Disabled Exemption

ADVERTISEMENT

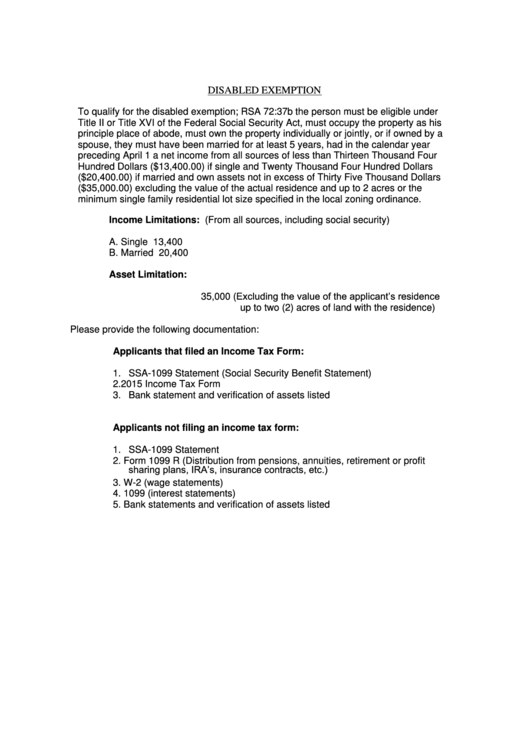

DISABLED EXEMPTION

To qualify for the disabled exemption; RSA 72:37b the person must be eligible under

Title II or Title XVI of the Federal Social Security Act, must occupy the property as his

principle place of abode, must own the property individually or jointly, or if owned by a

spouse, they must have been married for at least 5 years, had in the calendar year

preceding April 1 a net income from all sources of less than Thirteen Thousand Four

Hundred Dollars ($13,400.00) if single and Twenty Thousand Four Hundred Dollars

($20,400.00) if married and own assets not in excess of Thirty Five Thousand Dollars

($35,000.00) excluding the value of the actual residence and up to 2 acres or the

minimum single family residential lot size specified in the local zoning ordinance.

Income Limitations:

(From all sources, including social security)

A. Single

13,400

B. Married

20,400

Asset Limitation:

35,000 (Excluding the value of the applicant’s residence

up to two (2) acres of land with the residence)

Please provide the following documentation:

Applicants that filed an Income Tax Form:

1. SSA-1099 Statement (Social Security Benefit Statement)

2. 2015 Income Tax Form

3. Bank statement and verification of assets listed

Applicants not filing an income tax form:

1. SSA-1099 Statement

2. Form 1099 R (Distribution from pensions, annuities, retirement or profit

sharing plans, IRA’s, insurance contracts, etc.)

3. W-2 (wage statements)

4. 1099 (interest statements)

5. Bank statements and verification of assets listed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3