Click Here to Print Document

CLICK HERE TO CLEAR FORM

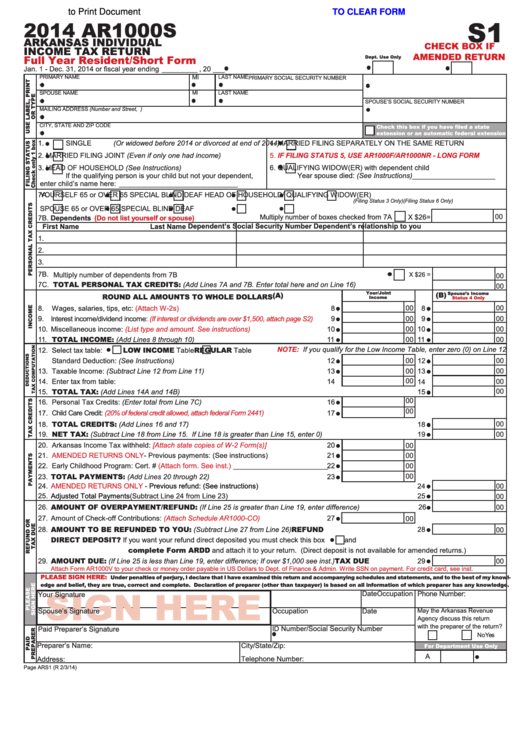

S1

2014 AR1000S

ARKANSAS INDIVIDUAL

CHECK BOX IF

INCOME TAX RETURN

AMENDED RETURN

Full Year Resident/Short Form

Dept. Use Only

Jan. 1 - Dec. 31, 2014 or fiscal year ending _________ , 20 ___

PRIMARY NAME

MI

LAST NAME

PRIMARY SOCIAL SECURITY NUMBER

SPOUSE NAME

MI

LAST NAME

SPOUSE’S SOCIAL SECURITY NUMBER

MAILING ADDRESS (Number and Street, P.O. Box or Rural Route)

Enter SSN(s) above

CITY, STATE AND ZIP CODE

Check this box if you have filed a state

extension or an automatic federal extension

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

1.

SINGLE (Or widowed before 2014 or divorced at end of 2014)

5.

IF FILING STATUS 5, USE AR1000F/AR1000NR - LONG FORM

2.

MARRIED FILING JOINT (Even if only one had income)

6.

QUALIFYING WIDOW(ER) with dependent child

3.

HEAD OF HOUSEHOLD (See Instructions)

If the qualifying person is your child but not your dependent,

Year spouse died: (See Instructions)_____________________

enter child’s name here: ______________________________

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/ QUALIFYING WIDOW(ER)

(Filing Status 3 Only)

(Filing Status 6 Only)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

Multiply number of boxes checked from 7A

X $26=

00

7B. Dependents

(Do not list yourself or spouse)

Dependent’s Social Security Number Dependent’s relationship to you

First Name

Last Name

1.

2.

3.

7B.

Multiply number of dependents from 7B ...........................................................................................................

X $26 =

00

7C. TOTAL PERSONAL TAX CREDITS: (Add Lines 7A and 7B. Enter total here and on Line 16)..................................7C

00

Your/Joint

(A)

(B)

Spouse’s Income

ROUND ALL AMOUNTS TO WHOLE DOLLARS

Income

Status 4 Only

00

00

8.

Wages, salaries, tips, etc:

(Attach W-2s)

.............................................................................

8

8

00

00

9.

Interest income/dividend income:

(If interest or dividends are over $1,500, attach page S2)

..........

9

9

10.

Miscellaneous income:

........................................

10

00

10

00

(List type and amount. See instructions)

TOTAL INCOME: (Add Lines 8 through 10) ...................................................................

11.

11

00

11

00

LOW INCOME Table

REGULAR Table

NOTE:

If you qualify for the Low Income Table, enter zero (0) on Line 12

12.

Select tax table:

Standard Deduction: (See Instructions)..............................................................................

12

00

12

00

13.

Taxable Income: (Subtract Line 12 from Line 11)...............................................................

13

00

13

00

00

14.

Enter tax from table:............................................................................................................

14

14

00

TOTAL TAX: (Add Lines 14A and 14B)..........................................................................................................................

00

15.

15

00

16.

Personal Tax Credits: (Enter total from Line 7C).................................................................

16

00

17.

Child Care Credit:

(20% of federal credit allowed, attach federal Form

2441).................................

17

TOTAL CREDITS: (Add Lines 16 and 17).....................................................................................................................

18.

00

18

NET TAX: (Subtract Line 18 from Line 15. If Line 18 is greater than Line 15, enter 0)..................................................

19.

19

00

20.

Arkansas Income Tax withheld:

[Attach state copies of W-2

Form(s)]................................

20

00

21.

AMENDED RETURNS ONLY

- Previous payments: (See instructions)..............................

21

00

22.

Early Childhood Program: Cert. #

(Attach form. See inst.)

________________________

22

00

TOTAL PAYMENTS: (Add Lines 20 through 22).............................................................

23

00

23.

24.

AMENDED RETURNS ONLY

- Previous refund: (See instructions)..................................................................................

24

00

25.

Adjusted Total Payments

(Subtract Line 24 from Line 23).................................................................................................

25

00

AMOUNT OF OVERPAYMENT/REFUND: (If Line 25 is greater than Line 19, enter difference)..............................

26.

26

00

27.

Amount of Check-off Contributions:

(Attach Schedule

AR1000-CO)..................................

27

00

AMOUNT TO BE REFUNDED TO YOU: (Subtract Line 27 from Line 26) ...............................................REFUND

28.

28

00

DIRECT DEPOSIT? If you want your refund direct deposited you must check this box

and

complete Form ARDD and attach it to your return. (Direct deposit is not available for amended returns.)

AMOUNT DUE: (If Line 25 is less than Line 19, enter difference; If over $1,000 see inst.) ........................TAX DUE

29.

29

00

Attach Form AR1000V to your check or money order payable in US Dollars to Dept. of Finance & Admin. Write SSN on payment. For credit card, see inst.

PLEASE SIGN HERE:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowl-

edge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

SIGN HERE

Occupation

Date

Phone Number:

Your Signature

Spouse’s Signature

Occupation

Date

May the Arkansas Revenue

Agency discuss this return

with the preparer of the return?

ID Number/Social Security Number

Paid Preparer’s Signature

Yes

No

Preparer’s Name:

City/State/Zip:

For Department Use Only

A

Telephone Number:

Address:

Page ARS1 (R 2/3/14)

1

1 2

2