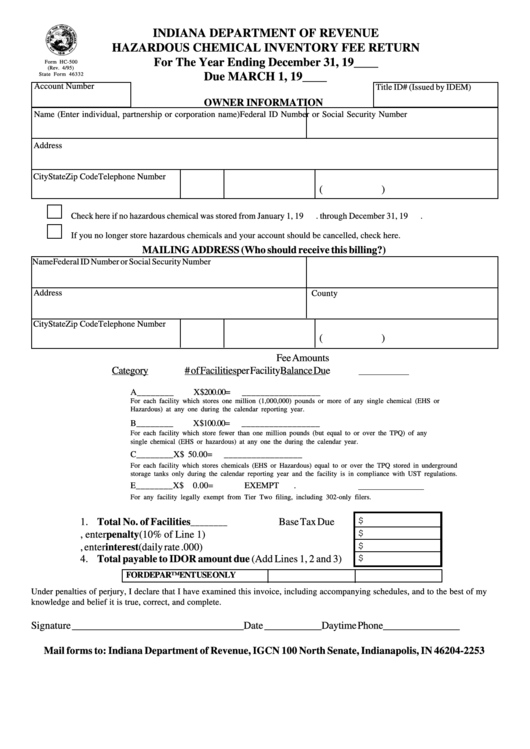

INDIANA DEPARTMENT OF REVENUE

HAZARDOUS CHEMICAL INVENTORY FEE RETURN

For The Year Ending December 31, 19____

Form HC-500

(Rev. 4/95)

Due MARCH 1, 19____

State Form 46332

Account Number

Title ID# (Issued by IDEM)

OWNER INFORMATION

Name (Enter individual, partnership or corporation name)

Federal ID Number or Social Security Number

Address

City

State

Zip Code

Telephone Number

(

)

Check here if no hazardous chemical was stored from January 1, 19

. through December 31, 19

.

If you no longer store hazardous chemicals and your account should be cancelled, check here.

MAILING ADDRESS (Who should receive this billing?)

Name

Federal ID Number or Social Security Number

Address

County

City

State

Zip Code

Telephone Number

(

)

Fee Amounts

Category

# of Facilities

per Facility

Balance Due

A

________

X

$200.00

=

_________________

For each facility which stores one million (1,000,000) pounds or more of any single chemical (EHS or

Hazardous) at any one during the calendar reporting year.

B

________

X

$100.00

=

_________________

For each facility which store fewer than one million pounds (but equal to or over the TPQ) of any

single chemical (EHS or hazardous) at any one the during the calendar year.

C

________

X

$ 50.00

=

_________________

For each facility which stores chemicals (EHS or Hazardous) equal to or over the TPQ stored in underground

storage tanks only during the calendar reporting year and the facility is in compliance with UST regulations.

E

________

X

$ 0.00

=

EXEMPT

.

For any facility legally exempt from Tier Two filing, including 302-only filers.

$

1. Total No. of Facilities

Base Tax Due

________

$

2. If paid late, enter penalty (10% of Line 1) .........................

$

3. If paid late, enter interest (daily rate .000) ............................

$

4. Total payable to IDOR amount due (Add Lines 1, 2 and 3)

FOR DEPARTMENT USE ONLY

Under penalties of perjury, I declare that I have examined this invoice, including accompanying schedules, and to the best of my

knowledge and belief it is true, correct, and complete.

Signature _________________________________ Date ___________

Daytime Phone_______________

Mail forms to: Indiana Department of Revenue, IGCN 100 North Senate, Indianapolis, IN 46204-2253

1

1 2

2