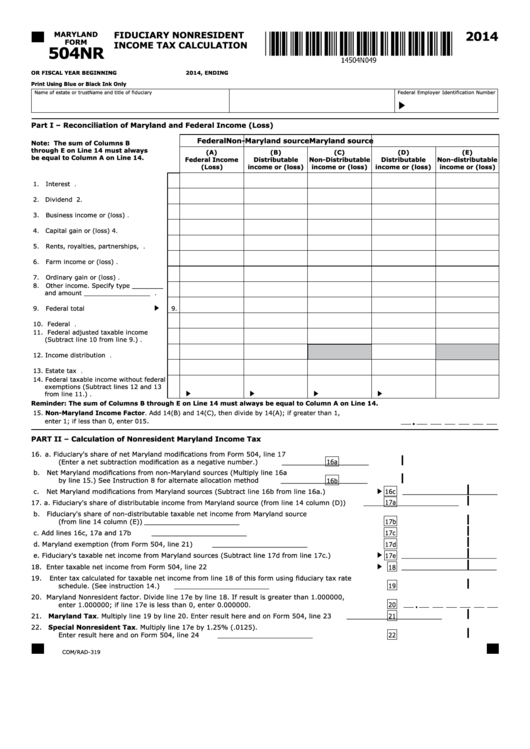

2014

FIDUCIARY NONRESIDENT

MARYLAND

FORM

INCOME TAX CALCULATION

504NR

OR FISCAL YEAR BEGINNING

2014, ENDING

Print Using Blue or Black Ink Only

Name of estate or trust

Name and title of fiduciary

Federal Employer Identification Number

Part I – Reconciliation of Maryland and Federal Income (Loss)

Federal

Non-Maryland source

Maryland source

Note: The sum of Columns B

through E on Line 14 must always

(A)

(B)

(C)

(D)

(E)

be equal to Column A on Line 14.

Federal Income

Distributable

Non-Distributable

Distributable

Non-distributable

(Loss)

income or (loss)

income or (loss)

income or (loss)

income or (loss)

1.

Interest income...............................

1

.

2. Dividend income...............................

2

.

3.

Business income or (loss)..................

3

.

4. Capital gain or (loss).........................

4

.

5.

Rents, royalties, partnerships, etc......

5

.

6.

Farm income or (loss).......................

6

.

7.

Ordinary gain or (loss)......................

7

.

8.

Other income. Specify type ________

and amount _________________ .....

8

.

9.

Federal total income..................

9

.

10. Federal deductions...........................

10

.

11. Federal adjusted taxable income

(Subtract line 10 from line 9.)............ 11

.

12. Income distribution deduction...........

12

.

13. Estate tax deduction.......................

13

.

14. Federal taxable income without federal

exemptions (Subtract lines 12 and 13

from line 11.)...............................

14

.

Reminder: The sum of Columns B through E on Line 14 must always be equal to Column A on Line 14.

15. Non-Maryland Income Factor. Add 14(B) and 14(C), then divide by 14(A); if greater than 1,

.

enter 1; if less than 0, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

PART II – Calculation of Nonresident Maryland Income Tax

16. a. Fiduciary's share of net Maryland modifications from Form 504, line 17

|

(Enter a net subtraction modification as a negative number.) . . . . . . . . . . . . . .

16a

_____________________

b. Net Maryland modifications from non-Maryland sources (Multiply line 16a

|

by line 15.) See Instruction 8 for alternate allocation method . . . . . . . . . . . . . .

_____________________

16b

|

c. Net Maryland modifications from Maryland sources (Subtract line 16b from line 16a.) . . . . . . . .

16c

_______________________

|

17a

17. a.

Fiduciary's share of distributable income from Maryland source (from line 14 column (D)) . . . . . . .

_______________________

b. Fiduciary's share of non-distributable taxable net income from Maryland source

|

17b

(from line 14 column (E)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________________

|

c.

Add lines 16c, 17a and 17b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

_______________________

|

d.

Maryland exemption (from Form 504, line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17d

_______________________

|

e.

Fiduciary's taxable net income from Maryland sources (Subtract line 17d from line 17c.) . . . . . .

_______________________

17e

|

18.

Enter taxable net income from Form 504, line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________________

18

19.

Enter tax calculated for taxable net income from line 18 of this form using fiduciary tax rate

|

19

schedule. (See instruction 14.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________________

20.

Maryland Nonresident factor. Divide line 17e by line 18. If result is greater than 1.000000,

enter 1.000000; if line 17e is less than 0, enter 0.000000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

___

|

21.

Maryland Tax. Multiply line 19 by line 20. Enter result here and on Form 504, line 23 . . . . . . . . . .

21

_______________________

22.

Special Nonresident Tax. Multiply line 17e by 1.25% (.0125).

|

Enter result here and on Form 504, line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

_______________________

COM/RAD-319

1

1