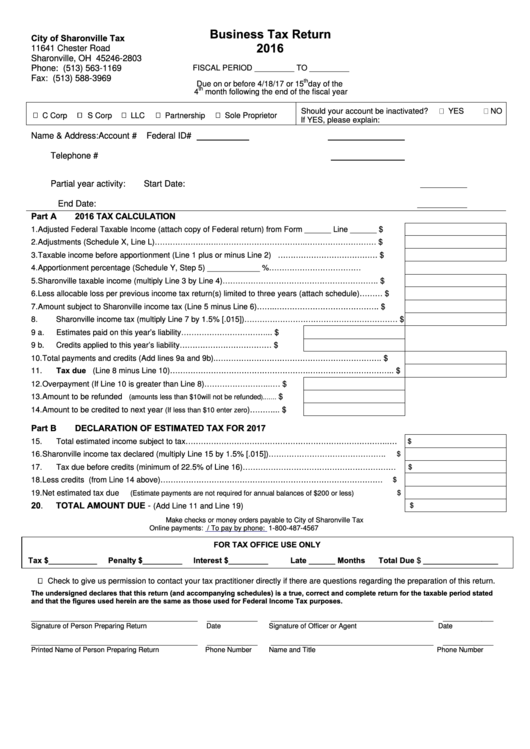

Business Tax Return

City of Sharonville Tax

2016

11641 Chester Road

Sharonville, OH 45246-2803

Phone: (513) 563-1169

FISCAL PERIOD _________ TO _________

Fax: (513) 588-3969

th

Due on or before 4/18/17 or 15

day of the

th

4

month following the end of the fiscal year

Should your account be inactivated?

YES

NO

C Corp

S Corp

LLC

Partnership

Sole Proprietor

If YES, please explain:

Name & Address:

Account #

Federal ID#

Telephone #

Partial year activity:

Start Date:

End Date:

Part A

2016 TAX CALCULATION

1.

Adjusted Federal Taxable Income (attach copy of Federal return) from Form ______ Line ______

$

2.

Adjustments (Schedule X, Line L)…………………….……………………………..………………………

$

3.

Taxable income before apportionment (Line 1 plus or minus Line 2) …………………………………

$

4.

Apportionment percentage (Schedule Y, Step 5) ____________ %………………………………

5.

Sharonville taxable income (multiply Line 3 by Line 4)…………………………………………………….

$

6.

Less allocable loss per previous income tax return(s) limited to three years (attach schedule)………

$

7.

Amount subject to Sharonville income tax (Line 5 minus Line 6)……..………………………………….

$

8.

Sharonville income tax (multiply Line 7 by 1.5% [.015])……………………………………………………

$

9 a.

Estimates paid on this year’s liability……………………………...

$

9 b.

Credits applied to this year’s liability………………………………

$

10.

Total payments and credits (Add lines 9a and 9b)..……………………………………………………….

$

Tax due (Line 8 minus Line 10)……………………………………………….……………….…………..

11.

$

12.

Overpayment (If Line 10 is greater than Line 8)……………………...…

$

13.

Amount to be refunded

$

(amounts less than $10 will not be refunded

).……

14.

Amount to be credited to next year

)………...

$

(If less than $10 enter zero

Part B

DECLARATION OF ESTIMATED TAX FOR 2017

15.

Total estimated income subject to tax……………………………………………………………………..…

$

16.

Sharonville income tax declared (multiply Line 15 by 1.5% [.015])……………………………………….

$

17.

Tax due before credits (minimum of 22.5% of Line 16)……………………………………………………

$

18.

Less credits (from Line 14 above)……………………………………………………………………………

$

19.

Net estimated tax due

$

(Estimate payments are not required for annual balances of $200 or less)

20.

TOTAL AMOUNT DUE -

(Add Line 11 and Line 19)

$

Make checks or money orders payable to City of Sharonville Tax

Online payments:

/ To pay by phone: 1-800-487-4567

FOR TAX OFFICE USE ONLY

Tax $___________

Penalty $_________

Interest $_________

Late ______ Months

Total Due $ _________________

Check to give us permission to contact your tax practitioner directly if there are questions regarding the preparation of this return.

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated

and that the figures used herein are the same as those used for Federal Income Tax purposes.

___________________________________________

_____________

__________________________________________

_____________

Signature of Person Preparing Return

Date

Signature of Officer or Agent

Date

___________________________________________

_____________

__________________________________________

_____________

Printed Name of Person Preparing Return

Phone Number

Name and Title

Phone Number

1

1 2

2