Application For A Tobacco Products Tax License - Michigan Department Of Treasury

ADVERTISEMENT

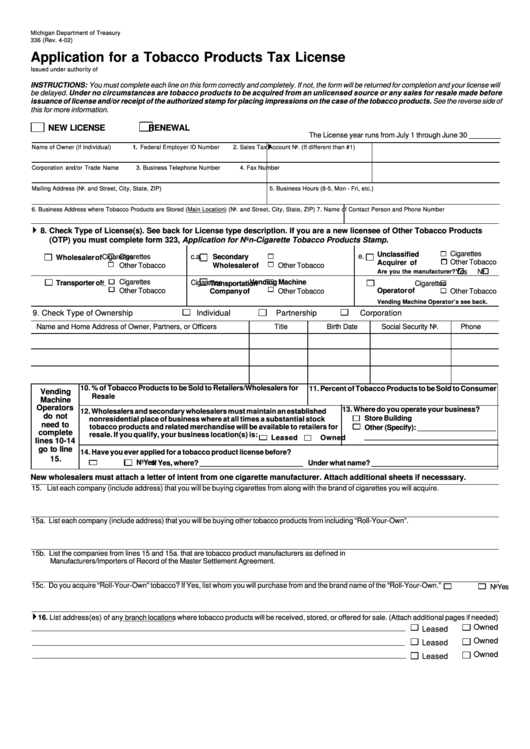

Michigan Department of Treasury

336 (Rev. 4-02)

Application for a Tobacco Products Tax License

Issued under authority of P.A. 327 of 1993. Filing is mandatory.

INSTRUCTIONS: You must complete each line on this form correctly and completely. If not, the form will be returned for completion and your license will

be delayed. Under no circumstances are tobacco products to be acquired from an unlicensed source or any sales for resale made before

issuance of license and/or receipt of the authorized stamp for placing impressions on the case of the tobacco products. See the reverse side of

this for more information.

NEW LICENSE

RENEWAL

The License year runs from July 1 through June 30 ________

4

Name of Owner (if Individual)

1. Federal Employer ID Number

2. Sales Tax Account No. (If different than #1)

Corporation and/or Trade Name

3. Business Telephone Number

4. Fax Number

Mailing Address (No. and Street, City, State, ZIP)

5. Business Hours (8-5, Mon - Fri, etc.)

6. Business Address where Tobacco Products are Stored (Main Location) (No. and Street, City, State, ZIP)

7. Name of Contact Person and Phone Number

4

8. Check Type of License(s). See back for License type description. If you are a new licensee of Other Tobacco Products

(OTP) you must complete form 323, Application for Non-Cigarette Tobacco Products Stamp.

Cigarettes

Unclassified

e.

a.

Cigarettes

c.

Secondary

Cigarettes

Wholesaler of

Other Tobacco

Acquirer of

Other Tobacco

Wholesaler of

Other Tobacco

Are you the manufacturer?

Yes

No

b.

Cigarettes

d.

Vending Machine

Transporter of

Cigarettes

Transportation

f.

Cigarettes

Other Tobacco

Operator of

Company of

Other Tobacco

Other Tobacco

Vending Machine Operator’s see back.

9. Check Type of Ownership

Individual

Partnership

Corporation

Name and Home Address of Owner, Partners, or Officers

Title

Birth Date

Social Security No.

Phone

10. % of Tobacco Products to be Sold to Retailers/Wholesalers for

11. Percent of Tobacco Products to be Sold to Consumer

Vending

Resale

Machine

Operators

13. Where do you operate your business?

12. Wholesalers and secondary wholesalers must maintain an established

do not

Store Building

nonresidential place of business where at all times a substantial stock

need to

tobacco products and related merchandise will be available to retailers for

Other (Specify): ____________________

complete

resale. If you qualify, your business location(s) is:

__________________________________

Leased

Owned

lines 10-14

go to line

14. Have you ever applied for a tobacco product license before?

15.

Yes

No

If Yes, where? __________________________ Under what name? ________________________________

New wholesalers must attach a letter of intent from one cigarette manufacturer. Attach additional sheets if necesssary.

15. List each company (include address) that you will be buying cigarettes from along with the brand of cigarettes you will acquire.

15a. List each company (include address) that you will be buying other tobacco products from including “Roll-Your-Own”.

15b. List the companies from lines 15 and 15a. that are tobacco product manufacturers as defined in P.A. 244 of 1999 that are Non-Participating

Manufacturers/Importers of Record of the Master Settlement Agreement.

15c. Do you acquire “Roll-Your-Own” tobacco? If Yes, list whom you will purchase from and the brand name of the “Roll-Your-Own.”

Yes

No

4

16. List address(es) of any branch locations where tobacco products will be received, stored, or offered for sale. (Attach additional pages if needed)

Owned

Leased

Owned

Leased

Owned

Leased

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2