International Fuel Tax Agreement Tax Return Form 2001 - South Dakota Department Of Revenue

ADVERTISEMENT

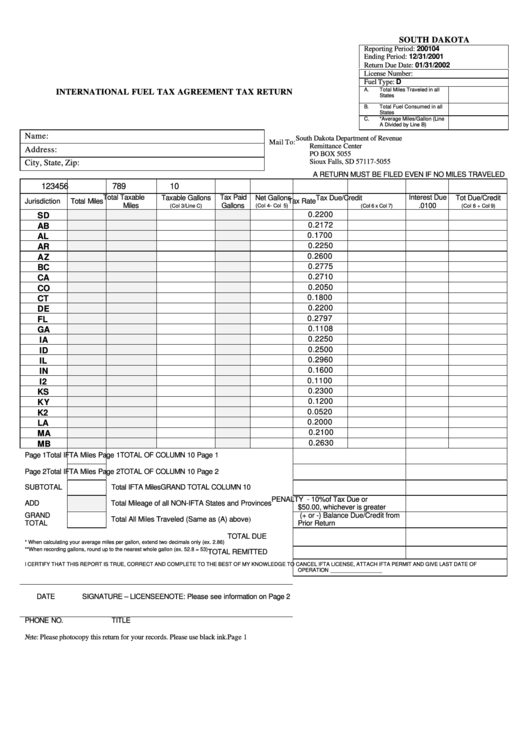

SOUTH DAKOTA

Reporting Period: 200104

Ending Period: 12/31/2001

Return Due Date: 01/31/2002

License Number:

Fuel Type: D

A.

Total Miles Traveled in all

INTERNATIONAL FUEL TAX AGREEMENT TAX RETURN

States

B.

Total Fuel Consumed in all

States

C.

*Average Miles/Gallon (Line

A Divided by Line B)

Name:

South Dakota Department of Revenue

Mail To:

Remittance Center

Address:

PO BOX 5055

City, State, Zip:

Sioux Falls, SD 57117-5055

A RETURN MUST BE FILED EVEN IF NO MILES TRAVELED

1

2

3

4

5

6

7

8

9

10

Total Taxable

Tax Paid

Interest Due

Taxable Gallons

Net Gallons

Tax Due/Credit

Tot Due/Credit

Jurisdiction

Total Miles

Tax Rate

Miles

Gallons

.0100

(Col 3/Line C)

(Col 4- Col 5)

(Col 6 x Col 7)

(Col 8 + Col 9)

0.2200

SD

0.2172

AB

0.1700

AL

0.2250

AR

0.2600

AZ

0.2775

BC

0.2710

CA

0.2050

CO

0.1800

CT

0.2200

DE

0.2797

FL

0.1108

GA

0.2250

IA

0.2500

ID

0.2960

IL

0.1600

IN

0.1100

I2

0.2300

KS

0.1200

KY

0.0520

K2

0.2000

LA

0.2100

MA

0.2630

MB

Page 1

Total IFTA Miles Page 1

TOTAL OF COLUMN 10 Page 1

Page 2

Total IFTA Miles Page 2

TOTAL OF COLUMN 10 Page 2

SUBTOTAL

Total IFTA Miles

GRAND TOTAL COLUMN 10

PENALTY - 10%of Tax Due or

ADD

Total Mileage of all NON-IFTA States and Provinces

$50.00, whichever is greater

GRAND

(+ or -) Balance Due/Credit from

Total All Miles Traveled (Same as (A) above)

TOTAL

Prior Return

TOTAL DUE

* When calculating your average miles per gallon, extend two decimals only (ex. 2.86)

**When recording gallons, round up to the nearest whole gallon (ex. 52.8 = 53)

TOTAL REMITTED

I CERTIFY THAT THIS REPORT IS TRUE, CORRECT AND COMPLETE TO THE BEST OF MY KNOWLEDGE

TO CANCEL IFTA LICENSE, ATTACH IFTA PERMIT AND GIVE LAST DATE OF

OPERATION __________________

DATE

SIGNATURE – LICENSEE

NOTE: Please see information on Page 2

PHONE NO.

TITLE

Note: Please photocopy this return for your records. Please use black ink.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2