STATE OF NORTH DAKOTA

OFFICE OF STATE TAX COMMISSIONER

STATE CAPITOL, 600 E. BOULEVARD AVE., DEPT. 127, BISMARCK, NORTH DAKOTA 58505-0599

701-328-2770

FAX 701-328-3700

Hearing/Speech Impaired 800-366-6888

C

F

ORY

ONG

C

OMMISSIONER

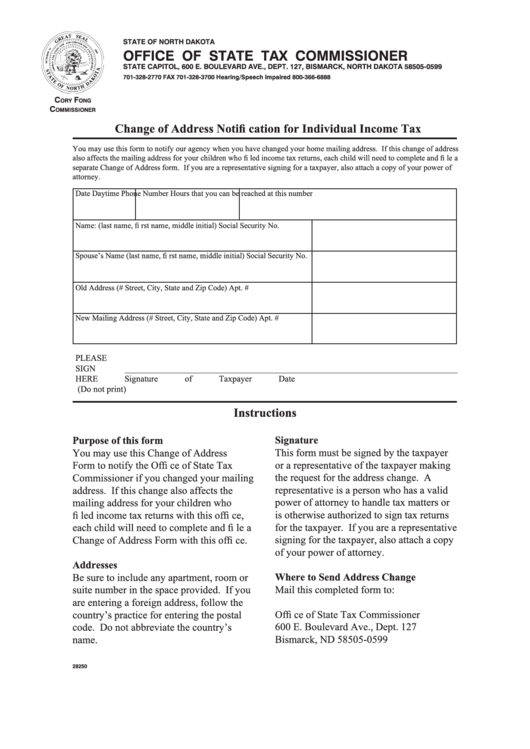

Change of Address Notifi cation for Individual Income Tax

You may use this form to notify our agency when you have changed your home mailing address. If this change of address

also affects the mailing address for your children who fi led income tax returns, each child will need to complete and fi le a

separate Change of Address form. If you are a representative signing for a taxpayer, also attach a copy of your power of

attorney.

Date

Daytime Phone Number

Hours that you can be reached at this number

Name: (last name, fi rst name, middle initial)

Social Security No.

Spouse’s Name (last name, fi rst name, middle initial)

Social Security No.

Old Address (# Street, City, State and Zip Code)

Apt. #

New Mailing Address (# Street, City, State and Zip Code)

Apt. #

PLEASE

SIGN

____________________________________________________________________________

HERE

Signature of Taxpayer

Date

(Do not print)

Instructions

Purpose of this form

Signature

This form must be signed by the taxpayer

You may use this Change of Address

or a representative of the taxpayer making

Form to notify the Offi ce of State Tax

Commissioner if you changed your mailing

the request for the address change. A

representative is a person who has a valid

address. If this change also affects the

power of attorney to handle tax matters or

mailing address for your children who

fi led income tax returns with this offi ce,

is otherwise authorized to sign tax returns

for the taxpayer. If you are a representative

each child will need to complete and fi le a

signing for the taxpayer, also attach a copy

Change of Address Form with this offi ce.

of your power of attorney.

Addresses

Be sure to include any apartment, room or

Where to Send Address Change

Mail this completed form to:

suite number in the space provided. If you

are entering a foreign address, follow the

Offi ce of State Tax Commissioner

country’s practice for entering the postal

600 E. Boulevard Ave., Dept. 127

code. Do not abbreviate the country’s

Bismarck, ND 58505-0599

name.

28250

1

1