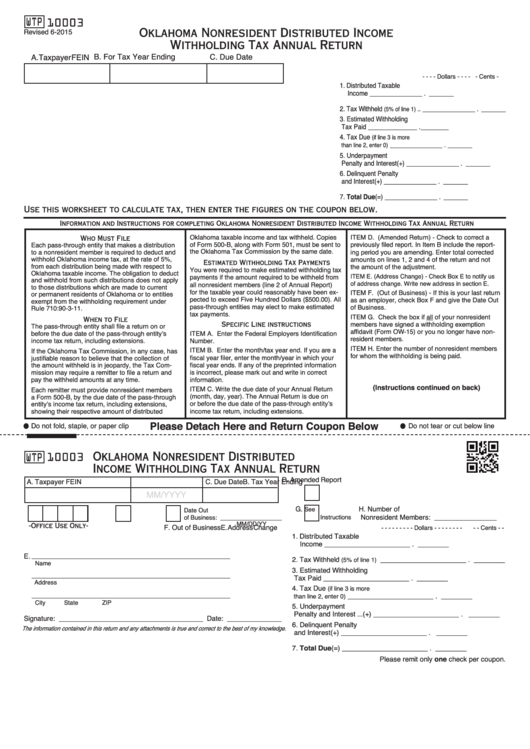

WTP

10003

Oklahoma Nonresident Distributed Income

Revised 6-2015

Withholding Tax Annual Return

B. For Tax Year Ending

C. Due Date

A. Taxpayer FEIN

- - - - Dollars - - - -

- Cents -

1. Distributed Taxable

Income .............................. _______________ . _______

2. Tax Withheld

.. _______________ . _______

(5% of line 1)

3. Estimated Withholding

Tax Paid ............................ ______________ . ________

4. Tax Due

(if line 3 is more

............... _______________ . _______

than line 2, enter 0)

5. Underpayment

Penalty and Interest ..... (+) _______________ . _______

6. Delinquent Penalty

and Interest .................. (+) _______________ . _______

7. Total Due ..................... (=) _______________ . _______

Use this worksheet to calculate tax, then enter the figures on the coupon below.

Information and Instructions for completing Oklahoma Nonresident Distributed Income Withholding Tax Annual Return

Oklahoma taxable income and tax withheld. Copies

ITEM D. (Amended Return) - Check to correct a

Who Must File

of Form 500-B, along with Form 501, must be sent to

previously filed report. In Item B include the report-

Each pass-through entity that makes a distribution

the Oklahoma Tax Commission by the same date.

to a nonresident member is required to deduct and

ing period you are amending. Enter total corrected

withhold Oklahoma income tax, at the rate of 5%,

amounts on lines 1, 2 and 4 of the return and not

Estimated Withholding Tax Payments

from each distribution being made with respect to

the amount of the adjustment.

You were required to make estimated withholding tax

Oklahoma taxable income. The obligation to deduct

ITEM E. (Address Change) - Check Box E to notify us

payments if the amount required to be withheld from

and withhold from such distributions does not apply

of address change. Write new address in section E.

all nonresident members (line 2 of Annual Report)

to those distributions which are made to current

for the taxable year could reasonably have been ex-

ITEM F. (Out of Business) - If this is your last return

or permanent residents of Oklahoma or to entities

pected to exceed Five Hundred Dollars ($500.00). All

as an employer, check Box F and give the Date Out

exempt from the withholding requirement under

pass-through entities may elect to make estimated

of Business.

Rule 710:90-3-11.

tax payments.

ITEM G. Check the box if all of your nonresident

When to File

members have signed a withholding exemption

Specific Line instructions

The pass-through entity shall file a return on or

affidavit (Form OW-15) or you no longer have non-

before the due date of the pass-through entity’s

ITEM A. Enter the Federal Employers Identification

resident members.

income tax return, including extensions.

Number.

ITEM H. Enter the number of nonresident members

ITEM B. Enter the month/tax year end. If you are a

If the Oklahoma Tax Commission, in any case, has

for whom the withholding is being paid.

fiscal year filer, enter the month/year in which your

justifiable reason to believe that the collection of

fiscal year ends. If any of the preprinted information

the amount withheld is in jeopardy, the Tax Com-

is incorrect, please mark out and write in correct

mission may require a remitter to file a return and

pay the withheld amounts at any time.

information.

(Instructions continued on back)

ITEM C. Write the due date of your Annual Return

Each remitter must provide nonresident members

(month, day, year). The Annual Return is due on

a Form 500-B, by the due date of the pass-through

or before the due date of the pass-through entity’s

entity’s income tax return, including extensions,

showing their respective amount of distributed

income tax return, including extensions.

Please Detach Here and Return Coupon Below

Do not fold, staple, or paper clip

Do not tear or cut below line

Oklahoma Nonresident Distributed

10003

WTP

Income Withholding Tax Annual Return

D. Amended Report

A. Taxpayer FEIN

B. Tax Year Ending

C. Due Date

MM/YYYY

G.

H. Number of

See

Date Out

Nonresident Members: ________________

of Business: __________________

Instructions

MM/DD/YY

-Office Use Only-

E. Address Change

F. Out of Business

- - - - - - - - - Dollars - - - - - - - -

- - Cents - -

1. Distributed Taxable

Income ............................. ______________________ . ________

___________________________________________________

E.

2. Tax Withheld

______________________ . ________

(5% of line 1)

Name

3. Estimated Withholding

___________________________________________________

Tax Paid ........................... ______________________ . ________

Address

4. Tax Due

(if line 3 is more

___________________________________________________

............. ______________________ . ________

than line 2, enter 0)

City

State

ZIP

5. Underpayment

Penalty and Interest ... (+) ______________________ . ________

Signature: _____________________________________

Date: ______________

6. Delinquent Penalty

The information contained in this return and any attachments is true and correct to the best of my knowledge.

and Interest ................ (+) ______________________ . ________

7. Total Due ................... (=) ______________________ . ________

Please remit only one check per coupon.

1

1