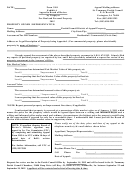

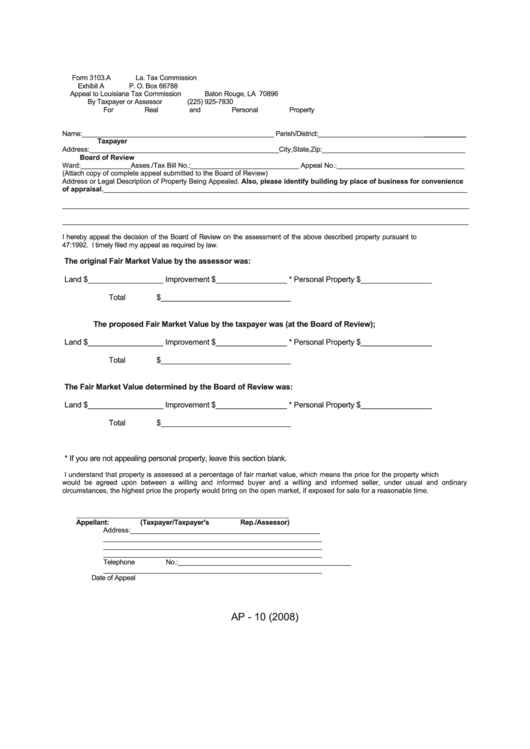

Form 3103.A

La. Tax Commission

Exhibit A

P. O. Box 66788

Appeal to Louisiana Tax Commission

Baton Rouge, LA 70896

By Taxpayer or Assessor

(225) 925-7830

For Real and Personal Property

Name:___________________________________________________ Parish/District:_______________________________________

Taxpayer

Address:_________________________________________________City,State,Zip:_____________________________________

Board of Review

Ward:_____________Asses./Tax Bill No.:____________________________ Appeal No.:_________________________________

(Attach copy of complete appeal submitted to the Board of Review)

Address or Legal Description of Property Being Appealed. Also, please identify building by place of business for convenience

of appraisal.______________________________________________________________________________________________

____________________________________________________________________________________________________________

_________________________________________________________________________________________________________

I hereby appeal the decision of the Board of Review on the assessment of the above described property pursuant to L.R.S.

47:1992. I timely filed my appeal as required by law.

The original Fair Market Value by the assessor was:

Land $__________________ Improvement $_________________ * Personal Property $_________________

Total $_______________________________

The proposed Fair Market Value by the taxpayer was (at the Board of Review);

Land $__________________ Improvement $_________________ * Personal Property $_________________

Total $_______________________________

The Fair Market Value determined by the Board of Review was:

Land $__________________ Improvement $_________________ * Personal Property $_________________

Total $_______________________________

* If you are not appealing personal property, leave this section blank.

I understand that property is assessed at a percentage of fair market value, which means the price for the property which

would be agreed upon between a willing and informed buyer and a willing and informed seller, under usual and ordinary

circumstances, the highest price the property would bring on the open market, if exposed for sale for a reasonable time.

_____________________________________________________

Appellant:

(Taxpayer/Taxpayer's Rep./Assessor)

Address:_________________________________________________

__________________________________________________________

__________________________________________________________

__________________________________________________________

Telephone No.:______________________________________________

__________________________________________________________

Date of Appeal

AP - 10 (2008)

1

1