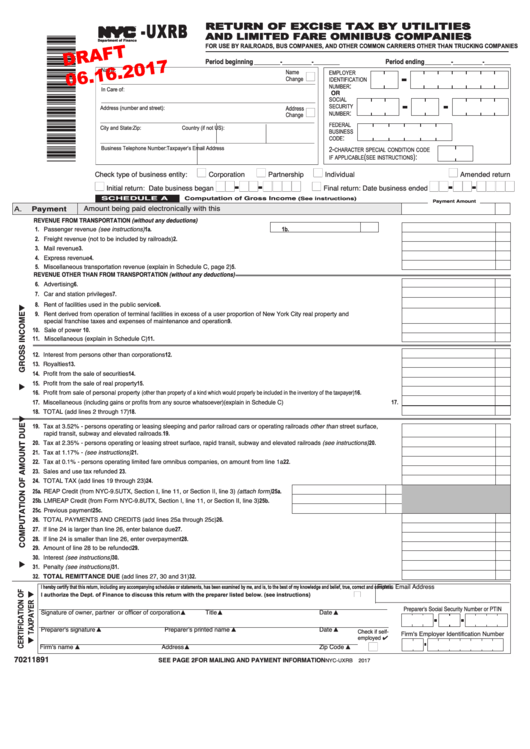

Form Nyc-Uxrb Draft - Return Of Excise Tax By Utilities And Limited Fare Omnibus Companies

ADVERTISEMENT

-UXRB

RE T U RN OF E XCI S E TAX B Y U T I L I T I E S

AN D LI MI T E D FA RE O MN I BU S CO MPAN I E S

TM

Department of Finance

FOR USE BY RAILROADS, BUS COMPANIES, AND OTHER COMMON CARRIERS OTHER THAN TRUCKING COMPANIES

Period beginning ________-_________-________

Period ending ________-_________-________

Name:

Name

n

EMPLOYER

Change

IDENTIFICATION

:

__________________________________________________________________________________________

NUMBER

In Care of:

OR

SOCIAL

__________________________________________________________________________________________

SECURITY

Address

n

Address (number and street):

:

NUMBER

Change

__________________________________________________________________________________________

FEDERAL

City and State:

Zip:

Country (if not US):

BUSINESS

:

CODE

__________________________________________________________________________________________

-

2

Business Telephone Number:

Taxpayer’s Email Address

CHARACTER SPECIAL CONDITION CODE

(

):

IF APPLICABLE

SEE INSTRUCTIONS

n

n

n

n

Check type of business entity:

Corporation

Partnership

Individual

Amended return

nn-nn-nnnn

nn-nn-nnnn

n

n

Initial return: Date business began

Final return: Date business ended

S C H E D U L E A

C o m p u t a t i o n o f G r o s s I n c o m e

( S e e i n s t r u c t i o n s )

Payment Amount

Payment

Amount being paid electronically with this return....................................................................... A.

A.

REVENUE FROM TRANSPORTATION (without any deductions)

1. Passenger revenue (see instructions)

1a.

1b.

..........................................................................................

2. Freight revenue (not to be included by railroads)

2.

....................................................................................................................................................................................

3. Mail revenue

3.

......................................................................................................................................................................................................................................................................

4. Express revenue

4.

..........................................................................................................................................................................................................................................................

5. Miscellaneous transportation revenue (explain in Schedule C, page 2)

5.

....................................................................................................................................

REVENUE OTHER THAN FROM TRANSPORTATION (without any deductions)

6. Advertising

6.

..........................................................................................................................................................................................................................................................................

7. Car and station privileges

7.

......................................................................................................................................................................................................................................

8. Rent of facilities used in the public service

8.

.................................................................................................................................................................................................

9. Rent derived from operation of terminal facilities in excess of a user proportion of New York City real property and

special franchise taxes and expenses of maintenance and operation

9.

.......................................................................................................................................

10. Sale of power

10.

...............................................................................................................................................................................................................................................................

11. Miscellaneous (explain in Schedule C)

11.

..........................................................................................................................................................................................................

12. Interest from persons other than corporations

12.

...........................................................................................................................................................................................

13. Royalties

13.

............................................................................................................................................................................................................................................................................

14. Profit from the sale of securities

14.

.........................................................................................................................................................................................................................

15. Profit from the sale of real property

15.

..................................................................................................................................................................................................................

16. Profit from sale of personal property (other than property of a kind which would properly be included in the inventory of the taxpayer)

16.

................................

17. Miscellaneous (including gains or profits from any source whatsoever)(explain in Schedule C)

17.

.............................................................................................

18. TOTAL (add lines 2 through 17)

18.

.........................................................................................................................................................................................................................

19. Tax at 3.52% - persons operating or leasing sleeping and parlor railroad cars or operating railroads other than street surface,

rapid transit, subway and elevated railroads

19.

.

.............................................................................................................................................................................................

20. Tax at 2.35% - persons operating or leasing street surface, rapid transit, subway and elevated railroads (see instructions)

20.

...................

21. Tax at 1.17% - (see instructions)

21.

........................................................................................................................................................................................................................

22. Tax at 0.1% - persons operating limited fare omnibus companies, on amount from line 1a

22.

..........................................................................................

23. Sales and use tax refunded

23.

................................................................................................................................................................................................................................

24. TOTAL TAX (add lines 19 through 23)

24.

...........................................................................................................................................................................................................

25a. REAP Credit (from NYC-9.5UTX, Section I, line 11, or Section II, line 3) (attach form)

25a.

25b. LMREAP Credit (from Form NYC-9.8UTX, Section I, line 11, or Section II, line 3)

25b.

. . . . . .

.................

25c. Previous payment

25c.

...........................................................................................................................................................

26. TOTAL PAYMENTS AND CREDITS (add lines 25a through 25c)

26.

..................................................................................................................................................

27. If line 24 is larger than line 26, enter balance due

27.

..................................................................................................................................................................................

28. If line 24 is smaller than line 26, enter overpayment

28.

.............................................................................................................................................................................

29. Amount of line 28 to be refunded

29.

......................................................................................................................................................................................................................

30. Interest (see instructions)

30.

31. Penalty (see instructions)

31.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32. TOTAL REMITTANCE DUE (add lines 27, 30 and 31)

32.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

........................................................................................................................................................................

Firm's Email Address

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES

n

________________________________________

Preparer's Social Security Number or PTIN

Signature of owner, partner or officer of corporation s

Title s

Date s

Preparer's signature s

Preparer’s printed name s

Date s

Check if self-

Firm's Employer Identification Number

employed 4

n

Firm's name s

Address s

Zip Code s

70211891

S E E PA G E 2 F O R M A I L I N G A N D PAY M E N T I N F O R M AT I O N

NYC-UXRB

2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4