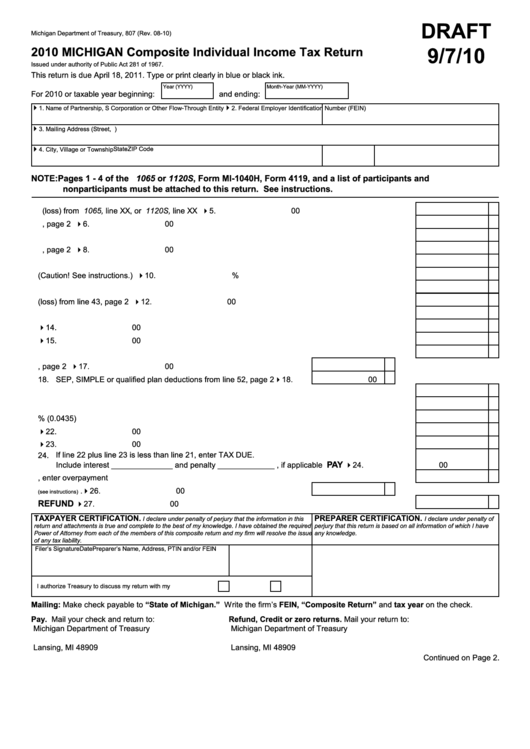

Form 807 Draft - Michigan Composite Individual Income Tax Return - 2010

ADVERTISEMENT

DRAFT

Michigan Department of Treasury, 807 (Rev. 08-10)

9/7/10

2010 MICHIGAN Composite Individual Income Tax Return

Issued under authority of Public Act 281 of 1967.

This return is due April 18, 2011. Type or print clearly in blue or black ink.

Year (YYYY)

Month-Year (MM-YYYY)

For 2010 or taxable year beginning:

and ending:

4

1. Name of Partnership, S Corporation or Other Flow-Through Entity

4

2. Federal Employer Identification Number (FEIN)

4

3. Mailing Address (Street, P.O. Box or Rural Route No.)

State

ZIP Code

4

4. City, Village or Township

NOTE: Pages 1 - 4 of the U.S. Forms 1065 or 1120S, Form MI-1040H, Form 4119, and a list of participants and

nonparticipants must be attached to this return. See instructions.

5. Ordinary income (loss) from U.S. Form 1065, line XX, or U.S. Form 1120S, line XX ........................ 45.

00

6. Additions from line 35, page 2 ............................................................................................................ 46.

00

7. Subtotal. Add lines 5 and 6 .................................................................................................................

7.

00

8. Subtractions from line 38, page 2 ....................................................................................................... 48.

00

9. Total income subject to apportionment. Subtract line 8 from line 7 ....................................................

9.

00

10. Apportionment percentage from MI-1040H. (Caution! See instructions.) ........................................... 410.

%

11. Total Michigan apportioned income. Multiply line 9 by the percentage on line 10 ..............................

11.

00

12. Michigan allocated income or (loss) from line 43, page 2 .................................................................. 412.

00

13. Total Michigan income. Add lines 11 and 12 .......................................................................................

13.

00

14. Michigan income attributable to Michigan residents ........................................................................... 414.

00

15. Michigan income attributable to nonparticipating nonresidents .......................................................... 415.

00

16. Michigan income attributable to participants ......................................................................................

16.

00

17. Exemption allowance from line 49, page 2 ......................................... 417.

00

18. SEP, SIMPLE or qualified plan deductions from line 52, page 2 ........ 418.

00

19. Add lines 17 and 18 ............................................................................................................................

19.

00

20. Taxable income. Subtract line 19 from line 16 ....................................................................................

20.

00

21. Tax due. Multiply line 20 by 4.35% (0.0435) .......................................................................................

21.

00

22. Michigan extension payments ............................................................................................................ 422.

00

23. Withholding tax payments attributable to participants ........................................................................ 423.

00

24. If line 22 plus line 23 is less than line 21, enter TAX DUE.

PAY

Include interest ______________ and penalty _____________ , if applicable .........................

00

424.

25. If line 22 plus line 23 is more than line 21, enter overpayment ..........................................................

25.

00

26. Amount of line 25 to apply to 2011 withholding account

. 426.

00

(see instructions)

REFUND

27. Subtract line 26 from line 25 ..............................................................................................

00

427.

TAXPAYER CERTIFICATION.

PREPARER CERTIFICATION.

I declare under penalty of

I declare under penalty of perjury that the information in this

return and attachments is true and complete to the best of my knowledge. I have obtained the required

perjury that this return is based on all information of which I have

Power of Attorney from each of the members of this composite return and my firm will resolve the issue

any knowledge.

of any tax liability.

Filer’s Signature

Date

Preparer’s Name, Address, PTIN and/or FEIN

I authorize Treasury to discuss my return with my preparer.

Yes

No

Mailing: Make check payable to “State of Michigan.” Write the firm’s FEIN, “Composite Return” and tax year on the check.

Pay. Mail your check and return to:

Refund, Credit or zero returns. Mail your return to:

Michigan Department of Treasury

Michigan Department of Treasury

P.O. Box 30207

P.O. Box 30058

Lansing, MI 48909

Lansing, MI 48909

Continued on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4