Schedule Cr Instructions-Illinois Form

ADVERTISEMENT

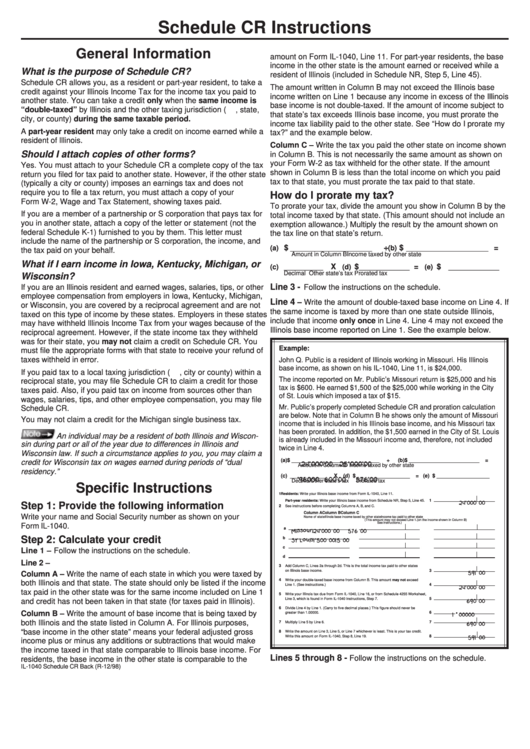

Schedule CR Instructions

General Information

amount on Form IL-1040, Line 11. For part-year residents, the base

income in the other state is the amount earned or received while a

What is the purpose of Schedule CR?

resident of Illinois (included in Schedule NR, Step 5, Line 45).

Schedule CR allows you, as a resident or part-year resident, to take a

The amount written in Column B may not exceed the Illinois base

credit against your Illinois Income Tax for the income tax you paid to

income written on Line 1 because any income in excess of the Illinois

another state. You can take a credit only when the same income is

base income is not double-taxed. If the amount of income subject to

“double-taxed” by Illinois and the other taxing jurisdiction ( i.e. , state,

that state’s tax exceeds Illinois base income, you must prorate the

city, or county) during the same taxable period.

income tax liability paid to the other state. See “How do I prorate my

A part-year resident may only take a credit on income earned while a

tax?” and the example below.

resident of Illinois.

Column C – Write the tax you paid the other state on income shown

Should I attach copies of other forms?

in Column B. This is not necessarily the same amount as shown on

your Form W-2 as tax withheld for the other state. If the amount

Yes. You must attach to your Schedule CR a complete copy of the tax

shown in Column B is less than the total income on which you paid

return you filed for tax paid to another state. However, if the other state

tax to that state, you must prorate the tax paid to that state.

(typically a city or county) imposes an earnings tax and does not

require you to file a tax return, you must attach a copy of your

How do I prorate my tax?

Form W-2, Wage and Tax Statement, showing taxes paid.

To prorate your tax, divide the amount you show in Column B by the

If you are a member of a partnership or S corporation that pays tax for

total income taxed by that state. (This amount should not include an

you in another state, attach a copy of the letter or statement (not the

exemption allowance.) Multiply the result by the amount shown on

federal Schedule K-1) furnished to you by them. This letter must

the tax line on that state’s return.

include the name of the partnership or S corporation, the income, and

$

÷

$

=

(a)

_____________________

(b)

_____________________

the tax paid on your behalf.

Amount in Column B

Income taxed by other state

What if I earn income in Iowa, Kentucky, Michigan, or

X

$

=

$

(c) __________

(d)

_____________

(e)

_____________

Decimal

Other state’s tax

Prorated tax

Wisconsin?

Line 3 -

If you are an Illinois resident and earned wages, salaries, tips, or other

Follow the instructions on the schedule.

employee compensation from employers in Iowa, Kentucky, Michigan,

Line 4

– Write the amount of double-taxed base income on Line 4. If

or Wisconsin, you are covered by a reciprocal agreement and are not

the same income is taxed by more than one state outside Illinois,

taxed on this type of income by these states. Employers in these states

include that income only once in Line 4. Line 4 may not exceed the

may have withheld Illinois Income Tax from your wages because of the

Illinois base income reported on Line 1. See the example below.

reciprocal agreement. However, if the state income tax they withheld

was for their state, you may not claim a credit on Schedule CR. You

Example:

must file the appropriate forms with that state to receive your refund of

taxes withheld in error.

John Q. Public is a resident of Illinois working in Missouri. His Illinois

base income, as shown on his IL-1040, Line 11, is $24,000.

If you paid tax to a local taxing jurisdiction ( i.e. , city or county) within a

The income reported on Mr. Public’s Missouri return is $25,000 and his

reciprocal state, you may file Schedule CR to claim a credit for those

tax is $600. He earned $1,500 of the $25,000 while working in the City

taxes paid. Also, if you paid tax on income from sources other than

of St. Louis which imposed a tax of $15.

wages, salaries, tips, and other employee compensation, you may file

Mr. Public’s properly completed Schedule CR and proration calculation

Schedule CR.

are below. Note that in Column B he shows only the amount of Missouri

You may not claim a credit for the Michigan single business tax.

income that is included in his Illinois base income, and his Missouri tax

has been prorated. In addition, the $1,500 earned in the City of St. Louis

An individual may be a resident of both Illinois and Wiscon-

is already included in the Missouri income and, therefore, not included

sin during part or all of the year due to differences in Illinois and

twice in Line 4.

Wisconsin law. If such a circumstance applies to you, you may claim a

(a) $ ______________________________

÷

(b) $ ________________________

=

credit for Wisconsin tax on wages earned during periods of “dual

Amount in Column B

Income taxed by other state

residency.”

(c) _____________

X

(d) $ __________________

= (e) $ __________________

Decimal

Other state's tax

Prorated tax

Specific Instructions

1

Residents: Write your Illinois base income from Form IL-1040, Line 11.

1

Part-year residents: Write your Illinois base income from Schedule NR, Step 5, Line 45.

Step 1: Provide the following information

2

See instructions before completing Columns A, B, and C.

Column A

Column B

Column C

Write your name and Social Security number as shown on your

Name of state

Illinois base income taxed by other state

Income tax paid to other state

(This amount may not exceed Line 1.

(on the income shown in Column B)

See instructions.)

Form IL-1040.

a

Step 2: Calculate your credit

b

c

Line 1 – Follow the instructions on the schedule.

d

Line 2 –

3

Add Column C, Lines 2a through 2d. This is the total income tax paid to other states

on Illinois base income.

3

Column A – Write the name of each state in which you were taxed by

4

Write your double-taxed base income from Column B. This amount may not exceed

both Illinois and that state. The state should only be listed if the income

4

Line 1. (See instructions.)

tax paid in the other state was for the same income included on Line 1

5

Write your Illinois tax due from Form IL-1040, Line 16, or from Schedule 4255 Worksheet,

5

Line 3, which is found in Form IL-1040 Instructions, Step 7.

and credit has not been taken in that state (for taxes paid in Illinois).

.

6

Divide Line 4 by Line 1. (Carry to five decimal places.) This figure should never be

Column B – Write the amount of base income that is being taxed by

greater than 1.00000.

6

both Illinois and the state listed in Column A. For Illinois purposes,

7

7

Multiply Line 5 by Line 6.

“base income in the other state” means your federal adjusted gross

8

Write the amount on Line 3, Line 5, or Line 7 whichever is least. This is your tax credit.

8

Write this amount on Form IL-1040, Step 8, Line 19.

income plus or minus any additions or subtractions that would make

the income taxed in that state comparable to Illinois base income. For

Lines 5 through 8 -

Follow the instructions on the schedule.

residents, the base income in the other state is comparable to the

IL-1040 Schedule CR Back (R-12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1