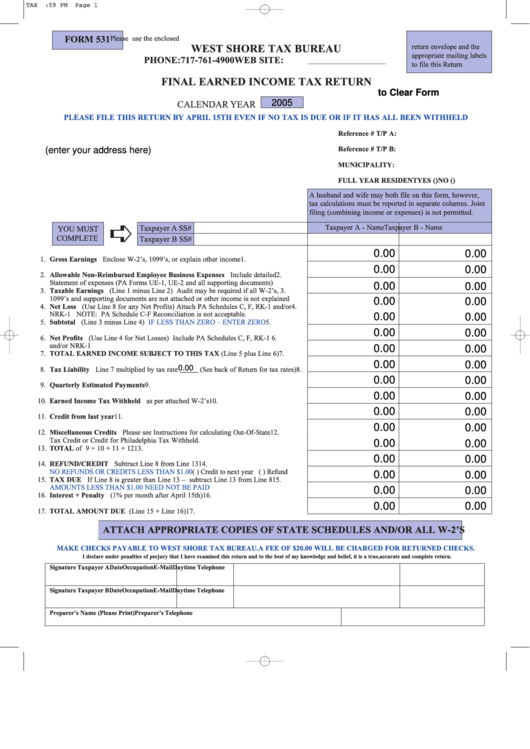

FORM 531

Please use the enclosed

return envelope and the

WEST SHORE TAX BUREAU

appropriate mailing labels

PHONE: 717-761-4900

WEB SITE:

to file this Return

FINAL EARNED INCOME TAX RETURN

Click Here to Clear Form

2005

CALENDAR YEAR

PLEASE FILE THIS RETURN BY APRIL 15TH EVEN IF NO TAX IS DUE OR IF IT HAS ALL BEEN WITHHELD

Reference # T/P A:

(enter your address here)

Reference # T/P B:

MUNICIPALITY:

FULL YEAR RESIDENT YES ( )

NO ( )

...select your municipality

A husband and wife may both file on this form, however,

Á

tax calculations must be reported in separate columns. Joint

filing (combining income or expenses) is not permitted.

Taxpayer A - Name

Taxpayer B - Name

Taxpayer A SS#

YOU MUST

COMPLETE

Taxpayer B SS#

0.00

0.00

1. Gross Earnings Enclose W-2’s, 1099’s, or explain other income

1.

0.00

0.00

2. Allowable Non-Reimbursed Employee Business Expenses Include detailed

2.

Statement of expenses (PA Forms UE-1, UE-2 and all supporting documents)

0.00

0.00

3. Taxable Earnings (Line 1 minus Line 2) Audit may be required if all W-2’s,

3.

1099’s and supporting documents are not attached or other income is not explained

0.00

0.00

4. Net Loss (Use Line 8 for any Net Profits) Attach PA Schedules C, F, RK-1 and/or

4.

NRK-1 NOTE: PA Schedule C-F Reconciliation is not acceptable.

0.00

0.00

5. Subtotal (Line 3 minus Line 4)

IF LESS THAN ZERO – ENTER ZERO

5.

0.00

0.00

6. Net Profits (Use Line 4 for Net Losses) Include PA Schedules C, F, RK-1

6.

and/or NRK-1

0.00

0.00

7. TOTAL EARNED INCOME SUBJECT TO THIS TAX (Line 5 plus Line 6)

7.

0.00

0.00

0.00

8. Tax Liability Line 7 multiplied by tax rate _____ (See back of Return for tax rates) 8.

0.00

0.00

9. Quarterly Estimated Payments

9.

0.00

0.00

10. Earned Income Tax Withheld as per attached W-2’s

10.

0.00

0.00

11. Credit from last year

11.

0.00

0.00

12. Miscellaneous Credits Please see Instructions for calculating Out-Of-State

12.

Tax Credit or Credit for Philadelphia Tax Withheld.

0.00

0.00

13. TOTAL of 9 + 10 + 11 + 12

13.

0.00

0.00

14. REFUND/CREDIT Subtract Line 8 from Line 13

14.

NO REFUNDS OR CREDITS LESS THAN $1.00

( ) Credit to next year ( ) Refund

0.00

0.00

15. TAX DUE If Line 8 is greater than Line 13 – subtract Line 13 from Line 8

15.

AMOUNTS LESS THAN $1.00 NEED NOT BE PAID

0.00

0.00

16. Interest + Penalty (1% per month after April 15th)

16.

0.00

0.00

17. TOTAL AMOUNT DUE (Line 15 + Line 16)

17.

ATTACH APPROPRIATE COPIES OF STATE SCHEDULES AND/OR ALL W-2’S

MAKE CHECKS PAYABLE TO WEST SHORE TAX BUREAU. A FEE OF $20.00 WILL BE CHARGED FOR RETURNED CHECKS.

I declare under penalties of perjury that I have examined this return and to the best of my knowledge and belief, it is a true, accurate and complete return.

Signature Taxpayer A

Date

Occupation

E-Mail

Daytime Telephone

Signature Taxpayer B

Date

Occupation

E-Mail

Daytime Telephone

Preparer’s Name (Please Print)

Preparer’s Telephone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2