Form Rp-420-A/b-Rnw-I - Renewal Application For Real Property Tax Exemption For Nonprofit Organizations I - Organization Purpose 2008

ADVERTISEMENT

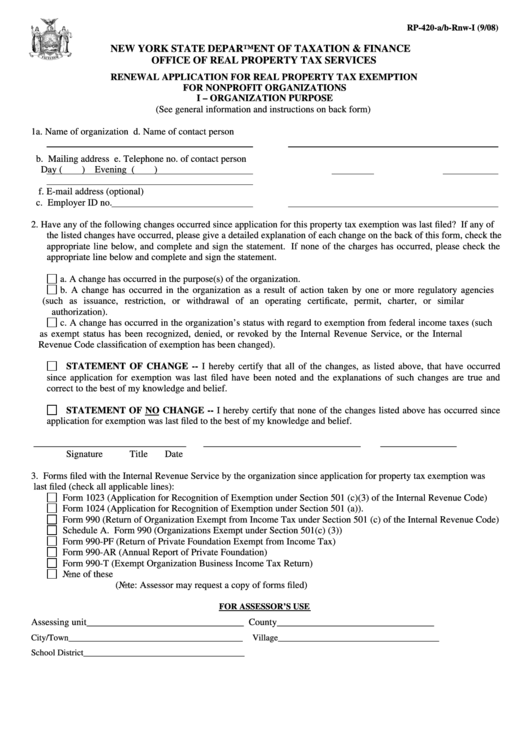

RP-420-a/b-Rnw-I (9/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

RENEWAL APPLICATION FOR REAL PROPERTY TAX EXEMPTION

FOR NONPROFIT ORGANIZATIONS

I – ORGANIZATION PURPOSE

(See general information and instructions on back form)

1a. Name of organization

d. Name of contact person

b. Mailing address

e. Telephone no. of contact person

Day (

)

Evening (

)

f.

E-mail address (optional)

c. Employer ID no.

2. Have any of the following changes occurred since application for this property tax exemption was last filed? If any of

the listed changes have occurred, please give a detailed explanation of each change on the back of this form, check the

appropriate line below, and complete and sign the statement. If none of the charges has occurred, please check the

appropriate line below and complete and sign the statement.

a. A change has occurred in the purpose(s) of the organization.

b. A change has occurred in the organization as a result of action taken by one or more regulatory agencies

(such as issuance, restriction, or withdrawal of an operating certificate, permit, charter, or similar

authorization).

c. A change has occurred in the organization’s status with regard to exemption from federal income taxes (such

as exempt status has been recognized, denied, or revoked by the Internal Revenue Service, or the Internal

Revenue Code classification of exemption has been changed).

STATEMENT OF CHANGE -- I hereby certify that all of the changes, as listed above, that have occurred

since application for exemption was last filed have been noted and the explanations of such changes are true and

correct to the best of my knowledge and belief.

STATEMENT OF NO CHANGE -- I hereby certify that none of the changes listed above has occurred since

application for exemption was last filed to the best of my knowledge and belief.

________________________________

_________________________________

________________

Signature

Title

Date

3. Forms filed with the Internal Revenue Service by the organization since application for property tax exemption was

last filed (check all applicable lines):

Form 1023 (Application for Recognition of Exemption under Section 501 (c)(3) of the Internal Revenue Code)

Form 1024 (Application for Recognition of Exemption under Section 501 (a)).

Form 990 (Return of Organization Exempt from Income Tax under Section 501 (c) of the Internal Revenue Code)

Schedule A. Form 990 (Organizations Exempt under Section 501(c) (3))

Form 990-PF (Return of Private Foundation Exempt from Income Tax)

Form 990-AR (Annual Report of Private Foundation)

Form 990-T (Exempt Organization Business Income Tax Return)

None of these

(Note: Assessor may request a copy of forms filed)

FOR ASSESSOR’S USE

Assessing unit_________________________________

County_________________________________

City/Town________________________________________

Village_____________________________________

School District_____________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2