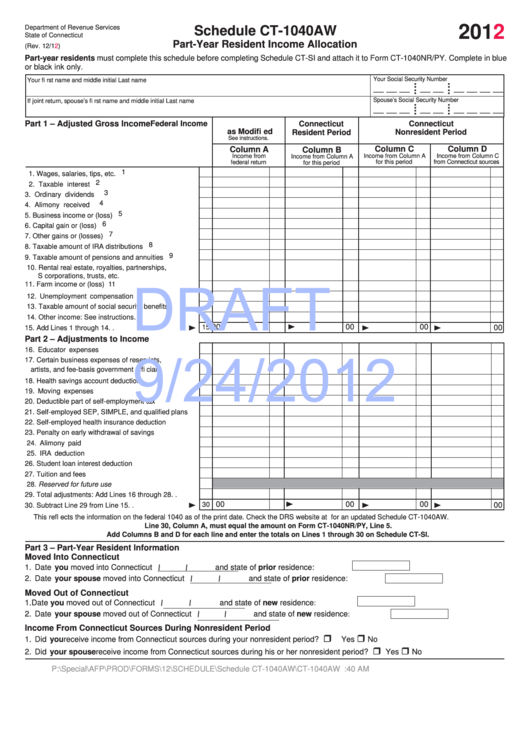

Schedule Ct-1040aw Draft - Part-Year Resident Income Allocation - 2012

ADVERTISEMENT

2012

Department of Revenue Services

Schedule CT-1040AW

State of Connecticut

Part-Year Resident Income Allocation

(Rev. 12/12)

Part-year residents must complete this schedule before completing Schedule CT-SI and attach it to Form CT-1040NR/PY. Complete in blue

or black ink only.

Your Social Security Number

Your fi rst name and middle initial

Last name

• •

• •

__ __ __ __ __ __ __ __ __

•

•

•

•

Spouse’s Social Security Number

If joint return, spouse’s fi rst name and middle initial

Last name

• •

• •

__ __ __ __ __ __ __ __ __

• •

• •

Part 1 – Adjusted Gross Income

Federal Income

Connecticut

Connecticut

as Modifi ed

Nonresident Period

Resident Period

See instructions.

Column C

Column D

Column A

Column B

Income from

Income from Column A

Income from Column C

Income from Column A

for this period

from Connecticut sources

federal return

for this period

1. Wages, salaries, tips, etc. .......................................... 1

2. Taxable interest .......................................................... 2

3. Ordinary dividends ..................................................... 3

4. Alimony received ....................................................... 4

5. Business income or (loss) .......................................... 5

6. Capital gain or (loss) .................................................. 6

7. Other gains or (losses) .............................................. 7

8. Taxable amount of IRA distributions .......................... 8

9. Taxable amount of pensions and annuities ................ 9

10. Rental real estate, royalties, partnerships,

DRAFT

S corporations, trusts, etc. ......................................... 10

11. Farm income or (loss) ................................................ 11

12. Unemployment compensation ................................... 12

13. Taxable amount of social security benefi ts ................ 13

14. Other income: See instructions. ................................ 14

00

00

00

00

15. Add Lines 1 through 14. . ......................................

15

Part 2 – Adjustments to Income

9/24/2012

16. Educator expenses .................................................... 16

17. Certain business expenses of reservists,

artists, and fee-basis government offi cials ................. 17

18. Health savings account deduction ............................. 18

19. Moving expenses ....................................................... 19

20. Deductible part of self-employment tax ..................... 20

21. Self-employed SEP, SIMPLE, and qualifi ed plans ..... 21

22. Self-employed health insurance deduction ................ 22

23. Penalty on early withdrawal of savings ...................... 23

24. Alimony paid .............................................................. 24

25. IRA deduction ............................................................ 25

26. Student loan interest deduction ................................. 26

27. Tuition and fees ......................................................... 27

28. Reserved for future use ............................................. 28

29. Total adjustments: Add Lines 16 through 28. . ........... 29

00

00

00

00

30. Subtract Line 29 from Line 15. . ............................

30

This refl ects the information on the federal 1040 as of the print date. Check the DRS website at for an updated Schedule CT-1040AW.

Line 30, Column A, must equal the amount on Form CT-1040NR/PY, Line 5.

Add Columns B and D for each line and enter the totals on Lines 1 through 30 on Schedule CT-SI.

Part 3 – Part-Year Resident Information

Moved Into Connecticut

/

/

1. Date you moved into Connecticut

and state of prior residence:

/

/

2. Date your spouse moved into Connecticut

and state of prior residence:

Moved Out of Connecticut

/

/

1. Date you moved out of Connecticut

and state of new residence

:

/

/

2. Date your spouse moved out of Connecticut

and state of new residence

:

Income From Connecticut Sources During Nonresident Period

1. Did you receive income from Connecticut sources during your nonresident period? ....................................................

Yes

No

2. Did your spouse receive income from Connecticut sources during his or her nonresident period? .............................

Yes

No

P:\Special\AFP\PROD\FORMS\12\SCHEDULE\Schedule CT-1040AW\CT-1040AW 20120731.indd

20120731

10:40 AM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1