University Of Dayton Retirement Plan Agreement For Salary Reduction/deduction - Form

ADVERTISEMENT

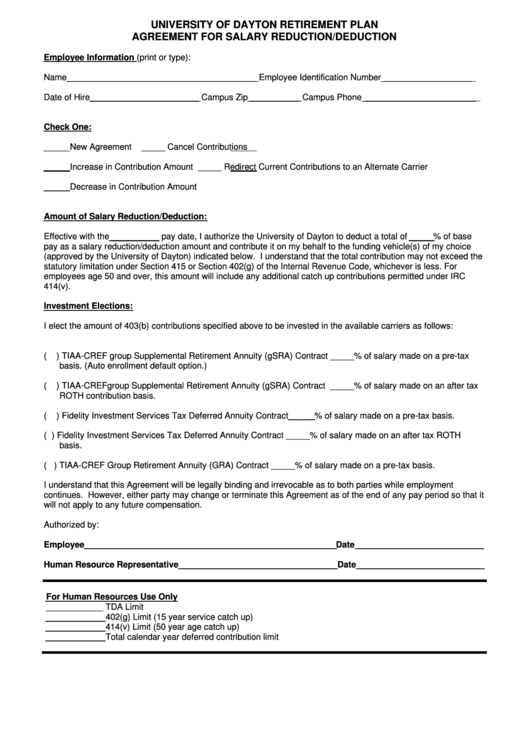

UNIVERSITY OF DAYTON RETIREMENT PLAN

AGREEMENT FOR SALARY REDUCTION/DEDUCTION

Employee Information (print or type):

Name________________________________________ Employee Identification Number___________________

Date of Hire_______________________ Campus Zip___________ Campus Phone________________________

Check One:

_____ New Agreement

_____ Cancel Contributions

_____ Increase in Contribution Amount

_____ Redirect Current Contributions to an Alternate Carrier

_____ Decrease in Contribution Amount

Amount of Salary Reduction/Deduction:

Effective with the __________ pay date, I authorize the University of Dayton to deduct a total of _____% of base

pay as a salary reduction/deduction amount and contribute it on my behalf to the funding vehicle(s) of my choice

(approved by the University of Dayton) indicated below. I understand that the total contribution may not exceed the

statutory limitation under Section 415 or Section 402(g) of the Internal Revenue Code, whichever is less. For

employees age 50 and over, this amount will include any additional catch up contributions permitted under IRC

414(v).

Investment Elections:

I elect the amount of 403(b) contributions specified above to be invested in the available carriers as follows:

(

) TIAA-CREF group Supplemental Retirement Annuity (gSRA) Contract _____% of salary made on a pre-tax

basis. (Auto enrollment default option.)

(

) TIAA-CREFgroup Supplemental Retirement Annuity (gSRA) Contract _____% of salary made on an after tax

ROTH contribution basis.

(

) Fidelity Investment Services Tax Deferred Annuity Contract _____% of salary made on a pre-tax basis.

(

) Fidelity Investment Services Tax Deferred Annuity Contract _____% of salary made on an after tax ROTH

basis.

( ) TIAA-CREF Group Retirement Annuity (GRA) Contract _____% of salary made on a pre-tax basis.

I understand that this Agreement will be legally binding and irrevocable as to both parties while employment

continues. However, either party may change or terminate this Agreement as of the end of any pay period so that it

will not apply to any future compensation.

Authorized by:

Employee____________________________________________________ Date_______________________

Human Resource Representative_________________________________ Date__________________________

For Human Resources Use Only

____________ TDA Limit

____________ 402(g) Limit (15 year service catch up)

____________ 414(v) Limit (50 year age catch up)

____________ Total calendar year deferred contribution limit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1