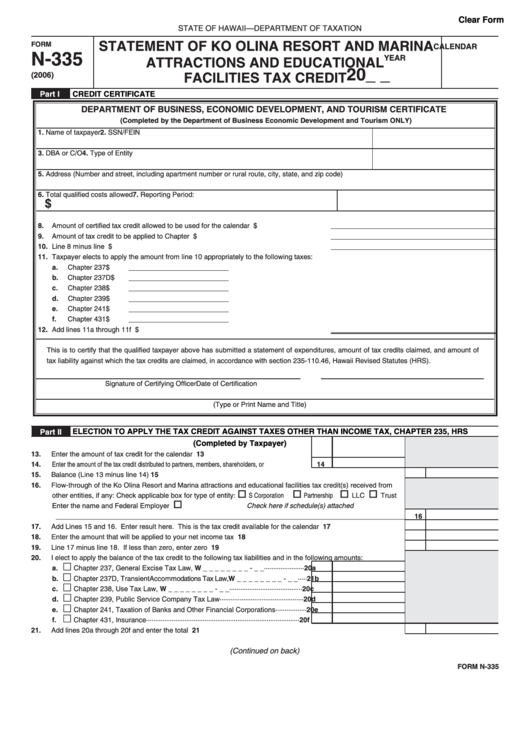

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

STATEMENT OF KO OLINA RESORT AND MARINA

FORM

CALENDAR

N-335

YEAR

ATTRACTIONS AND EDUCATIONAL

20_ _

(2006)

FACILITIES TAX CREDIT

Part I

CREDIT CERTIFICATE

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT, AND TOURISM CERTIFICATE

(Completed by the Department of Business Economic Development and Tourism ONLY)

1. Name of taxpayer

2. SSN/FEIN

3. DBA or C/O

4. Type of Entity

5. Address (Number and street, including apartment number or rural route, city, state, and zip code)

6. Total qualified costs allowed

7. Reporting Period:

$

8.

Amount of certified tax credit allowed to be used for the calendar year ................................$

9.

Amount of tax credit to be applied to Chapter 235 ................................................................$

10. Line 8 minus line 9 ...............................................................................................................$

11. Taxpayer elects to apply the amount from line 10 appropriately to the following taxes:

a.

Chapter 237

$

b.

Chapter 237D

$

c.

Chapter 238

$

d.

Chapter 239

$

e.

Chapter 241

$

f.

Chapter 431

$

12. Add lines 11a through 11f .....................................................................................................$

This is to certify that the qualified taxpayer above has submitted a statement of expenditures, amount of tax credits claimed, and amount of

tax liability against which the tax credits are claimed, in accordance with section 235-110.46, Hawaii Revised Statutes (HRS).

Signature of Certifying Officer

Date of Certification

(Type or Print Name and Title)

ELECTION TO APPLY THE TAX CREDIT AGAINST TAXES OTHER THAN INCOME TAX, CHAPTER 235, HRS

Part II

(Completed by Taxpayer)

13.

Enter the amount of tax credit for the calendar year....................................................

13

14.

Enter the amount of the tax credit distributed to partners, members, shareholders, or beneficiaries .......

14

15.

Balance (Line 13 minus line 14). ..................................................................................................................................

15

16.

Flow-through of the Ko Olina Resort and Marina attractions and educational facilities tax credit(s) received from

o

o

o

o

other entities, if any: Check applicable box for type of entity:

S Corporation

Partnership

LLC

Trust

o

Enter the name and Federal Employer I.D. No. of Entity

Check here if schedule(s) attached

__________________________________________________________________________________________

16

17.

Add Lines 15 and 16. Enter result here. This is the tax credit available for the calendar year...................................

17

18.

Enter the amount that will be applied to your net income tax liability. ..........................................................................

18

19.

Line 17 minus line 18. If less than zero, enter zero here.............................................................................................

19

20.

I elect to apply the balance of the tax credit to the following tax liabilities and in the following amounts:

£

a.

Chapter 237, General Excise Tax Law, W _ _ _ _ _ _ _ _ - _ _ ······················ 20a

£

b.

Chapter 237D, Transient Accommodations Tax Law, W _ _ _ _ _ _ _ _ - _ _ ····· 21b

£

c.

Chapter 238, Use Tax Law, W _ _ _ _ _ _ _ _ - _ _ ········································ 20c

£

d.

Chapter 239, Public Service Company Tax Law ·············································· 20d

£

e.

Chapter 241, Taxation of Banks and Other Financial Corporations ················· 20e

£

f.

Chapter 431, Insurance ···················································································· 20f

21.

Add lines 20a through 20f and enter the total here ......................................................................................................

21

(Continued on back)

FORM N-335

1

1 2

2