Form Nyc-114.5 Draft - Reap Credit Applied To Unincorporated Business Tax - 2017

ADVERTISEMENT

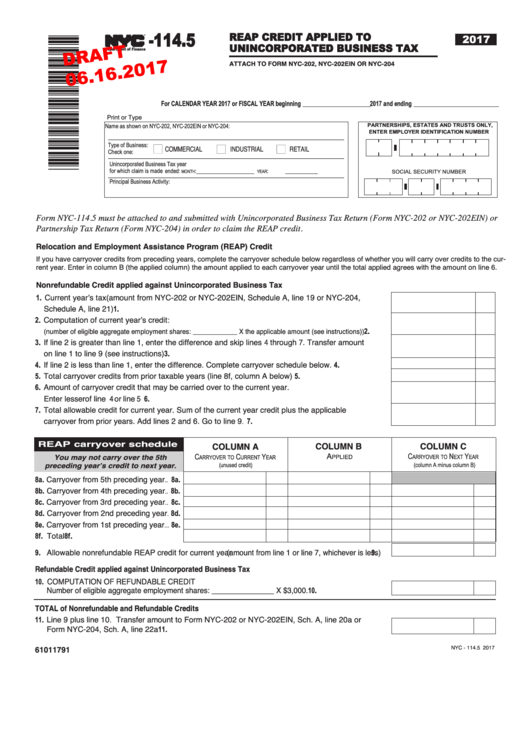

-114.5

REAP CREDIT APPLIED TO

2017

UNINCORPORATED BUSINESS TAX

TM

Department of Finance

attaCH to FoRM NYC-202, NYC-202EIN oR NYC-204

For CALENDAR YEAR 2017 or FISCAL YEAR beginning ____________________ 2017 and ending _________________________

print or Type

Name as shown on NYC-202, NYC-202EIN or NYC-204:

PARTNERSHIPS, ESTATES AND TRUSTS ONLY,

ENTER EMPLOYER IDENTIFICATION NUMBER

n

n

n

Type of Business:

CommERCIAL

INduSTRIAL

RETAIL

Check one:

Unincorporated Business Tax year

for which claim is made

ended:

:_________________

:___________

:

SOCIAL SECURITY NUMBER

MONTH

YEAR

Principal Business Activity:

Form NYC-114.5 must be attached to and submitted with Unincorporated Business Tax Return (Form NYC-202 or NYC-202EIN) or

Partnership Tax Return (Form NYC-204) in order to claim the REAP credit.

Relocation and Employment assistance Program (REaP) Credit

If you have carryover credits from preceding years, complete the carryover schedule below regardless of whether you will carry over credits to the cur-

rent year. Enter in column b (the applied column) the amount applied to each carryover year until the total applied agrees with the amount on line 6.

Nonrefundable Credit applied against Unincorporated Business tax

1. Current year’s tax (amount from NYC-202 or NYC-202EIN, Schedule A, line 19 or NYC-204,

Schedule A, line 21)

1.

..........................................................................................................................................................................

2. Computation of current year’s credit:

2.

(number of eligible aggregate employment shares: ____________ X the applicable amount (see instructions))

....

3. If line 2 is greater than line 1, enter the difference and skip lines 4 through 7. Transfer amount

on line 1 to line 9 (see instructions)

3.

...........................................................................................................................

4. If line 2 is less than line 1, enter the difference. Complete carryover schedule below.

4.

......................

5. Total carryover credits from prior taxable years (line 8f, column A below)

5.

...............................................

6. Amount of carryover credit that may be carried over to the current year.

Enter lesser of line 4 or line 5

6.

.......................................................................................................................................

7. Total allowable credit for current year. Sum of the current year credit plus the applicable

carryover from prior years. Add lines 2 and 6. Go to line 9

7.

. ...........................................................................

REaP carryover schedule

ColUMN B

ColUMN C

ColUMN a

A

C

N

Y

C

C

Y

You may not carry over the 5th

ppLIEd

ARRYOVER TO

EXT

EAR

ARRYOVER TO

URRENT

EAR

preceding year’s credit to next year.

(unused credit)

(column A minus column B)

8a. Carryover from 5th preceding year

8a.

..

8b. Carryover from 4th preceding year

8b.

..

8c. Carryover from 3rd preceding year

8c.

..

8d. Carryover from 2nd preceding year

8d.

.

8e. Carryover from 1st preceding year

8e.

...

8f. Total

8f.

................................................................

9. Allowable nonrefundable REAp credit for current year (amount from line 1 or line 7, whichever is less)

9.

....

Refundable Credit applied against Unincorporated Business tax

10. CompuTATIoN oF REFuNdAbLE CREdIT

Number of eligible aggregate employment shares: _______________ X $3,000.

10.

..........................................

total of Nonrefundable and Refundable Credits

11. Line 9 plus line 10. Transfer amount to Form NYC-202 or NYC-202EIN, Sch. A, line 20a or

Form NYC-204, Sch. A, line 22a

11.

................................................................................................................................

61011791

NYC - 114.5 2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2