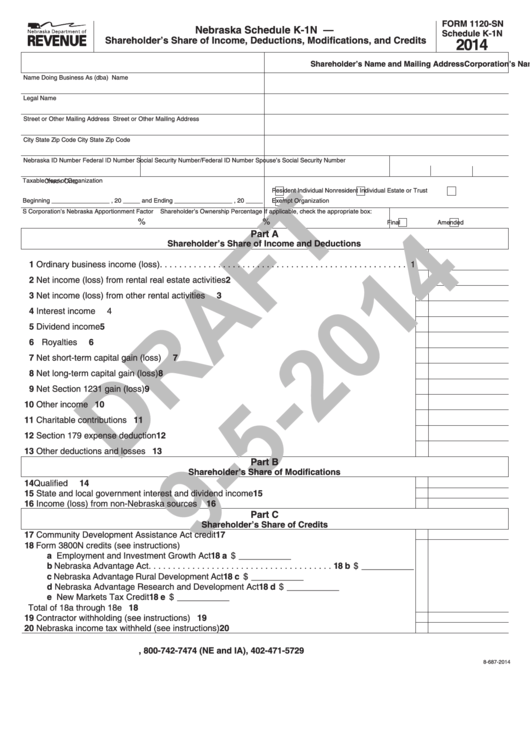

Form 1120-Sn Draft - Schedule K-1n - Shareholder'S Share Of Income, Deductions, Modifications, And Credits - 2014

ADVERTISEMENT

FORM 1120-SN

Nebraska Schedule K-1N —

Schedule K-1N

Shareholder’s Share of Income, Deductions, Modifications, and Credits

2014

Corporation’s Name and Mailing Address

Shareholder’s Name and Mailing Address

Name Doing Business As (dba)

Name

Legal Name

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Nebraska ID Number

Federal ID Number

Social Security Number/Federal ID Number

Spouse’s Social Security Number

Taxable Year of Organization

Check One:

Resident Individual

Nonresident Individual

Estate or Trust

Beginning _________________ , 20 _____ and Ending _________________ , 20 _____

Exempt Organization

S Corporation’s Nebraska Apportionment Factor

Shareholder’s Ownership Percentage

If applicable, check the appropriate box:

%

%

Final

Amended

Part A

Shareholder’s Share of Income and Deductions

1 Ordinary business income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Net income (loss) from rental real estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Net income (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Net short-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Net long-term capital gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Net Section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Charitable contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Section 179 expense deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Other deductions and losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Part B

Shareholder’s Share of Modifications

14 Qualified U.S. government interest deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 State and local government interest and dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Income (loss) from non-Nebraska sources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Part C

Shareholder’s Share of Credits

17 Community Development Assistance Act credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Form 3800N credits (see instructions)

a Employment and Investment Growth Act . . . . . . . . . . . . . . . . . . . . . . . . . 18 a $ ___________

b Nebraska Advantage Act. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 b $ ___________

c Nebraska Advantage Rural Development Act . . . . . . . . . . . . . . . . . . . . . . 18 c $ ___________

d Nebraska Advantage Research and Development Act . . . . . . . . . . . . . . . 18 d $ ___________

e New Markets Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 e $ ___________

Total of 18a through 18e . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Contractor withholding (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Nebraska income tax withheld (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-687-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1