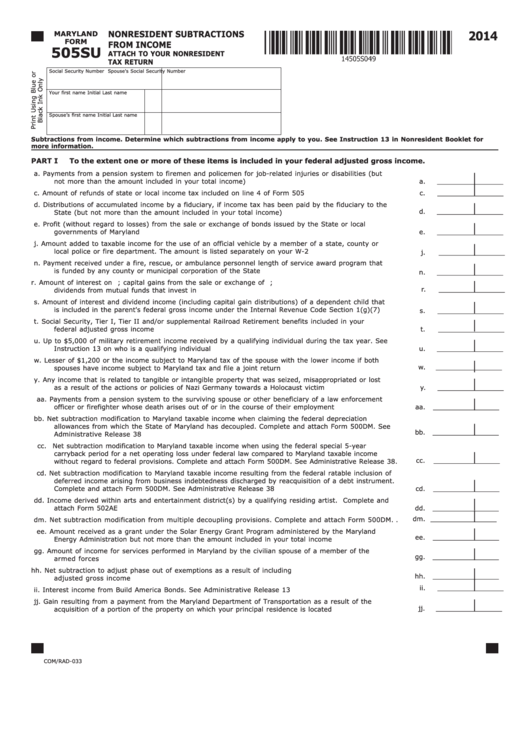

2014

NONRESIDENT SUBTRACTIONS

MARYLAND

FORM

FROM INCOME

505SU

ATTACH TO YOUR NONRESIDENT

TAX RETURN

Social Security Number

Spouse's Social Security Number

Your first name

Initial Last name

Spouse’s first name

Initial Last name

Subtractions from income. Determine which subtractions from income apply to you. See Instruction 13 in Nonresident Booklet for

more information.

PART I

To the extent one or more of these items is included in your federal adjusted gross income.

a.

Payments from a pension system to firemen and policemen for job-related injuries or disabilities (but

│

a. ________________

not more than the amount included in your total income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

│

c.

Amount of refunds of state or local income tax included on line 4 of Form 505 . . . . . . . . . . . . . . . . . .

c. ________________

d.

Distributions of accumulated income by a fiduciary, if income tax has been paid by the fiduciary to the

│

d. ________________

State (but not more than the amount included in your total income) . . . . . . . . . . . . . . . . . . . . . . . . . .

e.

Profit (without regard to losses) from the sale or exchange of bonds issued by the State or local

│

governments of Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e. ________________

j.

Amount added to taxable income for the use of an official vehicle by a member of a state, county or

│

local police or fire department. The amount is listed separately on your W-2 . . . . . . . . . . . . . . . . . . . .

j. ________________

n.

Payment received under a fire, rescue, or ambulance personnel length of service award program that

│

is funded by any county or municipal corporation of the State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

n. ________________

r.

Amount of interest on U.S. obligations; capital gains from the sale or exchange of U.S. obligations;

│

r. ________________

dividends from mutual funds that invest in U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

s.

Amount of interest and dividend income (including capital gain distributions) of a dependent child that

│

is included in the parent's federal gross income under the Internal Revenue Code Section 1(g)(7) . . . .

s. ________________

t.

Social Security, Tier I, Tier II and/or supplemental Railroad Retirement benefits included in your

│

federal adjusted gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

t. ________________

u.

Up to $5,000 of military retirement income received by a qualifying individual during the tax year. See

│

Instruction 13 on who is a qualifying individual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

u. ________________

w.

Lesser of $1,200 or the income subject to Maryland tax of the spouse with the lower income if both

│

w. ________________

spouses have income subject to Maryland tax and file a joint return . . . . . . . . . . . . . . . . . . . . . . . . . .

y.

Any income that is related to tangible or intangible property that was seized, misappropriated or lost

│

y. ________________

as a result of the actions or policies of Nazi Germany towards a Holocaust victim . . . . . . . . . . . . . . . .

aa.

Payments from a pension system to the surviving spouse or other beneficiary of a law enforcement

│

aa. ________________

officer or firefighter whose death arises out of or in the course of their employment . . . . . . . . . . . . . .

bb.

Net subtraction modification to Maryland taxable income when claiming the federal depreciation

allowances from which the State of Maryland has decoupled. Complete and attach Form 500DM. See

│

bb. ________________

Administrative Release 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

cc.

Net subtraction modification to Maryland taxable income when using the federal special 5-year

carryback period for a net operating loss under federal law compared to Maryland taxable income

│

cc. ________________

without regard to federal provisions. Complete and attach Form 500DM. See Administrative Release 38.

cd.

Net subtraction modification to Maryland taxable income resulting from the federal ratable inclusion of

deferred income arising from business indebtedness discharged by reacquisition of a debt instrument.

│

cd. ________________

Complete and attach Form 500DM. See Administrative Release 38 . . . . . . . . . . . . . . . . . . . . . . . . . . .

dd.

Income derived within arts and entertainment district(s) by a qualifying residing artist. Complete and

│

attach Form 502AE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

dd. ________________

│

dm. ________________

dm.

Net subtraction modification from multiple decoupling provisions. Complete and attach Form 500DM . .

│

ee.

Amount received as a grant under the Solar Energy Grant Program administered by the Maryland

ee. ________________

Energy Administration but not more than the amount included in your total income . . . . . . . . . . . . . . .

gg.

Amount of income for services performed in Maryland by the civilian spouse of a member of the

│

gg. ________________

armed forces . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

hh.

Net subtraction to adjust phase out of exemptions as a result of including U.S. obligations in your

│

hh. ________________

adjusted gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

│

ii. ________________

ii.

Interest income from Build America Bonds. See Administrative Release 13 . . . . . . . . . . . . . . . . . . . . .

jj.

Gain resulting from a payment from the Maryland Department of Transportation as a result of the

│

jj. ________________

acquisition of a portion of the property on which your principal residence is located . . . . . . . . . . . . . .

COM/RAD-033

1

1 2

2