Form Pt-100 - Business Personal Property Return

ADVERTISEMENT

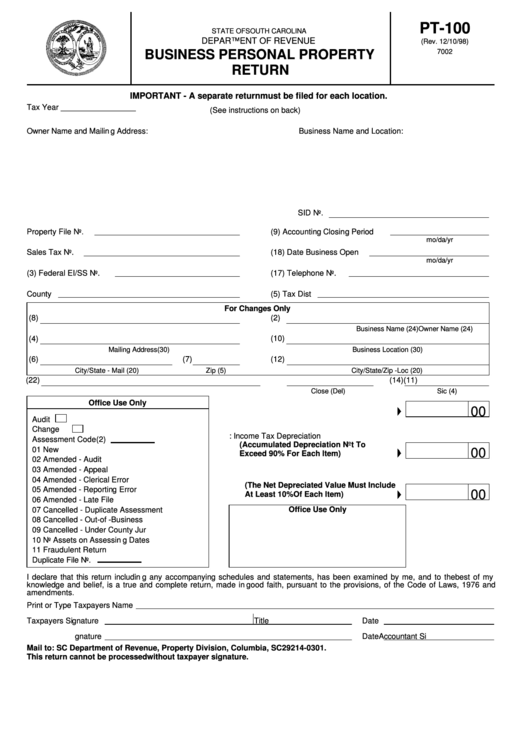

PT-100

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 12/10/98)

7002

BUSINESS PERSONAL PROPERTY

RETURN

IMPORTANT - A separate return must be filed for each location.

Tax Year _________________

(See instructions on back)

Owner Name and Mailing Address:

Business Name and Location:

SID No.

Property File No.

(9) Accounting Closing Period

mo/da/yr

Sales Tax No.

(18) Date Business Open

mo/da/yr

(3) Federal EI/SS No.

(17) Telephone No.

County

(5) Tax Dist

For Changes Only

(8)

(2)

Owner Name (24)

Business Name (24)

(4)

(10)

Mailing Address (30)

Business Location (30)

(6)

(7)

(12)

City/State - Mail (20)

Zip (5)

City/State/Zip - Loc (20)

(22)

(11)

(14)

Close (Del)

Sic (4)

Office Use Only

00

1. Total Acquisition Cost .................................

Audit

Change

2. Less: Income Tax Depreciation

Assessment Code (2)

(Accumulated Depreciation Not To

01 New

00

Exceed 90% For Each Item) ......................

02 Amended - Audit

03 Amended - Appeal

3.

Net Depreciated Value

04 Amended - Clerical Error

(The Net Depreciated Value Must Include

05 Amended - Reporting Error

00

At Least 10% Of Each Item) ..................

06 Amended - Late File

07 Cancelled - Duplicate Assessment

Office Use Only

08 Cancelled - Out-of -Business

09 Cancelled - Under County Jur

10 No Assets on Assessing Dates

11 Fraudulent Return

Duplicate File No.

I declare that this return including any accompanying schedules and statements, has been examined by me, and to the best of my

knowledge and belief, is a true and complete return, made in good faith, pursuant to the provisions, of the Code of Laws, 1976 and

amendments.

Print or Type Taxpayers Name

Taxpayers Signature

Title

Date

Accountant Signature

Date

Mail to: SC Department of Revenue, Property Division, Columbia, SC 29214-0301.

This return cannot be processed without taxpayer signature.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1