Form M-2220 - Underpayment Of Massachusetts Estimated Tax By Corporations - 1999

ADVERTISEMENT

1999

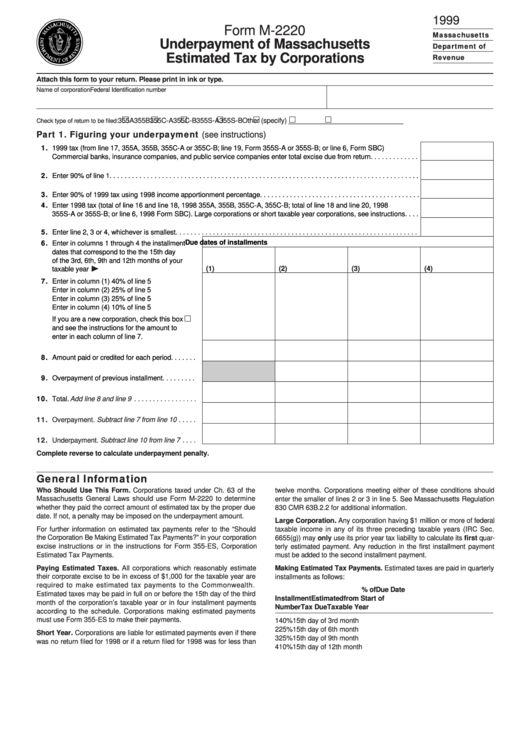

Form M-2220

Massachusetts

Underpayment of Massachusetts

Department of

Estimated Tax by Corporations

Revenue

Attach this form to your return. Please print in ink or type.

Name of corporation

Federal Identification number

355A

355B

355C-A

355C-B

355S-A

355S-B

Other (specify) ______________________________

Check type of return to be filed:

Part 1. Figuring your underpayment (see instructions)

11. 1999 tax (from line 17, 355A, 355B, 355C-A or 355C-B; line 19, Form 355S-A or 355S-B; or line 6, Form SBC)

Commercial banks, insurance companies, and public service companies enter total excise due from return . . . . . . . . . . . . .

12. Enter 90% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Enter 90% of 1999 tax using 1998 income apportionment percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Enter 1998 tax (total of line 16 and line 18, 1998 355A, 355B, 355C-A, 355C-B; total of line 18 and line 20, 1998

355S-A or 355S-B; or line 6, 1998 Form SBC). Large corporations or short taxable year corporations, see instructions . . . .

15. Enter line 2, 3 or 4, whichever is smallest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Due dates of installments

16. Enter in columns 1 through 4 the installment

dates that correspond to the the 15th day

of the 3rd, 6th, 9th and 12th months of your

¨

(1)

(2)

(3)

(4)

taxable year

17. Enter in column (1) 40% of line 5

Enter in column (2) 25% of line 5

Enter in column (3) 25% of line 5

Enter in column (4) 10% of line 5

If you are a new corporation, check this box

and see the instructions for the amount to

enter in each column of line 7.

18. Amount paid or credited for each period . . . . . . .

19. Overpayment of previous installment . . . . . . . . .

Add line 8 and line 9 . . . . . . . . . . . . . . . . .

10. Total.

11. Overpayment. Subtract line 7 from line 10 . . . . .

12. Underpayment. Subtract line 10 from line 7 . . . .

Complete reverse to calculate underpayment penalty.

General Information

Who Should Use This Form. Corporations taxed under Ch. 63 of the

twelve months. Corporations meeting either of these conditions should

Massachusetts General Laws should use Form M-2220 to determine

enter the smaller of lines 2 or 3 in line 5. See Massachusetts Regulation

whether they paid the correct amount of estimated tax by the proper due

830 CMR 63B.2.2 for additional information.

date. If not, a penalty may be imposed on the underpayment amount.

Large Corporation. Any corporation having $1 million or more of federal

For further information on estimated tax payments refer to the “Should

taxable income in any of its three preceding taxable years (IRC Sec.

the Corporation Be Making Estimated Tax Payments?” in your corporation

6655(g)) may only use its prior year tax liability to calculate its first quar-

excise instructions or in the instructions for Form 355-ES, Corporation

terly estimated payment. Any reduction in the first installment payment

Estimated Tax Payments.

must be added to the second installment payment.

Paying Estimated Taxes. All corporations which reasonably estimate

Making Estimated Tax Payments. Estimated taxes are paid in quarterly

their corporate excise to be in excess of $1,000 for the taxable year are

installments as follows:

required to make estimated tax payments to the Commonwealth.

% of

Due Date

Estimated taxes may be paid in full on or before the 15th day of the third

Installment

Estimated

from Start of

month of the corporation’s taxable year or in four installment payments

Number

Tax Due

Taxable Year

according to the schedule. Corporations making estimated payments

must use Form 355-ES to make their payments.

1

40%

15th day of 3rd month

2

25%

15th day of 6th month

Short Year. Corporations are liable for estimated payments even if there

3

25%

15th day of 9th month

was no return filed for 1998 or if a return filed for 1998 was for less than

4

10%

15th day of 12th month

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2