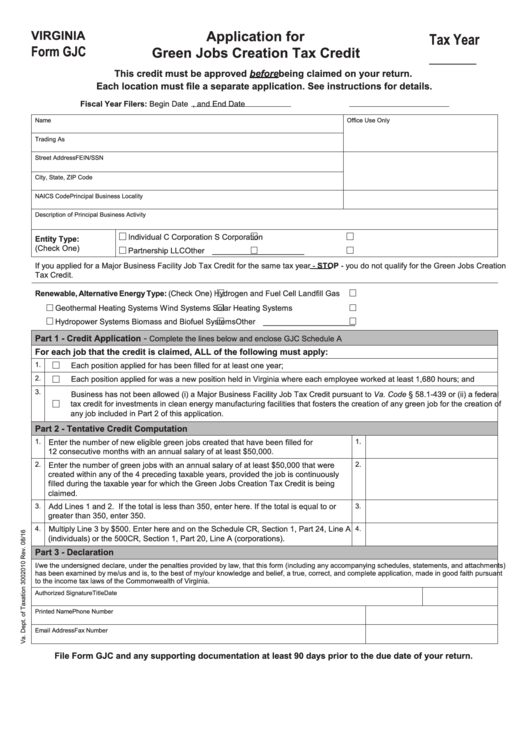

Application for

VIRGINIA

Tax Year

Form GJC

Green Jobs Creation Tax Credit

_______

This credit must be approved before being claimed on your return.

Each location must file a separate application. See instructions for details.

Fiscal Year Filers: Begin Date

, and End Date

Name

Office Use Only

Trading As

Street Address

FEIN/SSN

City, State, ZIP Code

NAICS Code

Principal Business Locality

Description of Principal Business Activity

Individual

C Corporation

S Corporation

Entity Type:

(Check One)

Partnership

LLC

Other _____________________

If you applied for a Major Business Facility Job Tax Credit for the same tax year - STOP - you do not qualify for the Green Jobs Creation

Tax Credit.

Renewable, Alternative Energy Type: (Check One)

Hydrogen and Fuel Cell

Landfill Gas

Geothermal Heating Systems

Wind Systems

Solar Heating Systems

Hydropower Systems

Biomass and Biofuel Systems

Other _____________________

-

Part 1 - Credit Application

Complete the lines below and enclose GJC Schedule A

For each job that the credit is claimed, ALL of the following must apply:

1.

Each position applied for has been filled for at least one year;

2.

Each position applied for was a new position held in Virginia where each employee worked at least 1,680 hours; and

3.

Business has not been allowed (i) a Major Business Facility Job Tax Credit pursuant to Va. Code § 58.1-439 or (ii) a federal

tax credit for investments in clean energy manufacturing facilities that fosters the creation of any green job for the creation of

any job included in Part 2 of this application.

Part 2 - Tentative Credit Computation

1.

1.

Enter the number of new eligible green jobs created that have been filled for

12 consecutive months with an annual salary of at least $50,000. ..................................

2.

Enter the number of green jobs with an annual salary of at least $50,000 that were

2.

created within any of the 4 preceding taxable years, provided the job is continuously

filled during the taxable year for which the Green Jobs Creation Tax Credit is being

claimed. ............................................................................................................................

3.

Add Lines 1 and 2. If the total is less than 350, enter here. If the total is equal to or

3.

greater than 350, enter 350. .............................................................................................

Multiply Line 3 by $500. Enter here and on the Schedule CR, Section 1, Part 24, Line A

4.

4.

(individuals) or the 500CR, Section 1, Part 20, Line A (corporations). .............................

Part 3 - Declaration

I/we the undersigned declare, under the penalties provided by law, that this form (including any accompanying schedules, statements, and attachments)

has been examined by me/us and is, to the best of my/our knowledge and belief, a true, correct, and complete application, made in good faith pursuant

to the income tax laws of the Commonwealth of Virginia.

Authorized Signature

Title

Date

Printed Name

Phone Number

Email Address

Fax Number

File Form GJC and any supporting documentation at least 90 days prior to the due date of your return.

1

1 2

2 3

3