1 S SANDUSKY ST / P.O. BOX 496

INCOME TAX DEPARTMENT

DELAWARE, OH 43015

740-203-1225 / FAX: 740-203-1249

INCOMETAX@DELAWAREOHIO.NET

2016 CURRENT RATE: 1.85%

QUARTERLY EMPLOYER CITY TAX WITHHOLDING PACKET

Coupon Packet—Included in this packet are Employer Withholding Coupons for the

withholding payments on or before the due dates as shown below to the Income Tax

period January 01-December 31 and a year-end Annual Reconciliation Form. Also

Department. The failure of any employer to receive or procure the forms shall not

included is an Annual Withholding Tax Worksheet for you to keep track of your

excuse him from making this return or from remitting the tax withheld.

•

payments. If you have any questions, contact our office at 740-203-1225. Additional

Quarterly—If tax withheld or required to be withheld is less than $200 per

coupon forms and information are available on the City of Delaware website at

month, remittance is due by the fifteenth day of the month following the

end of a quarterly period (April 15, July 15, October 15, January 15).

Who must file—Any employer within or doing business within the City of Delaware,

•

Monthly—If more than $200 is withheld or required to be withheld per month,

Ohio, who employs one or more persons is required to withhold the current tax rate

remittance is due by the fifteenth day of the following month.

from all qualifying wages paid to or accrued by the employee(s) and to file these

Failure To File Return and Pay Tax—All taxes, including taxes withheld or required to

coupon forms and remit tax to the City of Delaware Income Tax Department pursuant

be withheld from wages by an employer and remaining unpaid after they become

to the Delaware Income Tax Ordinance.

due, shall bear interest on the amount of the unpaid tax at the current annual

Deposit Requirements—The City of Delaware income tax must be remitted to the

short term rate plus five percent (5%) annually and a late payment penalty of fifty

Income Tax Department on a monthly basis unless withholding amounts are less than

percent (50%) of tax due. The failure to receive a withholding deposit coupon

two hundered dollars ($200.00) per month. Each employer is required to file the

form shall not excuse an employer from making a return and depositing the taxes

“Employer’s Return of Tax Withheld” coupon along with the monthly or quarterly

withheld.

COMPLETING THE WITHHOLDING COUPON FORMS

Line 1— Enter tax withheld on all qualifying wages paid to or accrued by all

Line 3—Enter total of Lines 1 and 2.

employees working within the City of Delaware.

Line 4—Adjust current payment of actual tax withheld for under payment or over

Line 2—Enter tax withheld as courtesy to Delaware City residents and indicate

payment in previous period. Attach explanation.

percentage used. If unsure of proper courtesy rate, please call the Income Tax

Lines 5 & 6—See instructions under Failure To File Return and Pay Tax.

Department.

Line 7—Enter total amount to be remitted.

QUALIFYING WAGES FOR WITHHOLDING (Ohio Revised Code, Sec 718.03)

•

Medicare Wages

Nonqualified Deferred Compensation Plan—Income from nonqualified plans is

An employer is required to withhold only on “qualifying wages,” which are wages as

included in the definition of “qualifying wages” at the time the income is deferred

defined in Internal Revenue Code Section 3121(a), generally the Medicare Wage Box

and is subject to withholding requirements.

of Form W-2.

•

Stock Options—Income from the exercise of stock options is included in the

•

Medicare Exempt Employees—These employees are subject to the requirements

definition of “qualifying wages” and is subject to withholding requirements.

for “qualifying wages” in the Medicare Wage Box of FormW-2 even though that

•

Disqualifying Disposition of an Incentive Stock Option—Employer is not required

box will remain blank.

to withhold, but the income is considered “qualifying wages,” and the recipient is

•

Cafeteria Plans—Internal Revenue Code Section 125 wages are not included in

liable for the tax.

the definition of Medicare wages and do not need to be deducted from the

Medicare Wage Box.

Note: As an employer, if the Medicare Wage Box is not the largest wage figure on

•

401(k), 457, and Supplemental Unemployment Compensation Benefits—These

the W-2 Form, a written explanation will be required.

items should all be included in the Medicare Wage Box and are subject to

withholding requirements.

Questions? Contact the City of Delaware Income Tax Department:

740-203-1225 or IncomeTax@DelawareOhio.Net

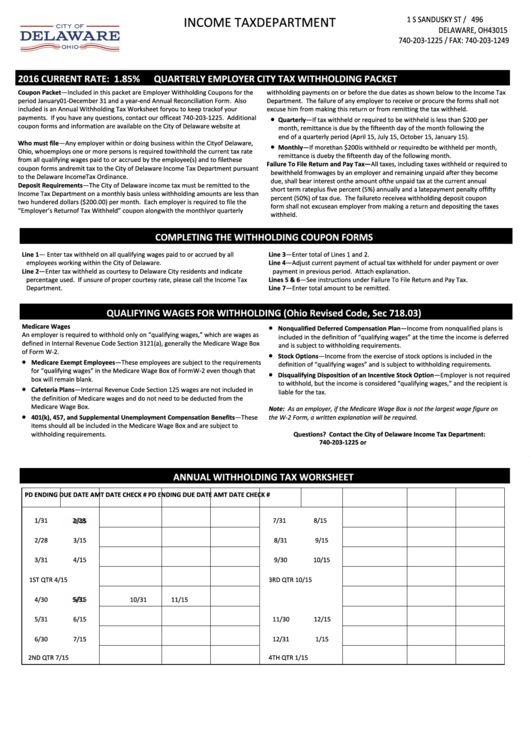

ANNUAL WITHHOLDING TAX WORKSHEET

PD ENDING

DUE DATE

AMT

DATE

CHECK #

PD ENDING

DUE DATE

AMT

DATE

CHECK #

2/28

2/15

1/31

7/31

8/15

2/28

3/15

8/31

9/15

3/31

4/15

9/30

10/15

1ST QTR

4/15

3RD QTR

10/15

5/15

5/31

4/30

10/31

11/15

5/31

6/15

11/30

12/15

6/30

7/15

12/31

1/15

2ND QTR

7/15

4TH QTR

1/15

1

1 2

2 3

3 4

4