Schedule Ct-706 Draft Template - Farmland

ADVERTISEMENT

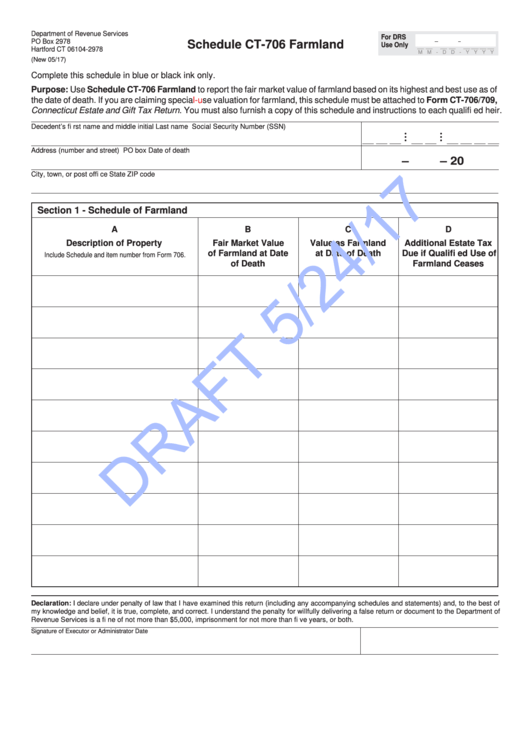

Department of Revenue Services

For DRS

PO Box 2978

Schedule CT-706 Farmland

Use Only

Hartford CT 06104-2978

M M - D D - Y Y Y Y

(New 05/17)

Complete this schedule in blue or black ink only.

Purpose: Use Schedule CT-706 Farmland to report the fair market value of farmland based on its highest and best use as of

the date of death. If you are claiming special-use valuation for farmland, this schedule must be attached to Form CT-706/709,

Connecticut Estate and Gift Tax Return. You must also furnish a copy of this schedule and instructions to each qualifi ed heir.

Decedent’s fi rst name and middle initial

Last name

Social Security Number (SSN)

•

•

•

•

•

•

__ __ __

__ __

__ __ __ __

Address (number and street)

PO box

Date of death

–

– 20

City, town, or post offi ce

State

ZIP code

Section 1 - Schedule of Farmland

A

B

C

D

Description of Property

Fair Market Value

Value as Farmland

Additional Estate Tax

of Farmland at Date

at Date of Death

Due if Qualifi ed Use of

Include Schedule and item number from Form 706.

of Death

Farmland Ceases

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of

Revenue Services is a fi ne of not more than $5,000, imprisonment for not more than fi ve years, or both.

Signature of Executor or Administrator

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4