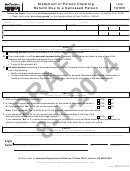

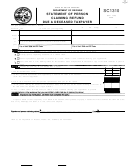

Form 1310n - Statement Of Person Claiming Refund Due A Deceased Person Page 2

ADVERTISEMENT

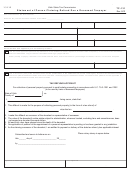

Instructions

Who Must File. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310N unless either of

the following applies:

P You are a surviving spouse filing an original or amended joint return with the deceased person, or

P You are a personal representative (defined on this page) filing an original Form 1040N for the deceased person and a

court certificate showing your appointment is attached to the return.

When and Where to File. If you are e-filing the income tax return, Form 1310N and required supporting documentation

may be submitted as an attached PDF document if your software supports these types of attachments. If the supporting

documentation is not received with the return, the Department may request the required documentation during the processing

of your return. This may result in a delayed refund.

If you are filing a paper income tax return, you must attach Form 1310N, and any other required documentation, to the

deceased person’s Nebraska Individual Income Tax Return, Form 1040N or 1040XN, and mail to:

Nebraska Department of Revenue

PO Box 98911

Lincoln, Nebraska 68509-8911

Personal Representative. For purposes of this form, a personal representative is the executor or administrator of the

deceased person’s estate, as appointed or certified by the court. A copy of the deceased person’s will cannot be accepted as

evidence that you are the personal representative.

Specific Information

Part I, Box A, Surviving Spouse. Check box A if you received a refund check in your name and your deceased spouse’s

name. You can return the joint-name check with Form 1310N to:

Nebraska Department of Revenue

PO Box 98911

Lincoln, Nebraska 68509-8911.

A new check will be issued solely in your name and mailed to you.

Part I, Box B, Personal Representative. Check box B only if you are the deceased person’s court‑appointed or

certified personal representative claiming a refund for the deceased person on Form 1040N or Form 1040XN. A copy of

your appointment, as described above, must be attached to the return being filed.

Part I, Box C, All Other Persons. Check box C if you are not a surviving spouse claiming a refund based on a joint return

and there is no court-appointed or certified personal representative. Claimants may be any person in charge of the deceased

person’s affairs. Complete Parts II and III.

Attach a copy of the following forms of proof of death:

P Death certificate (need not be certified); or

P The formal notification from the appropriate government office (for example, Department of Defense, Department of

Health and Human Services, Department of State, etc.) informing the next of kin of the deceased person’s death.

If you have already sent proof of death to the Department, write “Proof of Death Previously Filed” at the bottom of the form

when filing Form 1310N.

Example. Mr. Brown died on August 23. His son is his sole survivor. Mr. Brown did not have a will and the court

did not appoint a personal representative for his estate. Mr. Brown was entitled to a $330 refund. To receive the

refund, his son must complete and attach Form 1310N to his father’s final income tax return. He must check box C of

Form 1310N, answer all the questions in Part II, and sign his own name in Part III. He must also attach a copy of the

death certificate or other proof of death.

Part II, Lines 1-3. If you check box C, you must complete lines 1 through 3 of Part II.

Part III. All filers of Form 1310N must complete this part.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2