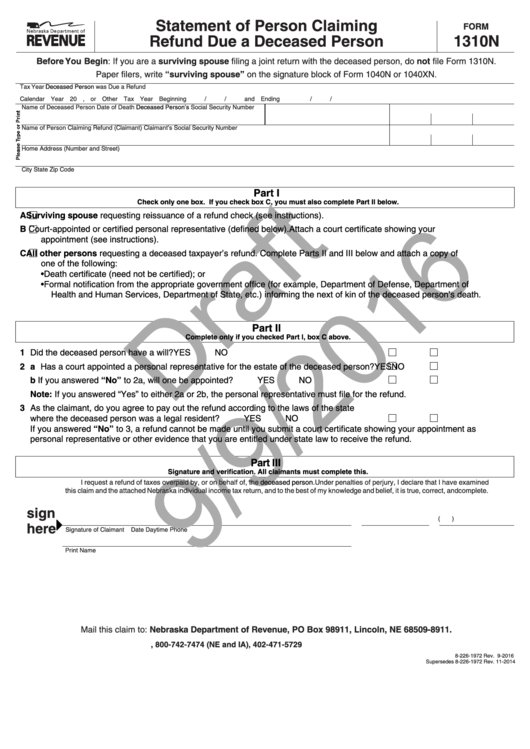

Form 1310n - Statement Of Person Claiming Refund Due A Deceased Person

ADVERTISEMENT

Statement of Person Claiming

FORM

Refund Due a Deceased Person

1310N

Before You Begin: If you are a surviving spouse filing a joint return with the deceased person, do not file Form 1310N.

Paper filers, write “surviving

spouse”

on the signature block of Form 1040N or 1040XN.

Tax Year

Deceased Person

was Due a Refund

Calendar Year 20

, or Other Tax Year Beginning

/

/

and Ending

/

/

Name of Deceased Person

Date of Death

Deceased Person’s

Social Security Number

Name of Person Claiming Refund (Claimant)

Claimant’s Social Security Number

Home Address (Number and Street)

City

State

Zip Code

Part I

Check only one box. If you check box C, you must also complete Part II below.

A

Surviving spouse requesting reissuance of a refund check (see instructions).

B

Court-appointed or certified personal representative (defined below). Attach a court certificate showing your

appointment (see instructions).

C

All other persons requesting a deceased taxpayer’s refund. Complete Parts II and III below and attach a copy of

one of the following:

• Death certificate (need not be certified); or

• Formal notification from the appropriate government office (for example, Department of Defense, Department of

Health and Human Services, Department of State, etc.) informing the next of kin of the deceased person’s death.

Part II

Complete only if you checked Part I, box C above.

1 Did the deceased person have a will?...................................................................................

YES

NO

2 a Has a court appointed a personal representative for the estate of the deceased person?

YES

NO

b If you answered “No” to 2a, will one be appointed? .........................................................

YES

NO

Note: If you answered “Yes” to either 2a or 2b, the personal representative must file for the refund.

3 As the claimant, do you agree to pay out the refund according to the laws of the state

where the deceased person was a legal resident? ...............................................................

YES

NO

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment as

personal representative or other evidence that you are entitled under state law to receive the refund.

Part III

Signature and verification. All claimants must complete this.

I request a refund of taxes overpaid by, or on behalf of, the

deceased

person. Under penalties of perjury, I declare that I have examined

this claim and the attached Nebraska individual income tax return, and to the best of my knowledge and belief, it is true, correct, and complete.

sign

(

)

here

Signature of Claimant

Date

Daytime Phone

Print Name

Mail this claim to: Nebraska Department of Revenue, PO Box 98911, Lincoln, NE 68509-8911.

revenue.nebraska.gov, 800-742-7474 (NE and IA), 402-471-5729

8-226-1972 Rev. 9-2016

Supersedes 8-226-1972 Rev. 11-2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2