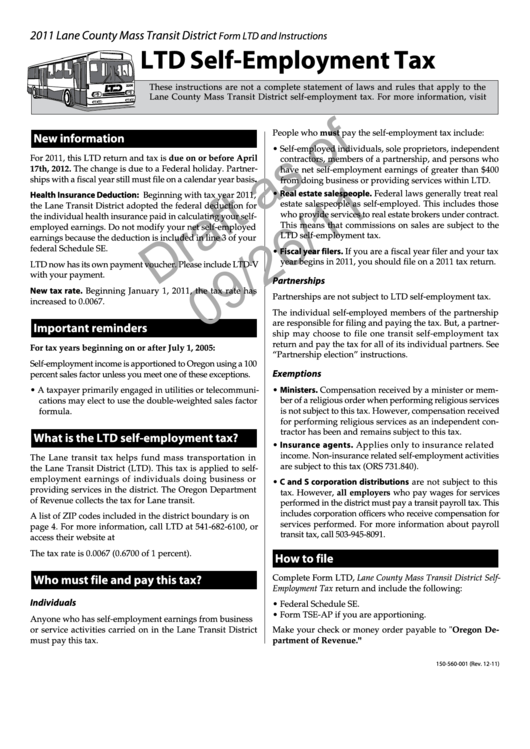

Form Ltd And Instructions Draft - Self-Employment Tax - 2011

ADVERTISEMENT

2011 Lane County Mass Transit District

Form LTD and Instructions

LTD Self-Employment Tax

These instructions are not a complete statement of laws and rules that apply to the

Lane County Mass Transit District self-employment tax. For more information, visit

People who must pay the self-employment tax include:

New information

• Self-employed individuals, sole proprietors, independent

For 2011, this LTD return and tax is due on or before April

contractors, members of a partnership, and persons who

17th, 2012. The change is due to a Federal holiday. Partner-

have net self-employment earnings of greater than $400

ships with a fiscal year still must file on a calendar year basis.

from doing business or providing services within LTD.

• Real estate salespeople. Federal laws generally treat real

Health Insurance Deduction: Beginning with tax year 2011,

estate salespeople as self-employed. This includes those

the Lane Transit District adopted the federal deduction for

who provide services to real estate brokers under contract.

the individual health insurance paid in calculating your self-

This means that commissions on sales are subject to the

employed earnings. Do not modify your net self-employed

LTD self-employment tax.

earnings because the deduction is included in line 3 of your

federal Schedule SE.

• Fiscal year filers. If you are a fiscal year filer and your tax

year begins in 2011, you should file on a 2011 tax return.

LTD now has its own payment voucher. Please include LTD-V

with your payment.

Partnerships

New tax rate. Beginning January 1, 2011, the tax rate has

Partnerships are not subject to LTD self-employment tax.

increased to 0.0067.

The individual self-employed members of the partnership

are responsible for filing and paying the tax. But, a partner-

Important reminders

ship may choose to file one transit self-employment tax

return and pay the tax for all of its individual partners. See

For tax years beginning on or after July 1, 2005:

“Partnership election” instructions.

Self-employment income is apportioned to Oregon using a 100

Exemptions

percent sales factor unless you meet one of these exceptions.

• Ministers. Compensation received by a minister or mem-

• A taxpayer primarily engaged in utilities or telecommuni-

cations may elect to use the double-weighted sales factor

ber of a religious order when performing religious services

is not subject to this tax. However, compensation received

formula.

for performing religious services as an independent con-

tractor has been and remains subject to this tax.

What is the LTD self-employment tax?

• Insurance agents. Applies only to insurance related

income. Non-insurance related self-employment activities

The Lane transit tax helps fund mass transportation in

are subject to this tax (ORS 731.840).

the Lane Transit District (LTD). This tax is applied to self-

employment earnings of individuals doing business or

• C and S corporation distributions are not subject to this

providing services in the district. The Oregon Department

tax. However, all employers who pay wages for services

of Revenue collects the tax for Lane transit.

performed in the district must pay a transit payroll tax. This

includes corporation officers who receive compensation for

A list of ZIP codes included in the district boundary is on

services performed. For more information about payroll

page 4. For more information, call LTD at 541-682-6100, or

transit tax, call 503-945-8091.

access their website at

The tax rate is 0.0067 (0.6700 of 1 percent).

How to file

Who must file and pay this tax?

Complete Form LTD, Lane County Mass Transit District Self-

Employment Tax return and include the following:

Individuals

• Federal Schedule SE.

• Form TSE-AP if you are apportioning.

Anyone who has self-employment earnings from business

or service activities carried on in the Lane Transit District

Make your check or money order payable to "Oregon De-

must pay this tax.

partment of Revenue."

150-560-001 (Rev. 12-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5