Form Il-1041 - Fiduciary Income And Replacement Tax Return

ADVERTISEMENT

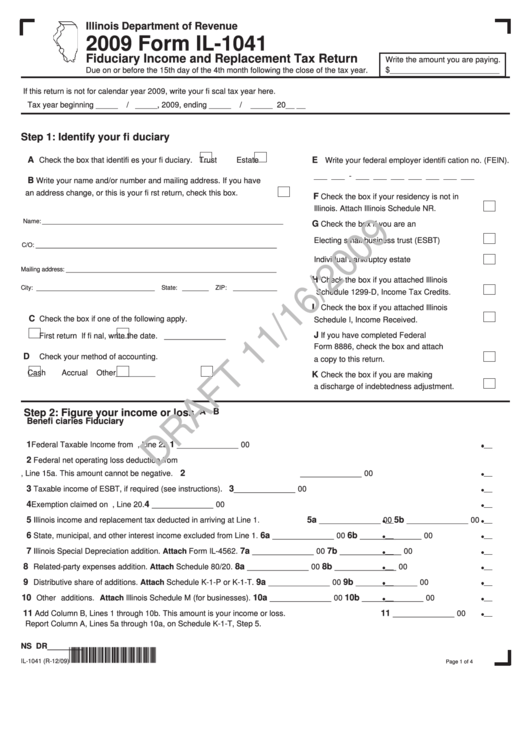

Illinois Department of Revenue

2009 Form IL-1041

Fiduciary Income and Replacement Tax Return

Write the amount you are paying.

$_________________________

Due on or before the 15th day of the 4th month following the close of the tax year.

If this return is not for calendar year 2009, write your fi scal tax year here.

Tax year beginning _____

/ _____, 2009, ending _____

/

_____ 20__ __

Step 1: Identify your fi duciary

A

Check the box that identifi es your fi duciary.

Trust

Estate

E

Write your federal employer identifi cation no. (FEIN).

___ ___ - ___ ___ ___ ___ ___ ___ ___

B

Write your name and/or number and mailing address. If you have

an address change, or this is your fi rst return, check this box.

F

Check the box if your residency is not in

Illinois. Attach Illinois Schedule NR.

_______________________________________________________

Name:

G

Check the box if you are an

Electing small business trust (ESBT)

_______________________________________________________

C/O:

Individual bankruptcy estate

________________________________________________

Mailing address:

H

Check the box if you attached Illinois

___________________________

______

__________

City:

State:

ZIP:

Schedule 1299-D, Income Tax Credits.

I

Check the box if you attached Illinois

C

Check the box if one of the following apply.

Schedule I, Income Received.

J

If you have completed Federal

First return

If fi nal, write the date. ______________

Form 8886, check the box and attach

D

Check your method of accounting.

a copy to this return.

Cash

Accrual

Other_________

K

Check the box if you are making

a discharge of indebtedness adjustment.

A

B

Step 2: Figure your income or loss

Benefi ciaries

Fiduciary

1

1

Federal Taxable Income from U.S. Form 1041, Line 22.

______________ 00

2

Federal net operating loss deduction from

2

U.S. Form 1041, Line 15a. This amount cannot be negative.

______________ 00

3

3

Taxable income of ESBT, if required (see instructions).

______________ 00

4

4

Exemption claimed on U.S. Form 1041, Line 20.

______________ 00

5

5a

5b

Illinois income and replacement tax deducted in arriving at Line 1.

______________ 00

______________ 00

6

6a

6b

State, municipal, and other interest income excluded from Line 1.

______________ 00

______________ 00

7

7a

7b

Illinois Special Depreciation addition. Attach Form IL-4562.

______________ 00

______________ 00

8

8a

8b

Related-party expenses addition. Attach Schedule 80/20.

______________ 00

______________ 00

9

9a

9b

Distributive share of additions. Attach Schedule K-1-P or K-1-T.

______________ 00

______________ 00

10

10a

10b

Other additions. Attach Illinois Schedule M (for businesses).

______________ 00

______________ 00

11

11

Add Column B, Lines 1 through 10b. This amount is your income or loss.

______________ 00

Report Column A, Lines 5a through 10a, on Schedule K-1-T, Step 5.

NS DR________

*963601110*

IL-1041 (R-12/09)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4