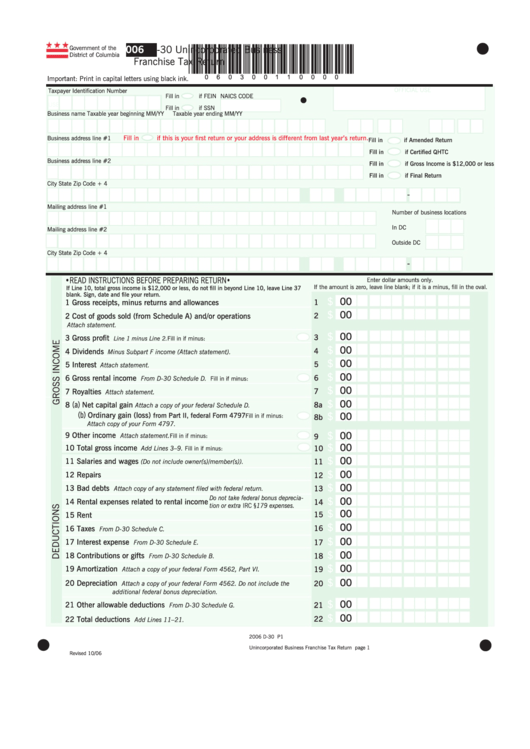

Form D-30 - Unincorporated Business Franchise Tax Return - 2006

ADVERTISEMENT

2006

D-30 Unincorporated Business

government of the

*060300110000*

District of Columbia

Franchise tax Return

Important: Print in capital letters using black ink.

oFFICIaL Use

taxpayer Identification Number

Fill in if FeIN

NaICs CoDe

Use

Fill in if ssN

Business name

taxable year beginning mm/YY taxable year ending mm/YY

Fill in if this is your first return or your address is different from last year’s return.

Business address line #1

Fill in if Amended Return

Fill in if Certified QHTC

Business address line #2

Fill in if Gross Income is $12,000 or less

Fill in if Final Return

City

state

Zip Code + 4

-

mailing address line #1

Number of business locations

In DC

mailing address line #2

outside DC

City

state

Zip Code + 4

-

•ReaD INstRUCtIoNs BeFoRe PRePaRINg RetURN•

enter dollar amounts only.

If the amount is zero, leave line blank; if it is a minus, fill in the oval.

If Line 10, total gross income is $12,000 or less, do not fill in beyond Line 10, leave Line 37

blank. Sign, date and file your return.

.

$

00

1

1 Gross receipts, minus returns and allowances

.

$

00

2

2 Cost of goods sold (from Schedule A) and/or operations

Attach statement.

.

$

00

3

3 Gross profit

Line 1 minus Line 2.

Fill in if minus:

.

$

00

4 Dividends

4

Minus Subpart F income (Attach statement).

.

$

00

5

5 Interest

Attach statement.

.

$

00

6

6 Gross rental income

From D-30 Schedule D.

Fill in if minus:

.

$

00

7

7 Royalties

Attach statement.

.

$

00

(a)

8a

8

Net capital gain

Attach a copy of your federal Schedule D.

.

(b)

$

00

Ordinary gain (loss)

from Part II, federal Form 4797

Fill in if minus:

8b

Attach copy of your Form 4797.

.

$

00

9 Other income

Attach statement.

Fill in if minus:

9

.

$

00

10 Total gross income

10

Add Lines 3–9.

Fill in if minus:

.

$

00

11 Salaries and wages

11

(Do not include owner(s)/member(s)).

.

$

00

12 Repairs

12

.

$

00

13 Bad debts

13

Attach copy of any statement filed with federal return.

.

Do not take federal bonus deprecia-

$

00

14 Rental expenses related to rental income

14

tion or extra IRC §179 expenses.

.

$

00

15

15 Rent

.

$

00

16

16 Taxes

From D-30 Schedule C.

.

$

00

17 Interest expense

17

From D-30 Schedule E.

.

$

00

18 Contributions or gifts

18

From D-30 Schedule B.

.

$

00

19 Amortization

19

Attach a copy of your federal Form 4562, Part VI.

.

$

00

20 Depreciation

20

Attach a copy of your federal Form 4562. Do not include the

additional federal bonus depreciation.

.

$

00

21 Other allowable deductions

21

From D-30 Schedule G.

.

$

00

22

22 Total deductions

Add Lines 11–21.

2006 D-30 P1

Unincorporated Business Franchise tax Return page 1

Revised 10/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5