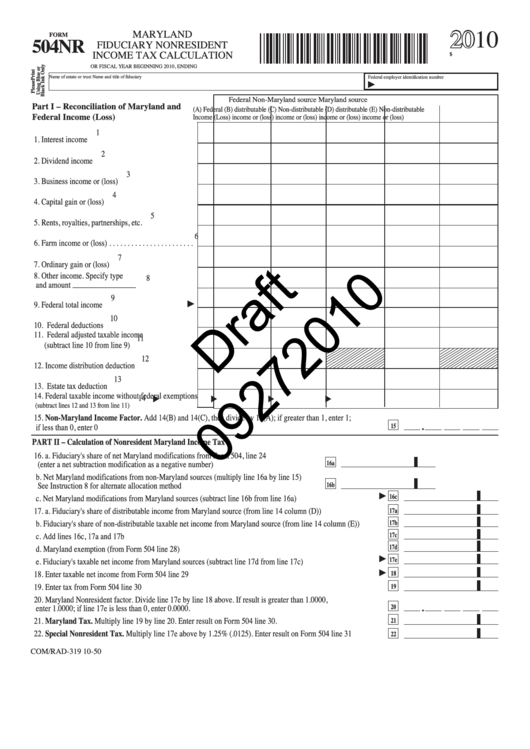

Form 504nr Draft - Maryland Fiduciary Nonresident Income Tax Calculation - 2010

ADVERTISEMENT

2010

MARYLAND

FORM

504NR

FIDUCIARY NONRESIDENT

INCOME TAX CALCULATION

$

OR FISCAL YEAR BEGINNING

2010, ENDING

10504N050

Name of estate or trust

Name and title of fiduciary

Federal employer identification number

Federal

Non-Maryland source

Maryland source

Part I – Reconciliation of Maryland and

(A) Federal

(B) distributable (C) Non-distributable (D) distributable (E) Non-distributable

Income (Loss)

income or (loss)

income or (loss)

income or (loss)

income or (loss)

Federal Income (Loss)

1

1. Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Business income or (loss) . . . . . . . . . . . . . . . . . . . .

4

4. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Rents, royalties, partnerships, etc.. . . . . . . . . . . . . .

6

6. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . .

7

7. Ordinary gain or (loss) . . . . . . . . . . . . . . . . . . . . . .

8. Other income. Specify type

8

and amount _________________ . . . . . . . . . . . . .

9

9. Federal total income . . . . . . . . . . . . . . . . . . . . . . . .

10

10. Federal deductions. . . . . . . . . . . . . . . . . . . . . . . . . .

11. Federal adjusted taxable income

11

(subtract line 10 from line 9). . . . . . . . . . . . . . . . . .

12

12. Income distribution deduction. . . . . . . . . . . . . . . . .

13

13. Estate tax deduction. . . . . . . . . . . . . . . . . . . . . . . . .

14. Federal taxable income without federal exemptions

14

. . . . . . . . . . . . . .

(subtract lines 12 and 13 from line 11)

15. Non-Maryland Income Factor. Add 14(B) and 14(C), then divide by 14(A); if greater than 1, enter 1;

.

if less than 0, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

PART II – Calculation of Nonresident Maryland Income Tax

16. a. Fiduciary's share of net Maryland modifications from Form 504, line 24

(enter a net subtraction modification as a negative number). . . . . . . . . . . . . . . . . . . . . . . . . . .

16a

b. Net Maryland modifications from non-Maryland sources (multiply line 16a by line 15)

See Instruction 8 for alternate allocation method . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

c. Net Maryland modifications from Maryland sources (subtract line 16b from line 16a). . . . . . . . . . . . . . . . . . . . .

16c

17. a. Fiduciary's share of distributable income from Maryland source (from line 14 column (D)) . . . . . . . . . . . . . . . .

17a

b. Fiduciary's share of non-distributable taxable net income from Maryland source (from line 14 column (E)). . . .

17b

c. Add lines 16c, 17a and 17b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

d. Maryland exemption (from Form 504 line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17d

e. Fiduciary's taxable net income from Maryland sources (subtract line 17d from line 17c). . . . . . . . . . . . . . . . . . . . .

17e

18. Enter taxable net income from Form 504 line 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Enter tax from Form 504 line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20. Maryland Nonresident factor. Divide line 17e by line 18 above. If result is greater than 1.0000,

.

enter 1.0000; if line 17e is less than 0, enter 0.0000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21. Maryland Tax. Multiply line 19 by line 20. Enter result on Form 504 line 30. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22. Special Nonresident Tax. Multiply line 17e above by 1.25% (.0125). Enter result on Form 504 line 31 . . . . . . . .

22

COM/RAD-319

10-50

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1