West Virginia Business And Occupation Tax Return - Quarterly Report Form

ADVERTISEMENT

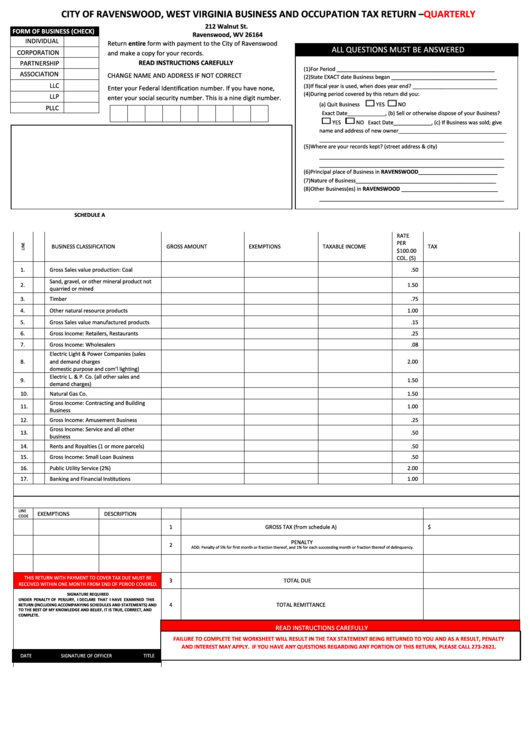

CITY OF RAVENSWOOD, WEST VIRGINIA BUSINESS AND OCCUPATION TAX RETURN –

QUARTERLY

212 Walnut St.

FORM OF BUSINESS (CHECK)

Ravenswood, WV 26164

INDIVIDUAL

Return entire form with payment to the City of Ravenswood

ALL QUESTIONS MUST BE ANSWERED

CORPORATION

and make a copy for your records.

READ INSTRUCTIONS CAREFULLY

PARTNERSHIP

(1)

For Period ______________________________________________________

ASSOCIATION

CHANGE NAME AND ADDRESS IF NOT CORRECT

(2)

State EXACT date Business began ____________________________________

LLC

(3)

If fiscal year is used, when does year end? _____________________________

Enter your Federal Identification number. If you have none,

(4)

During period covered by this return did you:

LLP

enter your social security number. This is a nine digit number.

(a) Quit Business

YES

NO

PLLC

Exact Date_____________, (b) Sell or otherwise dispose of your Business?

YES

NO Exact Date_____________, (c) If Business was sold; give

name and address of new owner_____________________________________

_______________________________________________________________

(5)

Where

are

your

records

kept?

(street

address

&

city)

_______________________________________________________________

_______________________________________________________________

(6)

Principal place of Business in RAVENSWOOD___________________________

(7)

Nature of Business________________________________________________

(8)

Other Business(es) in RAVENSWOOD _________________________________

_______________________________________________________________

SCHEDULE A

RATE

PER

BUSINESS CLASSIFICATION

GROSS AMOUNT

EXEMPTIONS

TAXABLE INCOME

TAX

$100.00

COL. (5)

1.

Gross Sales value production: Coal

.50

Sand, gravel, or other mineral product not

2.

1.50

quarried or mined

3.

Timber

.75

4.

Other natural resource products

1.00

5.

Gross Sales value manufactured products

.15

6.

Gross Income: Retailers, Restaurants

.25

7.

Gross Income: Wholesalers

.08

Electric Light & Power Companies (sales

8.

and demand charges

2.00

domestic purpose and com’l lighting)

Electric L. & P. Co. (all other sales and

9.

1.50

demand charges)

10.

Natural Gas Co.

1.50

Gross Income: Contracting and Building

11.

1.00

Business

12.

Gross Income: Amusement Business

.25

Gross Income: Service and all other

13.

.50

business

14.

Rents and Royalties (1 or more parcels)

.50

15.

Gross Income: Small Loan Business

.50

16.

Public Utility Service (2%)

2.00

17.

Banking and Financial Institutions

1.00

LINE

EXEMPTIONS

DESCRIPTION

CODE

1

GROSS TAX (from schedule A)

$

PENALTY

2

ADD: Penalty of 5% for first month or fraction thereof, and 1% for each succeeding month or fraction thereof of delinquency.

THIS RETURN WITH PAYMENT TO COVER TAX DUE MUST BE

3

TOTAL DUE

RECEIVED WITHIN ONE MONTH FROM END OF PERIOD COVERED.

SIGNATURE REQUIRED

UNDER PENALTY OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS

4

TOTAL REMITTANCE

RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND

TO THE BEST OF MY KNOWLEDGE AND BELIEF, IT IS TRUE, CORRECT, AND

COMPLETE.

READ INSTRUCTIONS CAREFULLY

FAILURE TO COMPLETE THE WORKSHEET WILL RESULT IN THE TAX STATEMENT BEING RETURNED TO YOU AND AS A RESULT, PENALTY

AND INTEREST MAY APPLY. IF YOU HAVE ANY QUESTIONS REGARDING ANY PORTION OF THIS RETURN, PLEASE CALL 273-2621.

DATE

SIGNATURE OF OFFICER

TITLE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1